U.S. Buyer Contract Cancellations Also Rising in 2025

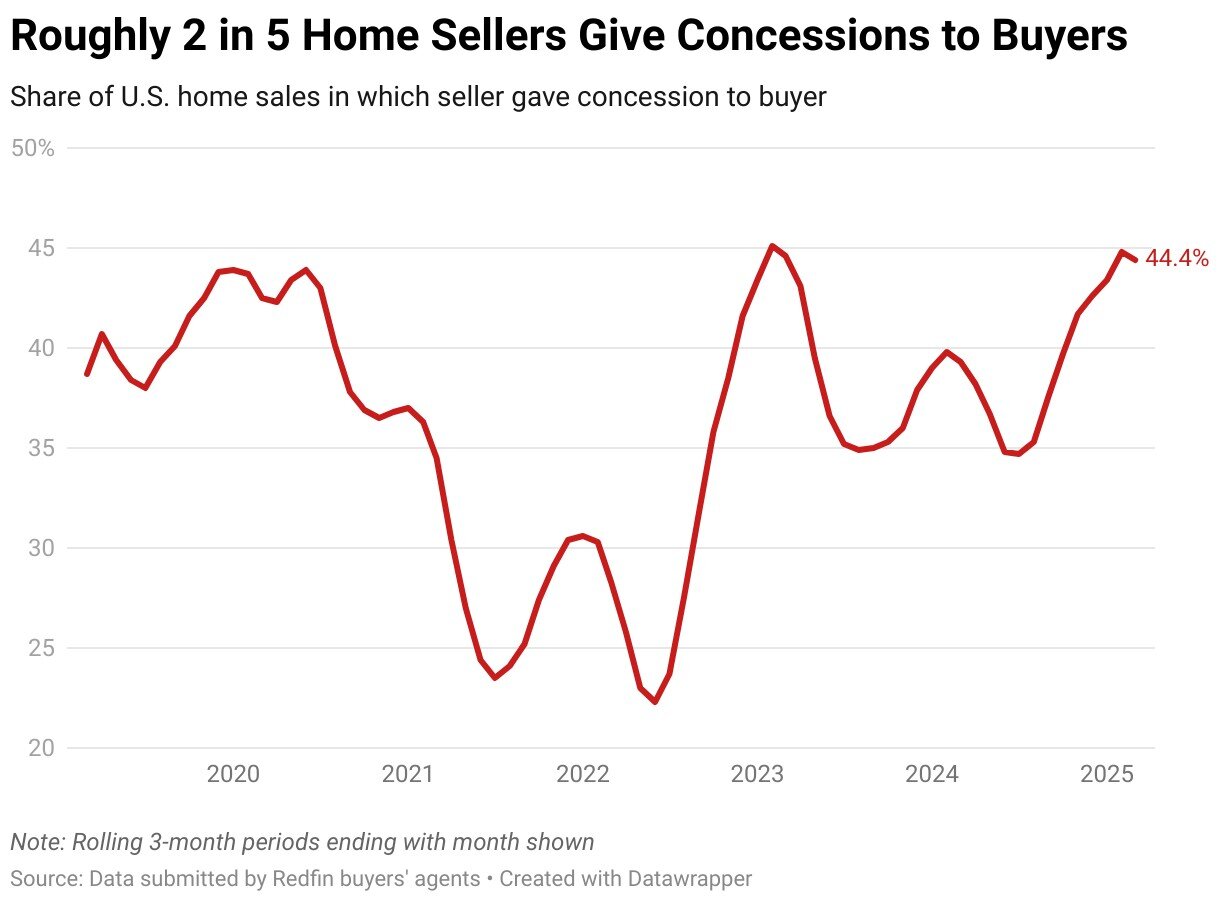

According to a recent report from Redfin, 44.4% of U.S. home-sale transactions in the first quarter of this year included concessions from sellers — an increase from 39.3% during the same period last year and just shy of the record 45.1% seen in early 2023.

This data, based on reports from Redfin buyers’ agents nationwide, covers rolling three-month periods dating back to 2019. A concession is recorded when a seller provides financial assistance to reduce a buyer’s total home purchase costs. Common concessions include funds for repairs, closing costs, or mortgage-rate buydowns. Notably, this doesn’t include instances where a seller drops the listing price or negotiates a lower sale price directly.

The uptick in concessions reflects a housing market increasingly tilted in buyers’ favor. High home prices, elevated mortgage rates, and broader economic uncertainty have dampened buyer demand. Meanwhile, inventory has reached a five-year high, giving buyers more choices and, in turn, greater negotiating leverage. Many properties, Redfin agents report, are overpriced and lingering on the market, prompting sellers to offer incentives to attract buyers.

Chaley McVay, a Redfin Premier agent in Portland, OR, notes that most of her current buyers offer request concessions — especially first-time homebuyers. “Where buyers once negotiated for minor repairs, many now seek concessions simply to make homeownership feasible,” McVay explained. “Sellers are frequently covering mortgage-rate buydowns, and I recently saw one pay seven months’ worth of HOA fees to help close a deal.”

McVay added that sellers are often nervous, having purchased at market peaks in 2021 and 2022, and are now facing higher mortgage rates when they buy again. “That’s why I tell buyers to ask for concessions rather than pushing for a lower sale price — it gives the seller peace of mind and helps the buyer stretch their budget.”

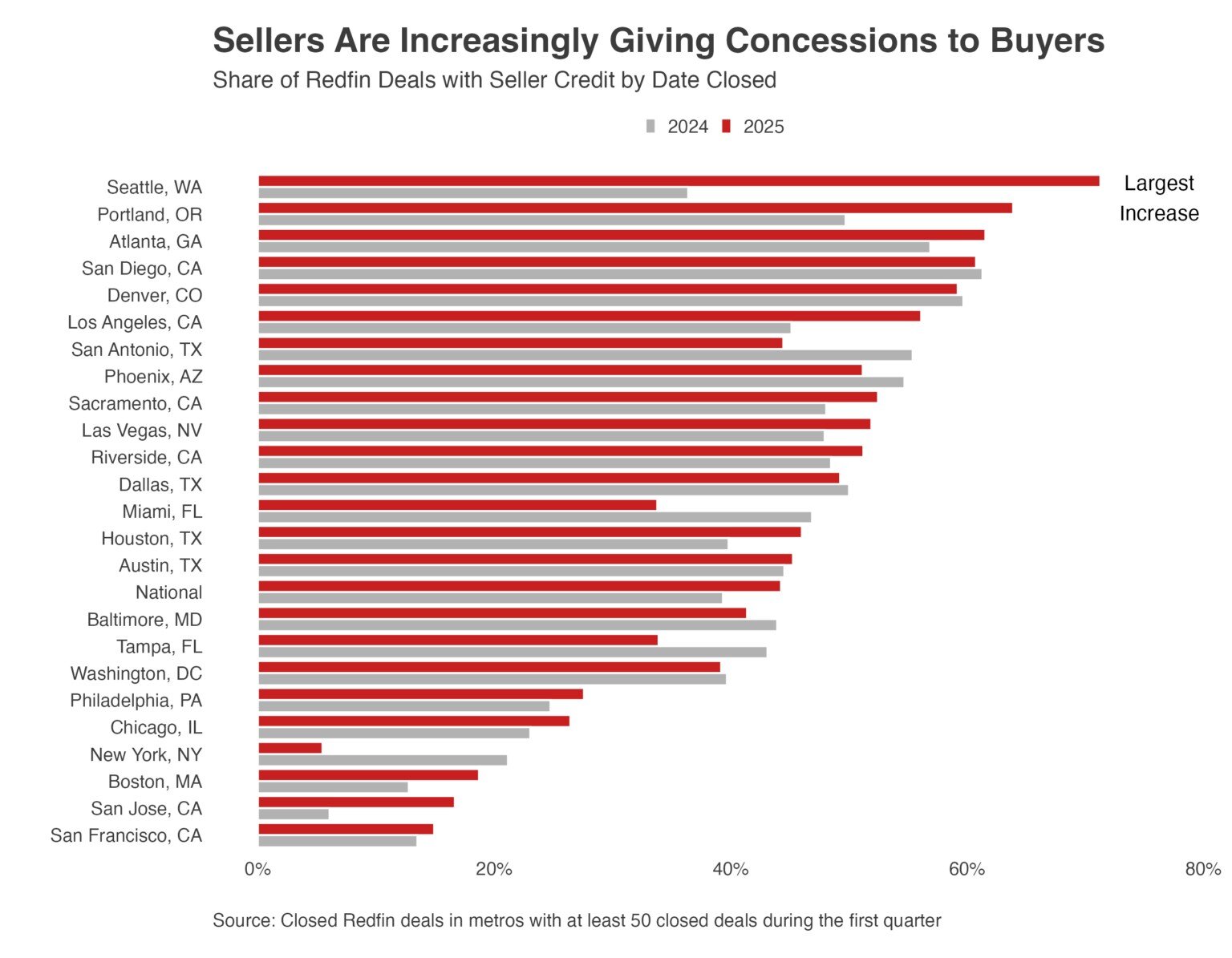

Concessions Climb Sharply in Seattle and Portland

Seattle saw the highest rate of concessions, with sellers offering incentives in 71.3% of transactions — nearly double the 36.4% reported a year prior and the largest increase among the 24 metro areas Redfin tracked.

“It’s typical to see concessions for condos and new-construction townhomes, but we’re increasingly seeing them for single-family homes too, especially if they’ve been on the market a while,” said Stephanie Kastner, a Redfin Premier agent in Seattle. She added that rising HOA fees and insurance costs have made condos tougher to sell, while builders often prefer to offer incentives like covering closing costs or throwing in appliances rather than lowering prices.

Portland followed closely, with concessions rising 14.2 percentage points year-over-year to 63.9%. Other notable increases occurred in Los Angeles (up 11 points to 56.1%), San Jose (up 10.6 points to 16.7%), and Houston (up 6.2 points to 46%).

After Seattle and Portland, the highest concession rates were seen in Atlanta, San Diego, and Denver.

New York Bucks the Trend with Fewer Concessions

At the other end of the spectrum, New York saw the largest decline in concessions, with only 5.5% of home sales including incentives — a drop of 15.7 points from a year earlier. Other significant declines occurred in Miami (down 13.1 points to 33.8%), San Antonio (down 10.9 points to 44.4%), Tampa (down 9.2 points to 33.9%), and Phoenix (down 3.5 points to 51.2%).

Markets in Florida and Texas, where price corrections have been ongoing for some time, have seen sellers adapt by pricing homes more realistically upfront, reducing the need for concessions.

Following New York, the metros with the lowest concession rates were San Francisco, San Jose, Boston, and Chicago.

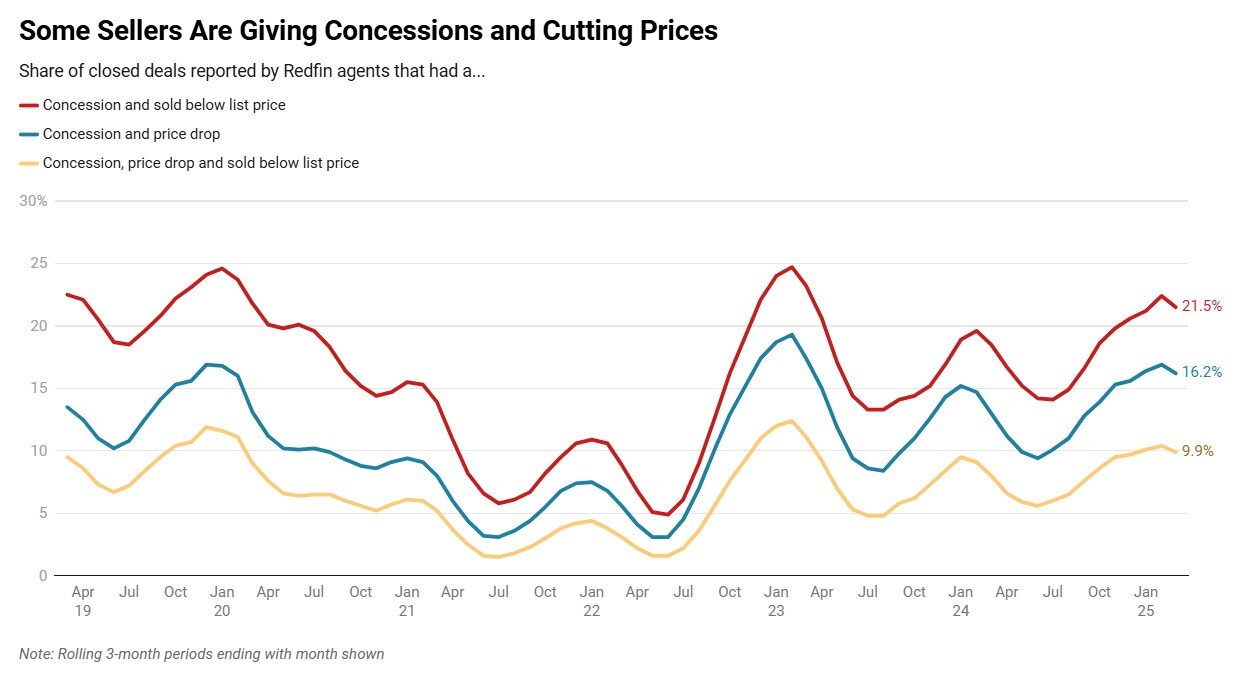

Some Sellers Are Cutting Prices and Offering Concessions

Alongside concessions, many sellers are also adjusting their asking prices to close deals. In the first quarter, 21.5% of homes sold had both a concession and a final sale price below asking — up from 18.5% a year ago. Additionally, 16.2% of sales involved both a price cut while the home was listed and a concession, up from 13% the year before. Notably, 9.9% of transactions included all three: a concession, a price cut, and a final sale price below the original list — up from 8% a year earlier.

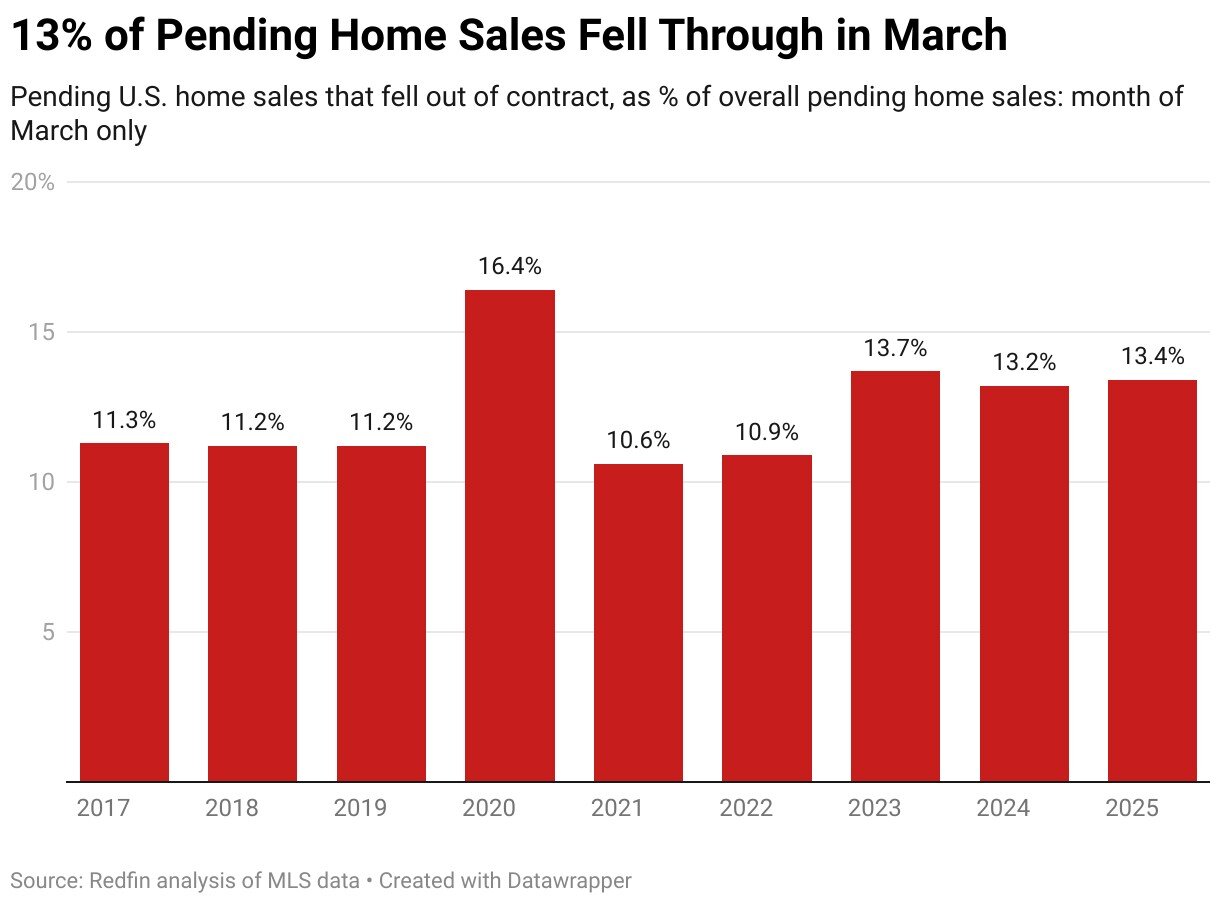

Contract Cancellations Also Rising

Economic uncertainty is also causing more home deals to fall through. Roughly 52,000 U.S. home-purchase agreements were canceled in March, representing 13.4% of all contracts signed that month. While only a slight increase year-over-year, it marked the third-highest March cancellation rate since 2017 — behind only 2020, when the pandemic briefly froze the housing market.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Please visit:

Our Sponsor