With headlines dominated by new tariffs, it’s natural to wonder how much each state depends on international trade. More broadly, how closely is each state’s economy tied to the flow of goods across U.S. borders? While it’s still early to measure the effects of recent trade changes, now is a good time to step back and look at the bigger picture, says the National Association of Realtors (NAR) senior economist and director of real estate research Nadia Evangelou.

Evangelou says tariffs are set at the federal level and apply nationwide, but their impacts vary locally. Some states have built entire economic ecosystems around global trade–exporting cars, chemicals, or electronics, or importing key materials that fuel local industries. For example, Texas exports a significant volume of oil and gas, while Michigan’s economy is closely tied to auto manufacturing. States also differ in their trading partners: Texas and Arizona are heavily integrated with Mexico, while West Coast states conduct more trade with Asia.

Understanding which states rely most on trade helps explain everything from warehouse demand and factory job growth to regional sensitivity to supply disruptions or price changes.

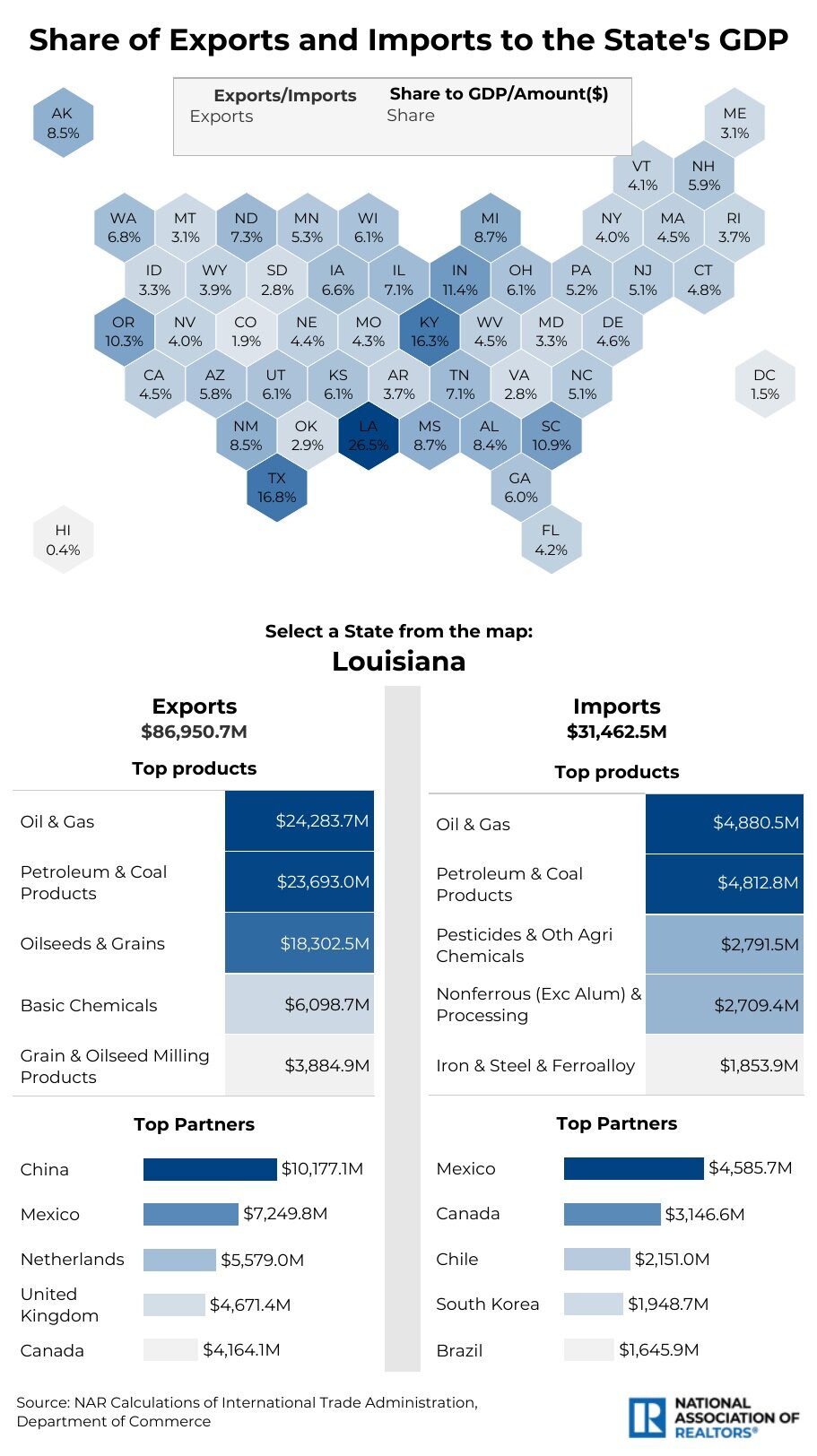

Top Export-Dependent States

Exports reflect goods produced in a state and sold abroad. Comparing export values to GDP reveals how vital exports are to each state’s economy. NAR says these states stood out:

- Louisiana leads the nation, with exports accounting for 26.5% of its GDP–driven by its energy and chemical sectors. Major partners include China, Mexico, and the Netherlands.

- Texas follows at 16.8%, exporting oil, gas, chemicals, and tech. Its infrastructure makes it a global shipping hub, with exports to Mexico, Canada, and the Netherlands each exceeding $30 billion.

- Kentucky, surprisingly, ranks third at 16.3%, thanks to strong auto and aerospace exports. It sends over $4.5 billion in goods to Canada, the UK, and France.

- Indiana (11.4%), South Carolina (10.9%), Oregon (10.3%), and Michigan (8.7%) also have robust export sectors, spanning pharmaceuticals to semiconductors.

Meanwhile, large states like New York (4.0%), Florida (4.2%), and California (4.5%) rank lower–not due to a lack of global influence, but because their economies are more service-oriented, centered on finance, tourism, and entertainment.

Top Import-Dependent States

NAR says imports include goods brought into the U.S., like car parts, electronics, and machinery. While imports subtract from GDP in a technical sense, comparing them to state GDP reveals how reliant states are on foreign goods.

- Kentucky again leads, with imports equaling 32.3% of GDP–highlighting its deep ties to global supply chains, especially in pharmaceuticals and auto manufacturing.

- Michigan (24.5%), Indiana (20.2%), Tennessee (21.9%), and Georgia (16.5%) also stand out, all serving as industrial or logistics hubs.

- Other notable states include Illinois (19.2%), New Jersey (18.1%), and South Carolina (16.6%), importing key goods like oil, tech equipment, and chemicals.

In contrast, more rural or service-based states such as South Dakota (2.2%), Nebraska (3.2%), and Wyoming (3.9%) have much lower import-to-GDP ratios, indicating a heavier reliance on domestic supply chains.

States Strong in Both Imports and Exports

Some states are heavily involved in both sides of trade:

- Kentucky ranks #1 in imports and #3 in exports, thanks to its strong logistics network and industrial base.

- Texas, #2 in exports and #9 in imports, benefits from its position on the U.S.-Mexico border and diversified economy.

- Indiana, Michigan, and South Carolina also rank high in both categories.

These states are more exposed to the ups and downs of global trade. When demand surges, they thrive. But disruptions–such as overseas factory shutdowns or sudden tariffs–can create ripple effects quickly.

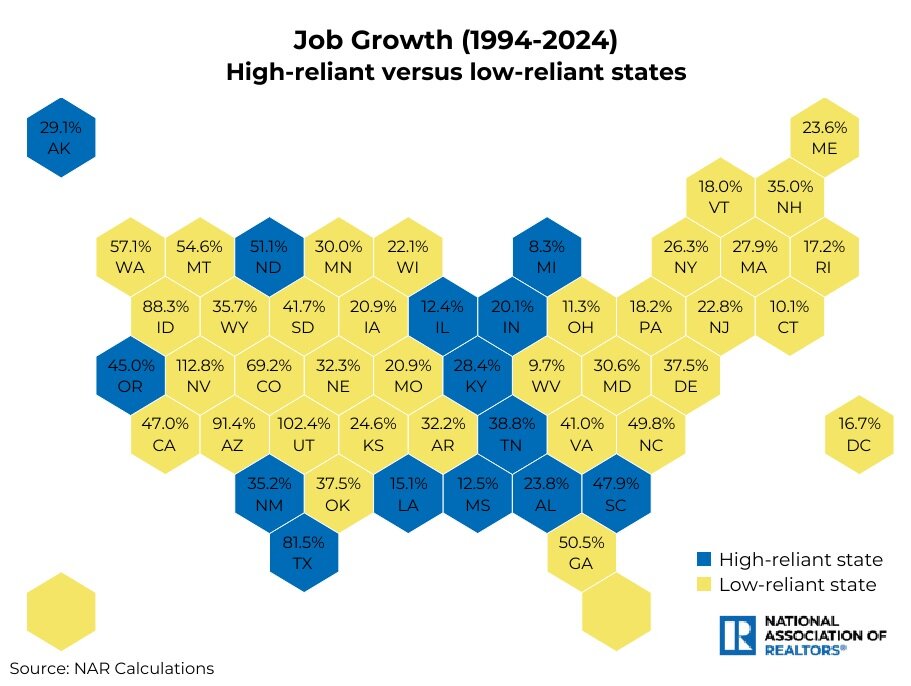

Labor Market Impacts

Global trade supports millions of jobs–directly and indirectly–but the employment effects vary widely by state. States with high trade reliance, like Texas and Michigan, tend to see greater volatility in job markets due to policy shifts.

Interestingly, states with lower trade exposure have often experienced stronger job growth. Since 1994 (post-NAFTA), low trade-reliant states (exports <7% of GDP) saw average job growth of 39%, while high trade-reliant states averaged 32%. Notably, Nevada (113%), Utah (102%), and Arizona (91%) doubled their job counts over the last 30 years, despite more modest trade footprints. Texas was the only high-trade state to crack the top 10, growing jobs by 81%.

Housing Market Trends

NAR says U.S. housing markets tell a similar story. Home prices have risen faster in states less reliant on trade. Low trade-reliant states saw an average increase of 291%, compared to 237% in high-trade-reliant states. Florida (406%), Washington (379%), and Colorado (377%) led the pack–all states with modest export levels but strong demand drivers like tech jobs, migration, and limited housing supply.

In short, while trade hubs like Dallas, Houston, Charleston, and Phoenix grew rapidly as logistics centers, broader economic success–especially in housing–has more to do with where people want to live and work than with where goods are shipped.

The Big Picture

Trade is undoubtedly a key economic driver for many states. But it’s not the sole factor shaping job or housing markets. In fact, the last few decades show that while trade can boost certain regions, long-term growth often hinges more on labor demand, local amenities, and demographic trends.

Whether you’re an investor, policymaker, or curious observer, knowing how trade impacts your state offers valuable perspective, says NAR — especially as global dynamics continue to evolve.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Please visit:

Our Sponsor