The introduction of Plus flats in the recent October BTO launch, including popular projects like Bayshore Vista and Bayshore Palms, did draw attention and decrease transaction volumes for resale HDB in the month. However, buyers interested in quicker housing solutions continued to look toward the HDB resale market. As this dynamic persists, HDB resale prices increased by 0.3% in October compared to the prior month, with a year-on-year jump of 9.8% that reflects sustained growth in the overall market.

This article explores the HDB resale price trends and statistics that influenced the market in October, providing essential insights into the performance across various regions and the broader market landscape.

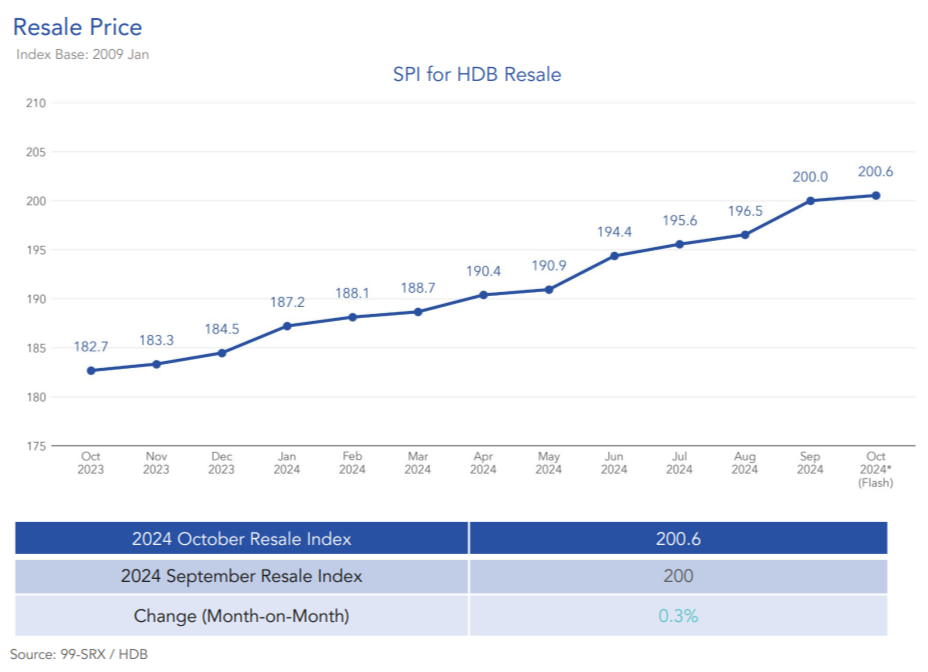

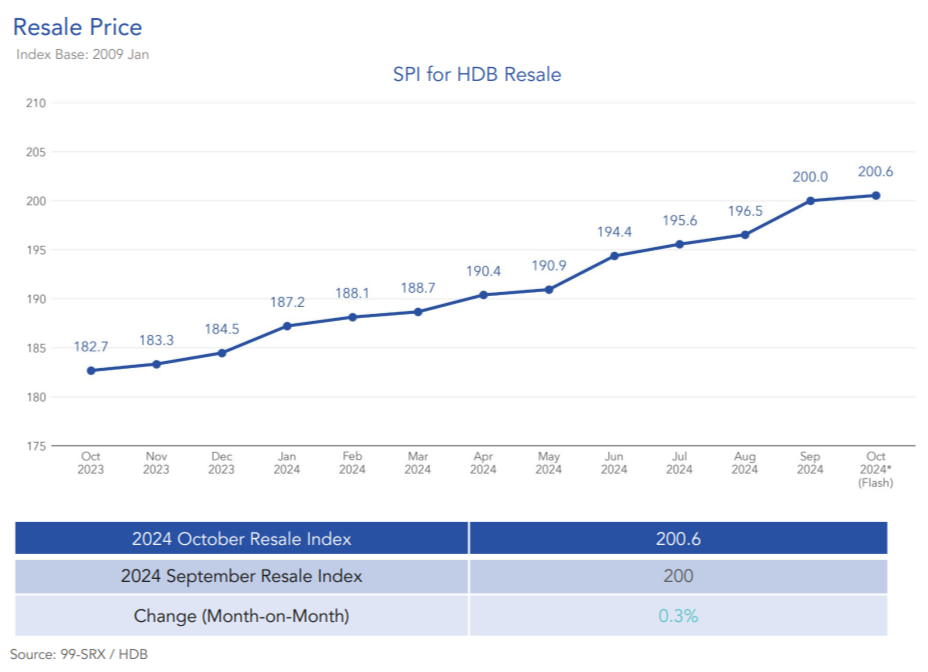

HDB resale price trend: Increased by 0.3%

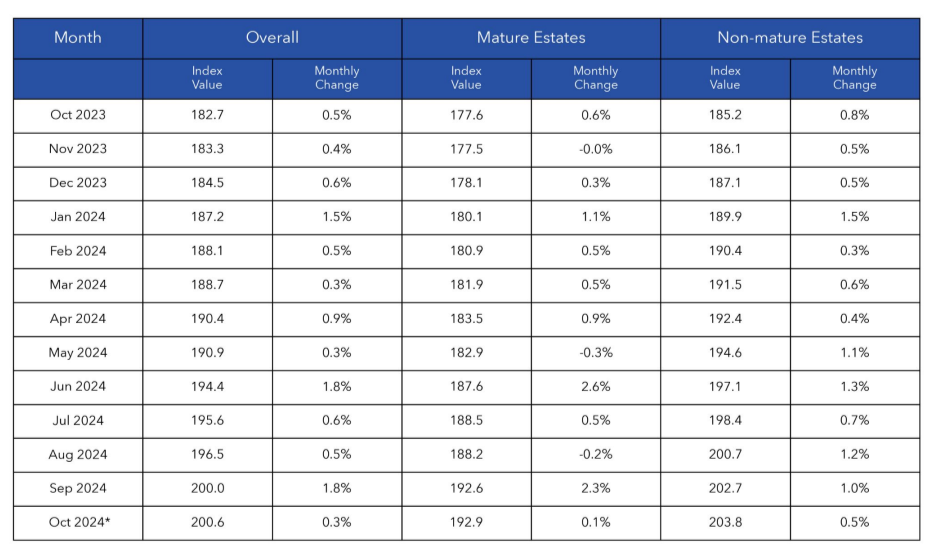

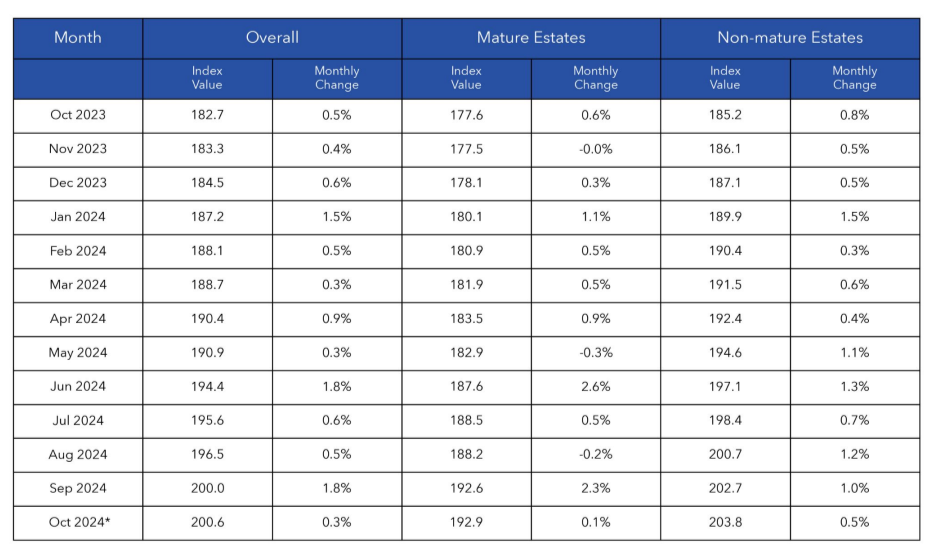

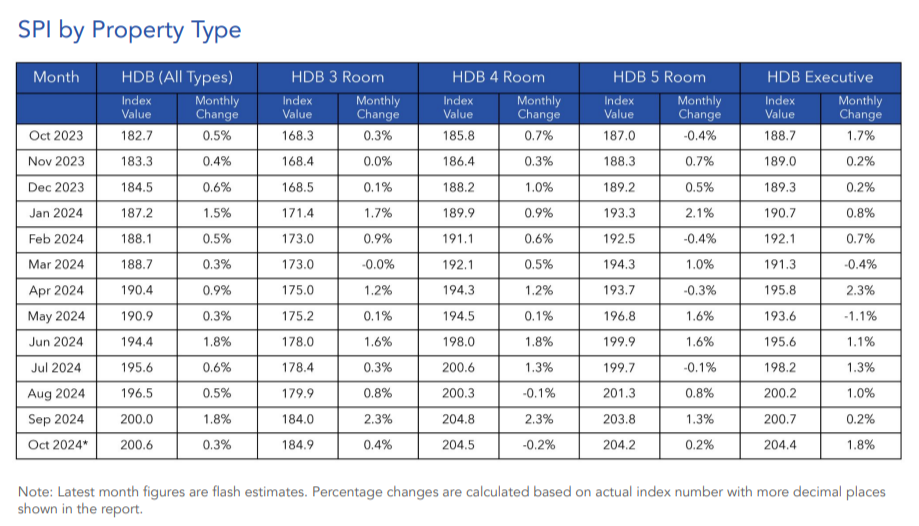

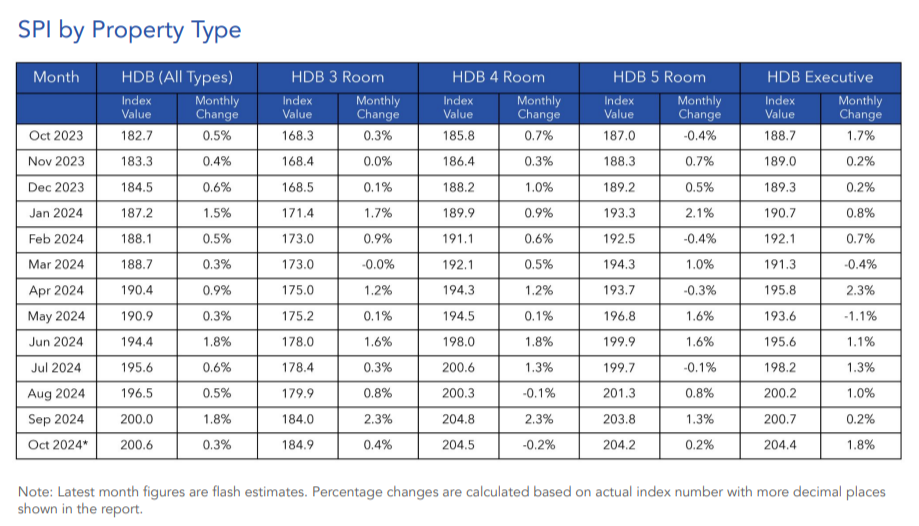

The digits recorded previously in September marked a new milestone where HDB resale prices have doubled since 2009. In October, HDB resale prices managed an increase again, a modest 0.3% rise, despite competitive pressures from the BTO launch. A closer look reveals a more pronounced rise in Non-Mature Estates (0.5%) compared to Mature Estates (0.1%).

In terms of flat types, the pricing shifts were nuanced: 3-room, 5-room, and Executive flats saw price increases of 0.4%, 0.2%, and 1.8%, respectively, while 4-room flats experienced a slight decrease of 0.2%. This data suggests continued buyer interest in certain configurations and regions, with Non-Mature Estates seeing a steadier demand.

Year-on-year, HDB resale prices reflected a stronger upward trend with an overall increase of 9.8% from October 2023. This growth was broadly distributed across different flat types, with prices for 3-room, 4-room, and 5-room flats rising by 9.8%, 10.1%, and 9.2%, respectively, and Executive flats following closely at 8.3%. Mature and Non-Mature Estate prices also saw respective gains of 8.6% and 10%, highlighting sustained demand despite evolving market dynamics.

Additional reading: HDB resale market: 1.8% price increase and 14.9% volume decrease in September 2024

Continued drop in transaction volumes

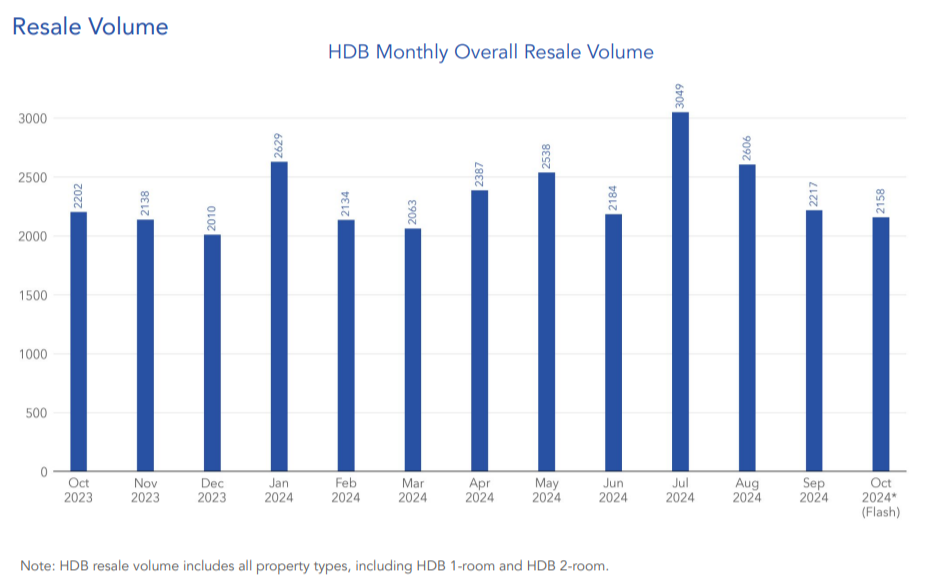

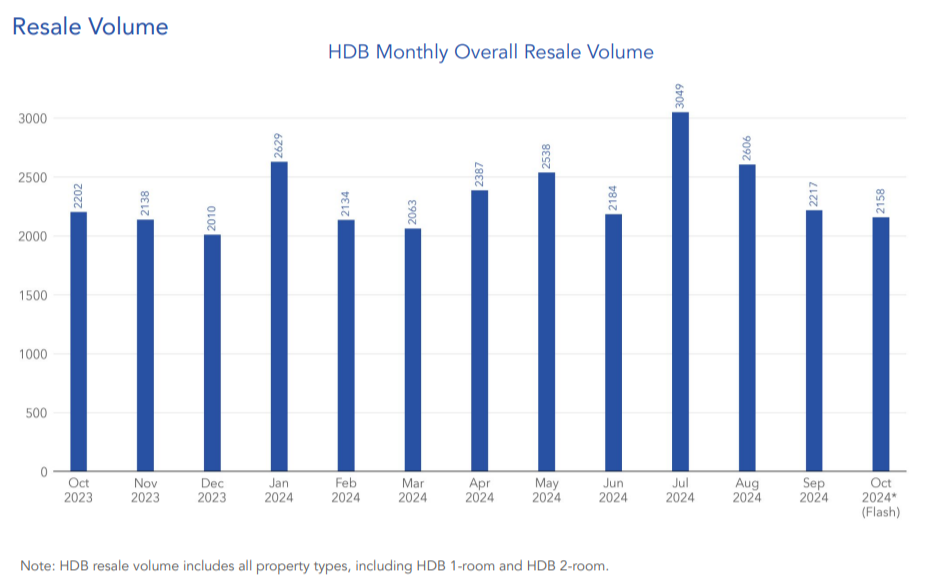

Transaction volumes in October 2024 declined slightly, with 2,158 resale flats transacted — down by 2.7% from the previous month. Year-on-year, the volume was also 2% lower, pointing to a tentative shift in buyer behaviour, potentially influenced by high asking prices and the BTO alternatives.

In October 2024, particularly, the HDB resale market faced intensified competition due to the availability of approximately 8,500 new flats under the BTO scheme. Attractive projects like Bayshore Vista and Bayshore Palms, which boast sea views and proximity to major business hubs like Changi Business Park and the CBD, captured substantial interest from prospective buyers. Additionally, singles were offered the opportunity to purchase BTO flats in non-mature estates, further adding more options outside the resale market.

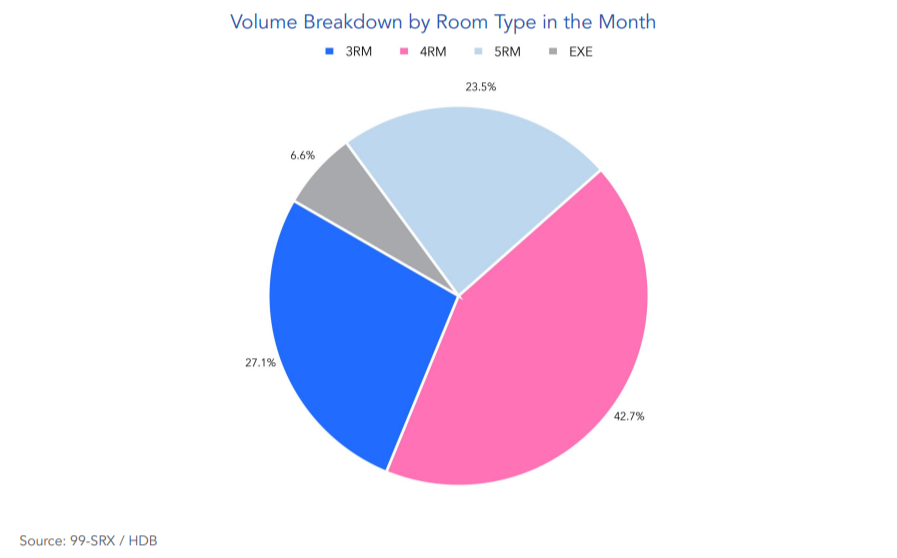

Room type distribution in October shows that 4-room flats continued to dominate resale transactions, accounting for 42.7% of the total volume, followed by 3-room, 5-room, and Executive flats with 27.1%, 23.5%, and 6.6%, respectively.

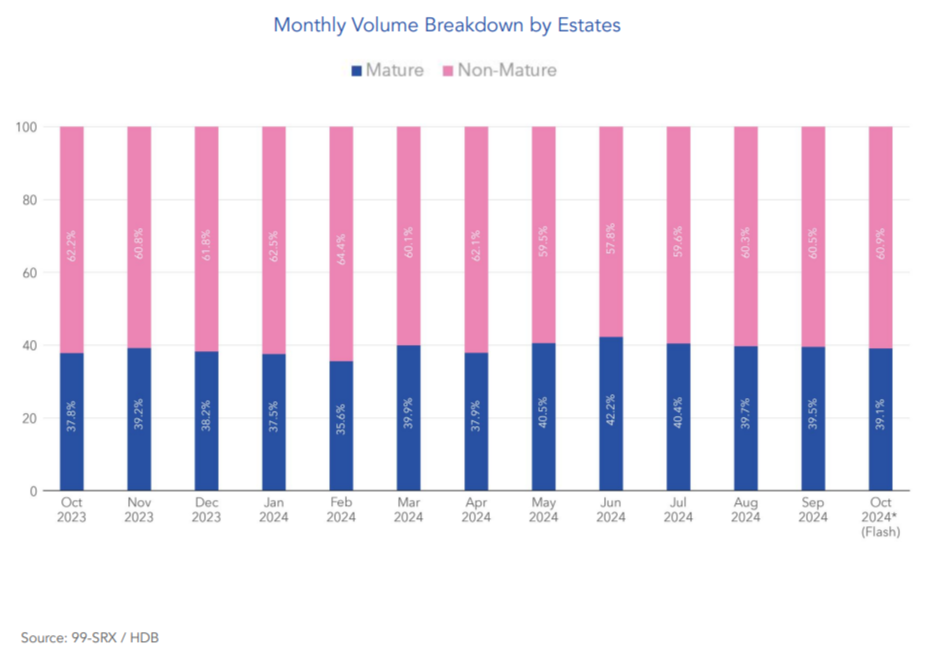

Breaking down by estate, Non-Mature Estates accounted for the majority of resale activity, contributing 60.9% of the transactions, while Mature Estates made up the remaining 39.1%. This reflects the trend of buyers favouring the relative affordability and availability of flats in Non-Mature Estates, particularly as more families and young professionals look beyond central locations.

Additional reading: September 2024 rental market: Condo and HDB rental volumes continue to drop amid stabilisation of condo rents

High-value transactions and million-dollar flats

In October 2024, the HDB resale market saw continued interest in high-value flats, with the highest transacted price reaching S$1.54 million for a 5-room flat located on Cantonment Road. Among Non-Mature Estates, the most expensive transaction was S$1.155 million for an Executive flat on Woodlands Street 82.

Notably, 103 HDB flats resold for at least S$1 million in October, slightly fewer than the 106 units in September, comprising 4.8% of the total resale volume. The demand for million-dollar flats concentrated in select areas, with Toa Payoh recording 18 transactions, followed by Kallang/Whampoa with 15, and Bukit Merah and Queenstown with 13 and 12 transactions, respectively. The appeal of these locations lies in their access to amenities and proximity to employment hubs, factors that continue to support high valuations.

Other areas with million-dollar transactions included Bishan, Ang Mo Kio, Central Area, Woodlands, Clementi, Geylang, Bedok, Tampines, Serangoon, Bukit Panjang, Bukit Timah, Hougang, and Yishun. This broad geographic spread indicates a robust appetite for high-end HDB flats across the island, underscoring the willingness of buyers to invest in resale flats that offer either strategic locations or unique features.

Wrapping up

HDB resale market in October 2024 displayed a blend of steady price growth and softened transaction volumes, due to high asking prices and competitive options from the BTO new launch sales. However, demand is expected to recover in the following months, aided by lower interest rates that reduce borrowing costs and allow for higher loan amounts. The sustained interest in the high-value resale flats also suggests that even with emerging competition from new BTO offerings, there remains a dedicated market segment willing to pay a premium for desirable resale options.

Would you pay a premium for a resale flat? Or are you eyeing the next BTO launch? Share your thoughts in the comments section below or on our Facebook page.

Please visit:

Our Sponsor