Los Angeles Faces $40 Billion Rebuild After January Wildfires as Western Risk Grows

The January 7, 2025, Palisades and Eaton wildfires inflicted catastrophic damage on Los Angeles, destroying more than 13,500 properties and triggering an estimated $40 billion in insured losses, according to property data firm Cotality. Nearly nine months later, recovery remains stalled. LA County reports fewer than 50 rebuilding permits issued by late May, while Altadena officials indicate only 15 permits have been granted for the Eaton fire zone.

Supply-side constraints are a major obstacle. Skilled contractor shortages, elevated material costs, and construction loan rates lingering between 10% and 12% are squeezing both homeowners and builders. Compounding the issue, underinsurance leaves many property owners facing six-figure shortfalls between policy payouts and actual rebuild costs.

“The scale of the rebuilding challenge is unprecedented,” said a local official. “Many families are discovering that their insurance payouts fall far short of what it costs to rebuild, leaving six-figure gaps they simply cannot cover.”

Wildfire Risk Is a Growing Investment Concern

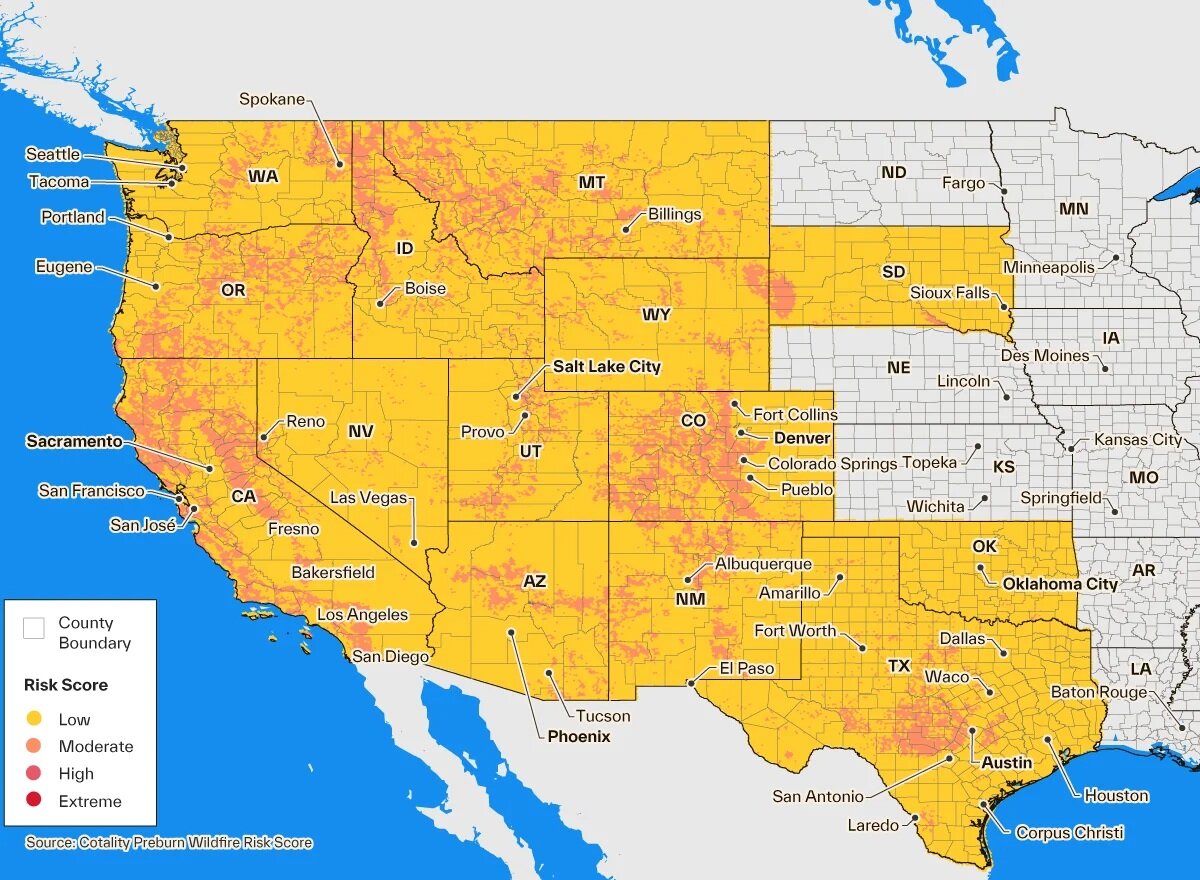

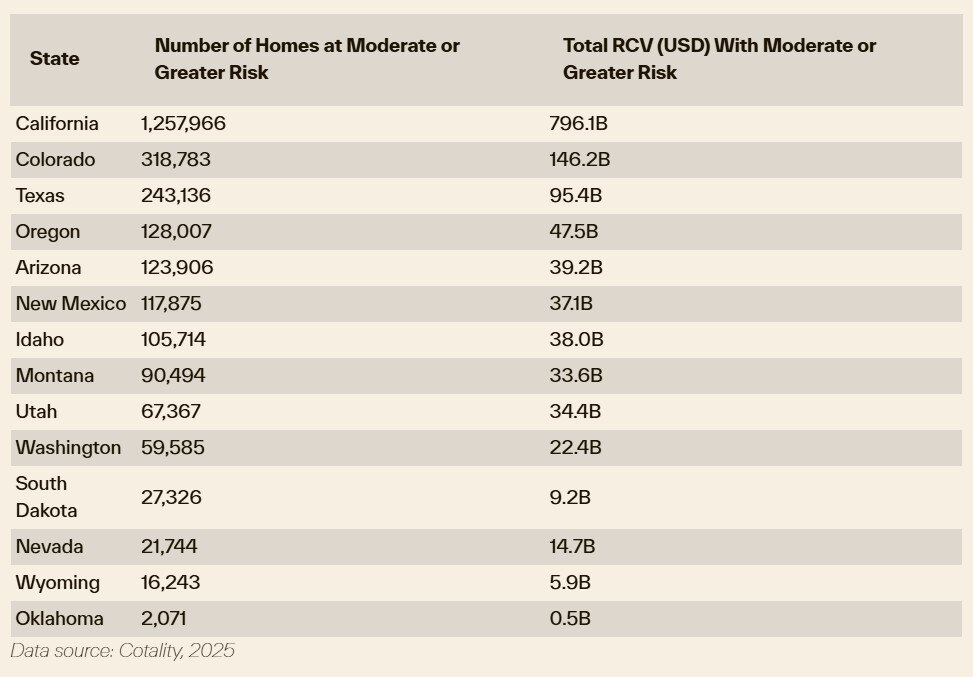

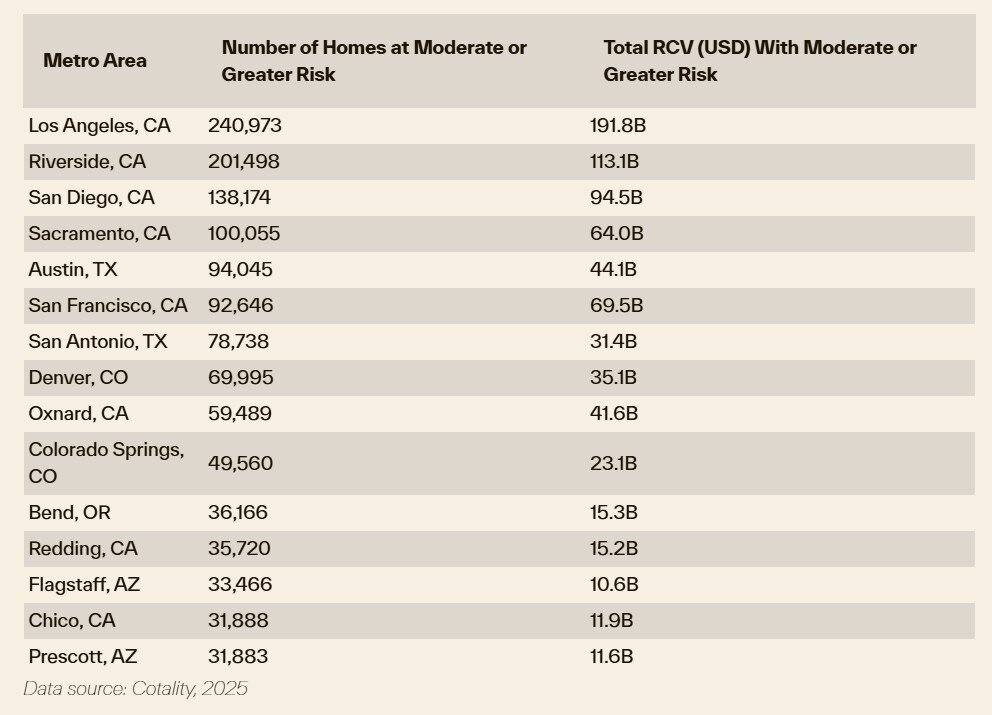

Cotality estimates 2.6 million homes in the western U.S. are at moderate or greater wildfire risk, representing $1.3 trillion in reconstruction value. Approximately 1.2 million homes are at very high risk, with California, Colorado, and Texas leading in exposure. Eight of the 15 most at-risk U.S. metropolitan areas are in California, including Los Angeles, while Austin, Denver, Bend, and Flagstaff round out the list.

Risk is concentrated in the Wildland-Urban Interface, where population growth, dense vegetation, and prolonged fire seasons exacerbate losses. In Los Angeles, nearly 241,000 homes carry moderate or greater wildfire risk, representing over $191 billion in reconstruction value.

Conflagration Risk Redefines the Hazard Profile

The Palisades and Eaton fires illustrate the rise of wildfire-induced conflagration, where flames shift from vegetation to structures, amplifying destruction. Retrospective analysis shows significant gaps between traditional wildfire hazard ratings and actual loss exposure:

Eaton Fire: 75% of properties rated low-to-moderate wildfire hazard had high conflagration risk; 84% of destroyed structures fell into this category.

Palisades Fire: 37% of properties rated low-to-moderate wildfire hazard carried high conflagration risk; 48% of destroyed homes were affected.

Market Implications

Rising reconstruction costs, persistent underinsurance, archaic government regulations and limited private coverage are creating a significant drag on recovery. For lenders, insurers, and investors, the fires underscore the need for parcel-level analytics integrating both wildfire and conflagration risk. Data-driven approaches can help protect capital, accelerate recovery, and mitigate future exposure in high-risk markets.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Please visit:

Our Sponsor