Executive Summary (TL;DR)

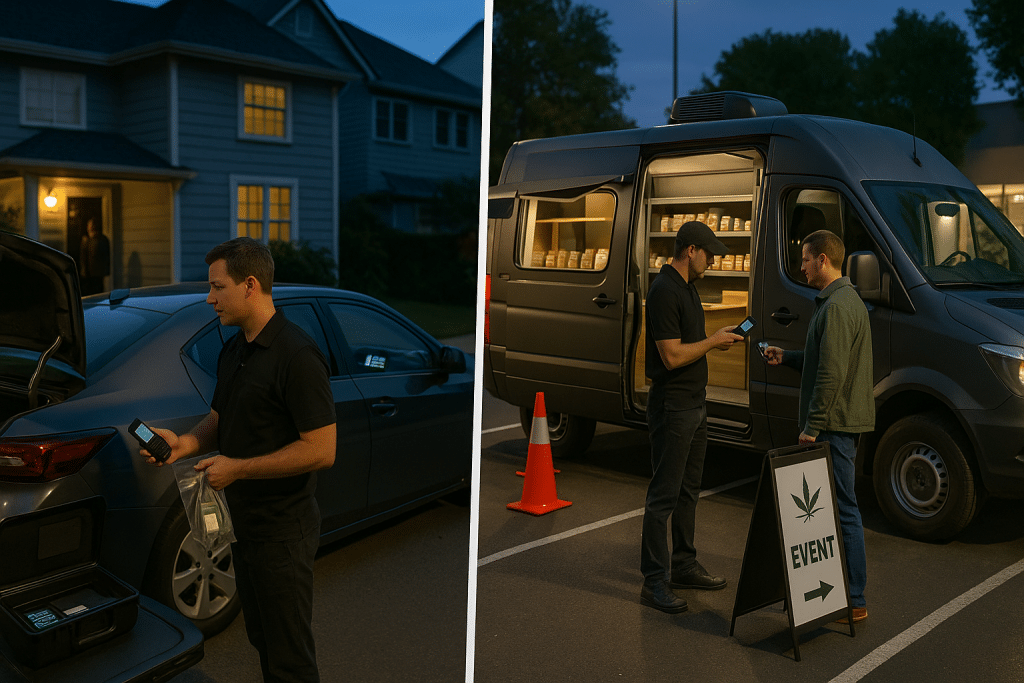

- “Ice cream truck” and “pizza delivery” are shorthand for two very different cannabis last-mile models. One is roving retail with inventory on wheels; the other is hub-and-spoke dispatch from a licensed premises to a specific address.

- Most U.S. rules favor the pizza model (pre-order, address-to-address, GPS, secure storage, track-and-trace); true roving retail is often restricted or prohibited. Confirm locally—the Authority Having Jurisdiction (AHJ) decides. Department of Cannabis Control+1Legal Information Institute

- Pick your model by regulatory fit, density, and unit economics. In dense metros, batched “pizza” routes outperform; in rural/suburban markets, hybrid mobile fulfillment (scheduled micro-hubs + dispatch) wins.

- If speed matters, buy the route, SOPs, and license. → Browse delivery businesses for sale

- This guide compares capital, compliance, staffing, routing, CX, KPIs, and real-estate needs to help investors and operators choose or combine models.

Table of Contents

- What these delivery models really mean

- Compliance reality (what the rules actually require)

- Model-by-model comparison (capex, opex, risk, KPIs)

- Routing, batching, and on-time performance

- Cash, ID, and security workflow (field SOPs that pass audits)

- Real-estate strategy: hubs, buffers, and where you can stage vehicles

- Build vs. buy (decision table)

- Due-diligence checklist (ready to use)

- Next steps

What these delivery models really mean

- Ice cream truck model (roving retail): A vehicle carries sellable inventory and circulates inside an authorized geography, ideally converting demand where it is—pop-up windows, on-the-spot orders, scheduled neighborhood time blocks, or micro-hub rendezvous. In the strict sense (flag-me-down sales), this is rarely permitted; many jurisdictions require pre-orders to a named customer at a fixed address and explicitly ban public-place vending.

- Pizza delivery model (hub-and-spoke): Orders are placed first (app/phone/web). A delivery employee departs a licensed premises with secured inventory, follows a planned route, verifies ID and address, and records the drop. This is the dominant, clearly regulated pattern in mature programs.

Operator note: In markets that don’t permit roving retail, you can still borrow the route-density and micro-hub ideas from the “ice cream” playbook while staying within “pizza” compliance.

Compliance reality (what the rules actually require)

Regulators care about traceability, security, and age control. Across leading markets:

- Track-and-trace/ledgering. California requires information about cannabis goods leaving a retail premises in a delivery vehicle to be recorded in the statewide track-and-trace system (Metrc). Delivery sales must be recorded; many operators create a delivery inventory ledger before wheels roll. Department of Cannabis Control+1Meadow

- Vehicle rules. CA regulations require enclosed, unmarked vehicles with secure storage compartments (trunk or caged/locked interior), and cannabis not visible to the public. Legal Information InstituteDepartment of Cannabis Control

- GPS & route logs. Programs commonly require GPS tracking and historical route records for delivery vehicles; compliance vendors and legal summaries emphasize this in CA and other states. KayaPush

- License types. Some states split delivery into courier vs. delivery operator licenses (e.g., Massachusetts 935 CMR 500), with different inventory possession rules and whether drivers can carry sellable goods. Massachusetts Cannabis CommissionMass.gov

- Age verification. Robust ID checks at the door (and sometimes at order) are expected; mobile ID-scan best practices are widely published. IDScan.netIncode

Bottom line: True “ice cream truck” (walk-up retail) is generally not allowed. Most jurisdictions require pre-ordered deliveries to private locations with GPS, unmarked vehicles, secure storage, and track-and-trace.

Model-by-model comparison

1) Economics, CX, and regulatory friction

| Dimension | Ice Cream Truck (roving retail) | Pizza Delivery (hub-and-spoke) |

|---|---|---|

| Regulatory fit | Often restricted/prohibited; if allowed, expect tight rules (pre-orders, no public vending) | Widely supported with clear rules on GPS, storage, and ledgering Department of Cannabis Control+1 |

| Capex | Upfitted vehicles (secure cages, safe, cameras), mobile POS, route sensors | Light vehicles + secure storage; stronger premises (vault, staging) |

| Opex | Higher idle time if demand pockets are thin; more driver dwell | Efficient if you batch stops; better labor per order |

| CX | Perceived spontaneity and locality | Reliable ETAs, full menu breadth, easy re-orders |

| Risk | Greater enforcement scrutiny; harder to prove address-to-address compliance | Mature audits; track-and-trace aligns cleanly with SOPs Department of Cannabis Control |

| Best when | Jurisdiction explicitly allows mobile retail and density clusters exist | Most markets; urban/suburban with batchable demand |

2) Staffing, routing, and throughput

| Topic | Ice Cream | Pizza |

|---|---|---|

| Dispatch | Dynamic—drivers roam within geofences/time windows | Centralized—drivers launch with multi-stop routes |

| Throughput | Spiky; relies on local events & micro-hubs | Predictable; batched 3–6+ stops per run |

| Training | Heavier on on-the-fly ID/age control in variable settings | SOP-driven handoffs at doors or building lobbies |

| Loss prevention | More exposure in public places | Lower exposure; address-verified handoffs |

Routing, batching, and on-time performance

Regardless of model, profits live in route density:

- Batch windows. In dense zones, launch with 3–6 stops per run; keep route cycle within 45–75 minutes to hold freshness and SLA.

- Geofenced slots. For hybrid models, publish neighborhood time blocks (e.g., 6–8 PM in ZIP 12345). Customers pick a block; you batch automatically.

- Fallback for low density. In exurbs, set two waves nightly and accumulate orders to minimum batch size before dispatch.

- KPI targets: on-time arrival ≥95%; route variance ≤10 minutes; re-attempts ≤2%.

Cash, ID, and security workflow (field SOPs that pass audits)

Vehicle & storage

- Enclosed, unmarked vehicles; no visible product; secure trunk or locked interior compartment (cage or shatter-resistant acrylic as defined). Department of Cannabis Control

- GPS on and recording; route logs preserved per record-retention rules. KayaPush

Inventory control

ID & age verification

- Two-step: soft verify at checkout (DOB validation) and hard verify at the door with a mobile ID scanner; never rely on visual checks alone. IDScan.netIncode

Cash handling

- If taking cash, use drop safes, minimal float, and end-of-run reconciliation; vary banking times and routes.

- Driver pairs are valuable in high-cash or high-density windows; otherwise, build panic workflows and geofenced alerts.

No public-place sales

- Deliver to the customer’s address or a location expressly allowed; avoid parks, schools, and public areas (typical prohibitions). Tie your app logic to geofences.

Real-estate strategy: hubs, buffers, and where you can stage vehicles

Even delivery-only businesses need the right address:

- Zoning: Many jurisdictions limit retail cannabis (including non-storefront delivery) to specific commercial/industrial districts. Confirm with the AHJ where non-storefront retail, delivery staging, and vaulting are allowed.

- Buffers & measurement methods: Sensitive-use buffers (common baselines ~600 ft) and how they’re measured (property-line, entrance-to-entrance, parcel centroid) define your parcel universe. Get the method in writing from planning staff.

- Premises vs. warehouse. A non-storefront retail premises may look like an ordinary warehouse from the street but must meet retail security, track-and-trace, and storage rules.

- Utilities & space: Secure vault, camera coverage, driver staging, packing benches, and vehicle parking (consider indoor bays for discretion and weather).

- When retail matters. If you plan to attach a showroom or pickup, underwrite a separate retail CUP/permit track and traffic counts. → Evaluate retail dispensary opportunities

Build vs. buy (decision table)

| Priority | Build from scratch | Acquire a delivery operation |

|---|---|---|

| Timeline | 4–12+ months (site selection, entitlements, SOPs, app stack) | Faster—licenses, SOPs, routes, and ratings transfer |

| Capex | Premises improvements, vault, vehicles, scanners, software | Purchase price + upgrades; lower initial capex |

| Regulatory certainty | Requires fresh compliance approvals | Known compliance history eases underwriting |

| Customer acquisition | Start at zero; heavy marketing | Inherit cohorts, reviews, and demand density |

Playbook: Buy a delivery license with active routes, then add route batching, mobile ID scanners, and ledger discipline to tighten margin—and expand into adjacent ZIPs when density warrants. → Browse delivery businesses for sale

Due-diligence checklist (ready to use)

Regulatory

Operations & tech

- Route data (orders per hour, batches per run, on-time rate, re-attempts).

- ID tech stack (device model, SDK, fraud libraries), failure-mode SOPs. IDScan.net

- Cash SOPs (floats, armored pickup schedule, exceptions).

- App & menu accuracy (ETA promises vs. actuals; cancellation reasons).

Financial

- CAC/LTV by channel; promo mix; average discount vs. retail peers.

- Contribution margin by route window; driver cost per order; refunds/chargebacks.

- Insurance limits (auto, GL, cargo) and losses.

People

- Driver background policy; crash history; training completion logs.

- Mystery-shop results (ID pass rate, timeliness, demeanor).

Myth vs. Fact

- Myth: Ice-cream-truck-style walk-up sales are an easy growth hack.

Fact: In most markets, public-place vending is not allowed, and deliveries must be address-to-address with prior order and GPS logs. Department of Cannabis Control - Myth: A smartphone camera is enough for ID verification.

Fact: Mobile ID scanners catch fakes and create audit trails that survive inspections. IDScan.net - Myth: Delivery is low-capex.

Fact: You shift capex from storefront to vehicles, vaulting, scanners, software, and compliance instrumentation (GPS, cameras, track-and-trace). - Myth: You can’t build brand without a store.

Fact: High-reliability ETAs, clean handoffs, consistent packaging, and fast refunds build five-star delivery brands that outperform many showrooms.

KPI dashboard (review weekly)

- On-time arrival % and route variance

- Stops per run and orders per labor hour

- ID scan pass rate and exception rate (expired, mismatch)

- Ledger accuracy (variance between outbound and return)

- Refunds & re-attempts (% of orders)

- CAC/LTV (by paid and organic channels), repeat rate 30/60/90

- Vehicle incidents and insurance claims

Next steps

- Choose your model (pure pizza or permitted hybrid).

- Check regulatory fit: zoning, buffer method, license type, route SOPs, and vehicle rules.

- Design the hub: vault, staging, driver parking, scanners, GPS, ledger workflow.

- Pilot with SLA discipline: batch windows, 95% on-time target, two-step ID.

- Scale by density: split zones, add vehicles after route batching saturates.

- Want a running start? → Browse delivery operators for sale or pair delivery with an existing storefront → Retail dispensary businesses

Disclaimer

This article is for educational purposes only and does not constitute legal, engineering, financial, or tax advice. Always consult qualified professionals and your local Authority Having Jurisdiction before making decisions.

Please visit:

Our Sponsor