Executive Summary (TL;DR)

- Buyers/investors: Distressed cannabis assets can create real estate entry points (and negotiation leverage) only if you underwrite transferability (license + lease + zoning) as hard closing conditions—not assumptions.

- Receivership ≠ “cheap.” Court-supervised sales can be cleanly administered, but they’re often as-is/where-is, timeline-driven, and heavy on lien/title/consent diligence.

- Value lives in what survives the transfer: real estate, utility capacity, compliant buildout, assignable lease, municipal approval posture, and a viable path through state ownership-change rules.

- Fast triage wins: zoning verification, landlord consent, UCC/lien search, and track-and-trace readiness (e.g., METRC where applicable) should happen before you spend heavily on a Quality of Earnings (QoE) review.

- Start your pipeline by monitoring Receivership Sale Listings and building a repeatable diligence + bidding playbook.

Table of Contents

- Context: why distressed cannabis real estate is showing up

- What buyers/investors should do next

- Receivership vs. foreclosure vs. “distressed” listings: what changes for real estate

- Valuation lens for distressed cannabis assets

- Deal process overview (NDA → LOI → diligence → close)

- Due diligence checklist (with table)

- Myth vs. Fact

- Decision matrix: which distressed path fits your strategy

- 30/60/90-day execution plan

- Next steps on 420 Property

- Sources

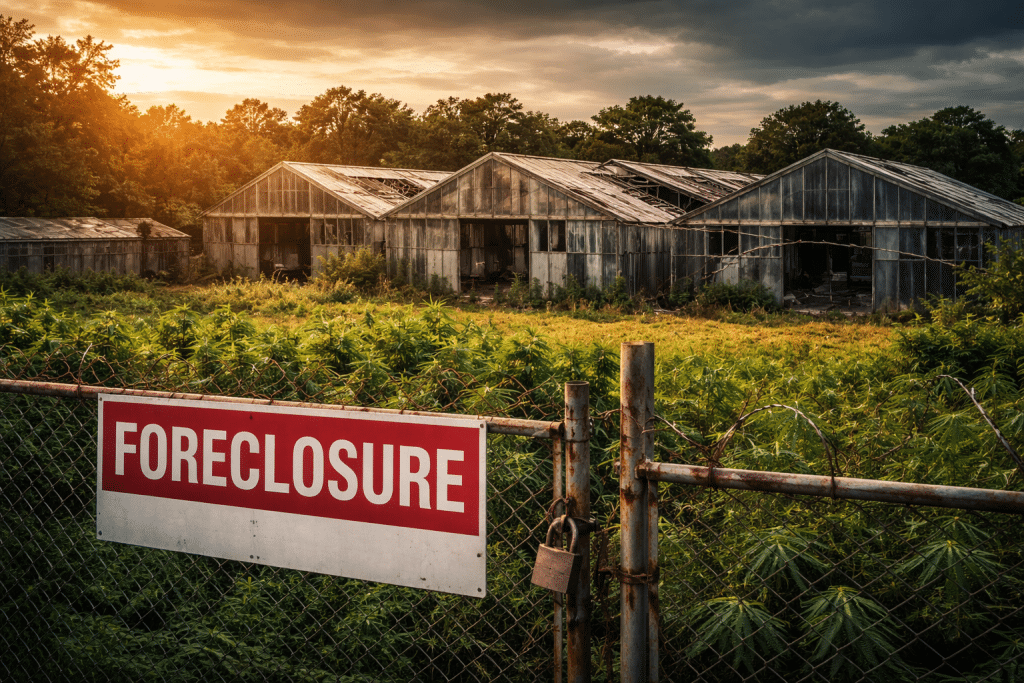

Context: why distressed cannabis real estate is showing up

Distress in cannabis is rarely “one thing.” It’s usually a stack of pressures that hits real estate-heavy operators first:

- Capital structure meets higher-for-longer rates. Cannabis operators often rely on private credit, seller notes, and short-term facilities. When refis don’t pencil, the real estate becomes the most obvious source of liquidity (or collateral enforcement).

- Margin compression + compliance costs. Even well-run operators can get squeezed by price competition, labor, security requirements, and track-and-trace operating overhead.

- Tax friction (280E) distorts true cash flow. A business can look EBITDA-positive but still be cash-starved after taxes, penalties, or payment plans.

- Lease fragility. One missed covenant, one landlord dispute, or one non-assignable clause can turn a “going concern” into an equipment liquidation.

- Municipal and licensing gatekeeping. Real estate that was usable can become functionally obsolete if local approvals lapse, buffers change, or a new ownership group triggers a re-review.

The opportunity is real—but only for buyers who treat real estate + regulatory survivability as the core asset, and the operating business as optional upside.

What buyers/investors should do next

1) Write a “distressed mandate” that matches cannabis realities

Before you chase deals, define what you’ll buy:

- Asset you actually want: fee-simple real estate, leasehold + tenant improvements (TI), equipment, or a full operating entity (asset vs. stock sale).

- License posture you require: transferable/approvable ownership change, timeline expectations, and whether you’ll accept a pause in operations.

- Your build-vs-buy threshold: maximum “cost to cure” for electrical, HVAC, fire/life-safety, odor mitigation, and security/operations plan upgrades.

2) Build a specialist team before the first LOI

Distressed cannabis assets punish slow starts. Your minimum team should include:

- Cannabis-savvy transactional counsel (reps & warranties, court sale orders, escrow)

- Real estate counsel (title, lease assignment, landlord consent, estoppels)

- A diligence lead who can run a data room and keep a tight schedule

- A broker/advisor who understands cannabis licensing + local zoning dynamics

You can source qualified specialists through Find a Cannabis & Hemp Industry Professional.

3) Source deals from multiple channels (not just “for sale” listings)

Use a blended funnel:

- Court-supervised opportunities via Receivership Sale Listings

- Non-court “motivated” opportunities via Distressed Sale

- Lender conversations (note sales, deed-in-lieu discussions, UCC enforcement paths)

- Landlords (takebacks, re-tenanting, sublease rescues, “consent-for-fee” dynamics)

- Operator networks (silent distress shows up as “partner buyout,” “JV needed,” or “quick sale”)

4) Create a two-speed diligence model: triage first, QoE second

Phase A (48–96 hours): kill or advance the deal with zoning + lease + liens + utility capacity.

Phase B (1–3 weeks): financial diligence (QoE), compliance history, and operational risk.

If you want a baseline valuation framework you can reuse across deals, keep SDE (seller’s discretionary earnings), EBITDA (earnings before interest, taxes, depreciation, and amortization), and add-backs definitions standardized across your pipeline; 420 Property’s Cannabis Business Valuation: Methods and Best Practices is a helpful reference point for consistent underwriting language.

Receivership vs. foreclosure vs. “distressed” listings: what changes for real estate

Distressed cannabis assets come to market through different mechanisms. For real estate buyers, the mechanism determines what you’re actually buying and what gets cleared.

Receivership (court-supervised)

A receiver is appointed to preserve value, operate (sometimes), and sell assets under court oversight. For buyers, this can mean:

- More structured timelines (bid deadlines, court confirmation)

- Stronger process documentation (sale orders, notices)

- Often limited seller representations and “as-is” terms

- A premium on proving funds and closing certainty

Lender enforcement (foreclosure / UCC disposition)

If a secured lender enforces collateral rights, the sale may happen under a secured transaction process. The practical buyer implication: you must confirm whether you’re getting real estate, personal property (equipment/FF&E), or both—and what liens remain.

Assignment for the Benefit of Creditors (ABC) / other state-level liquidation

An ABC is a state-law alternative to federal bankruptcy that can move quickly and liquidate assets through a fiduciary. In cannabis, these state-level paths can be more common than federal bankruptcy for plant-touching operators.

“Distressed sale” (negotiated)

A distressed sale listing may simply mean:

- urgent seller timeline,

- debt pressure,

- pending landlord action,

- or a forced consolidation move.

It’s not inherently “bad”—but it’s also not inherently “protected.” Your LOI must do the protecting.

Valuation lens for distressed cannabis assets

For distressed cannabis assets, valuation is less about “what the seller says it used to earn” and more about “what survives transfer and what it costs to stabilize.”

The three-layer valuation stack

- Real estate (or leasehold) value

- Location, zoning eligibility, buffers, municipal approvals

- Utility capacity (power/water/sewer/gas), ventilation pathways

- Replacement cost of compliant buildout (security, vaults, fire systems)

- Improvements + equipment (FF&E)

- What is owned vs. leased vs. financed?

- What is compliant and permitted?

- What must be removed or remediated (mold, contamination, unpermitted work)?

- Operating value (optional upside)

- If the license can transfer/approve and operations can continue, then you can underwrite EBITDA or SDE with a conservative multiple.

- In distressed situations, treat many “add-backs” skeptically. If the business has been shrinking, the “normalized” picture may not exist anymore.

Working capital matters more than people expect

Even “asset” deals have working capital realities:

- inventory counts and shrink,

- prepaid expenses,

- deposits,

- tax liabilities,

- payroll obligations, and

- vendor cure amounts needed to restart.

If you’re buying an operating business component, define working capital targets in the LOI and set a clean inventory counting method at close.

Real estate-specific discounting factors in cannabis

Price discounts are usually justified by one or more of:

- Lease non-assignability or expensive landlord consent

- Zoning uncertainty (buffers, permitted use, grandfathering questions)

- Time-to-license approval (carrying costs)

- Security/operations plan upgrades

- Track-and-trace reconfiguration (devices, SOP changes, training)

- Tax posture uncertainty (especially 280E effects)

Deal process overview (NDA → LOI → diligence → close)

Distressed doesn’t remove the deal sequence—it compresses it.

- NDA (non-disclosure agreement)

You’ll often get a “data dump” instead of a polished CIM (confidential information memorandum). That’s normal. - LOI (letter of intent)

Your LOI should be a risk-control document, not a love letter. Include:

- deal structure (asset vs. stock sale),

- what specifically is included/excluded (real estate, licenses, equipment),

- required consents (landlord consent, municipal approval, state ownership change),

- a diligence schedule,

- and an outside closing date with clear extension triggers.

- Diligence (fast triage → deep dive)

- Title + UCC/lien search first

- Lease abstract + assignment language review

- Compliance + licensing posture confirmation

- Then QoE and operational validation

- Close (and transition period)

- Funds flow clarity is critical in court and distressed sales.

- Define the transition period and who holds operational responsibility during any licensing gap.

- Expect reduced or no traditional reps & warranties; protect yourself with conditions, holdbacks, escrow, and scope-limited indemnities where available.

For a deeper walkthrough of bidding mechanics and “as-is” realities, see Cannabis Auctions and Receivership Sales – Everything You Need to Know Before Placing a Bid.

Due diligence checklist

Below is a practical “distressed real estate + license survivability” checklist you can use to screen deals quickly.

| Diligence Area | What to Verify (Minimum) | Why it Matters in Distress | Evidence to Request |

|---|---|---|---|

| Sale process & authority | Receiver authority / seller authority, required notices, court confirmation steps | You can “win” a bid and still lose time if the process isn’t tight | Court orders, bid procedures, proof of authority |

| Title & liens | Title commitment, easements, property tax status; UCC/lien search on equipment/FF&E | Distressed assets often have layered liens; you need to know what clears | Title report, UCC search results, payoff/termination statements |

| Lease & landlord consent | Assignability, change-of-control clauses, cure amounts, estoppel, SNDA | A great site becomes unusable if the lease can’t transfer | Lease abstract, landlord consent form, estoppel draft |

| Zoning verification | Permitted use, buffers, CUP/permits, grandfathering status | Zoning is the “license behind the license” | Zoning letter, CUP/permits, municipal correspondence |

| Licensing & ownership change | License status, renewal dates, ownership-change requirements, financial interest disclosures | You may need approval before operating under new ownership | License certificates, regulator correspondence, org charts |

| Compliance history | Inspections, corrective actions, security logs, inventory variance patterns | Compliance issues can delay approvals and add cost | Inspection reports, SOPs, incident logs |

| Track-and-trace readiness | Account status, device inventory, SOP alignment, training plan | Restart speed often hinges on system readiness | System screenshots/reports, SOPs, training records |

| Facility condition | Electrical capacity, HVAC, fire/life safety, COAs for extraction areas | The “cost to cure” can exceed the discount | As-builts, permits, contractor bids, maintenance logs |

| Environmental/health risks | Mold, pesticides, waste handling, odors, solvents (if applicable) | Remediation can be expensive and slow | Env. reports (where relevant), waste manifests, lab history |

| Financial triage | Revenue quality, customer concentration, vendor debts, tax posture | Distress can hide in receivables/taxes/vendors | Bank statements, tax returns, aging reports, POS exports |

| Deal economics | Occupancy cost ratio, DSCR sensitivity, stabilization budget | Prevents buying a site that can’t cash-flow post-fix | Underwriting model + downside case |

Myth vs. Fact

- Myth: “Receivership means liens are wiped clean.”

Fact: Some liens may be addressed through process and payoffs, but you still need title + UCC clarity and a documented path to releases. - Myth: “The license comes with the building.”

Fact: In many states, licenses are not simple transferable property rights; ownership change and/or new licensing steps may be required. - Myth: “Distressed equals bargain.”

Fact: Distressed often equals speed + uncertainty. You earn the discount by being prepared and underwriting the “cost to cure.” - Myth: “If the buildout is there, I can operate.”

Fact: You still need zoning eligibility, municipal approvals, and a compliant security/operations plan—plus landlord consent if leased. - Myth: “Seller add-backs tell me what it’s worth.”

Fact: In distress, “normalized” can be fiction. Anchor value to survivable assets and conservative stabilization economics.

Decision matrix: choosing the right distressed path

| Path | Best When | Pros | Watch-outs |

|---|---|---|---|

| Receivership sale | You want a structured process and clearer authority | Court oversight, documented procedures, potentially cleaner administration | “As-is” terms, compressed timelines, limited reps |

| UCC/secured party sale | You’re targeting equipment/FF&E or want to buy collateral efficiently | Can be faster than full litigation in some cases | Must confirm scope of collateral; real estate may be separate |

| Foreclosure / deed-in-lieu | You want fee-simple control (or to negotiate with lender) | Can reset tenancy/ownership and simplify control | Title issues, redemption periods (jurisdiction-dependent), tenant risks |

| Negotiated distressed sale | You can move fast and negotiate protections in LOI/APA | Flexibility on structure (seller note, earnout, sale-leaseback) | Needs strong diligence discipline; less “process protection” |

| Note purchase (buy the debt) | You’re sophisticated and want control via creditor position | Potentially best economics; can steer outcome | Complex, legal-heavy, and timeline uncertain |

30/60/90-day execution plan

First 30 days: build your “ready-to-bid” machine

- Define deal box (asset type, states/metros, max rehab budget)

- Create a standard LOI template with cannabis-specific conditions (license/lease/zoning)

- Pre-stage vendor relationships (title/escrow, inspectors, contractors)

- Build a scoring model: survivability (license + lease + zoning) > price

Next 60 days: scale sourcing and triage

- Track receivership and distressed inventory weekly

- Run Phase A triage on every deal within 48–96 hours

- Submit only “clean” offers where the closing path is realistic

- Develop a stabilization budget library (power upgrades, HVAC, security)

Next 90 days: win deals through certainty, not optimism

- Tighten your diligence playbook based on wins/losses

- Standardize your QoE request list and data room structure

- Optimize your closing timeline with escrow + landlord consent workflows

- Build optionality: be willing to buy real estate only if the license path is uncertain

Next steps on 420 Property

If you’re actively underwriting distressed cannabis assets, use these marketplace hubs to build deal flow and execute faster:

This article is for educational purposes only and does not constitute legal, financial, tax, or business brokerage advice. Always consult qualified professionals before making decisions, and verify all requirements with the appropriate authorities and counterparties.

Please visit:

Our Sponsor