The global data center industry is entering an era of expansion unlike anything it has seen before, driven by surging demand from artificial intelligence and cloud computing while avoiding the excesses that typically accompany rapid growth.

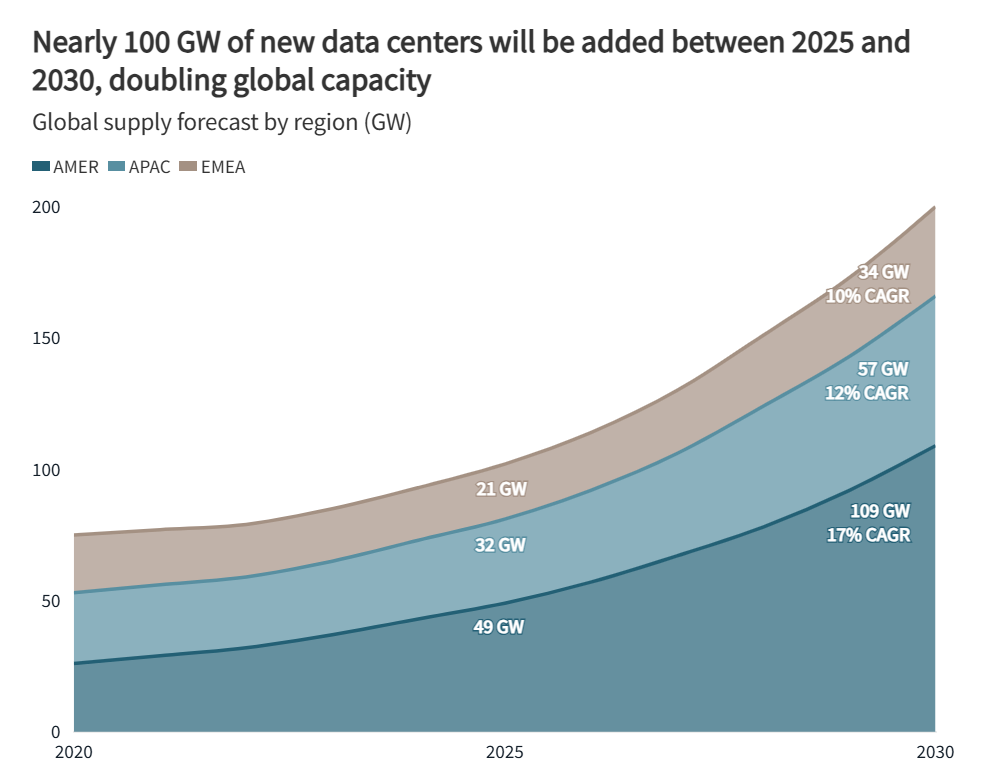

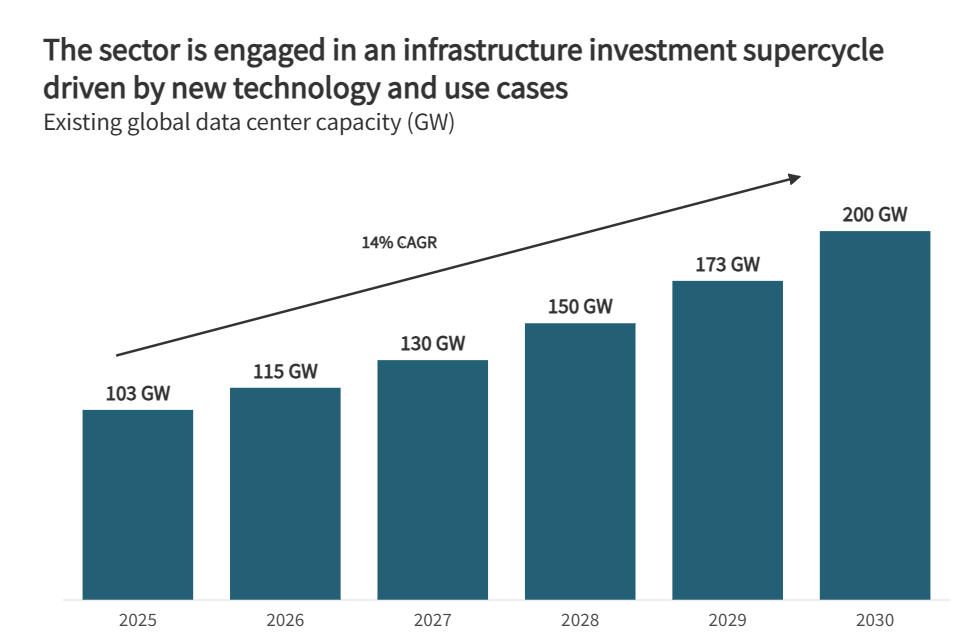

Worldwide data center capacity is expected to nearly double to about 200 gigawatts by 2030, up from roughly 103 gigawatts today, according to JLL’s newly released 2026 Global Data Center Outlook. AI is emerging as the dominant force behind that growth, with workloads tied to artificial intelligence projected to account for about half of all global data center capacity by the end of the decade. Despite the scale of expansion, JLL said sector fundamentals remain sound, with leasing, occupancy and development trends showing no signs of a speculative bubble.

The buildout will demand extraordinary levels of capital. JLL estimates as much as $3 trillion in total investment over the next five years, including roughly $1.2 trillion in new real estate value creation and about $870 billion in additional debt financing. The figures point to what the firm characterizes as a once-in-a-generation infrastructure investment supercycle.

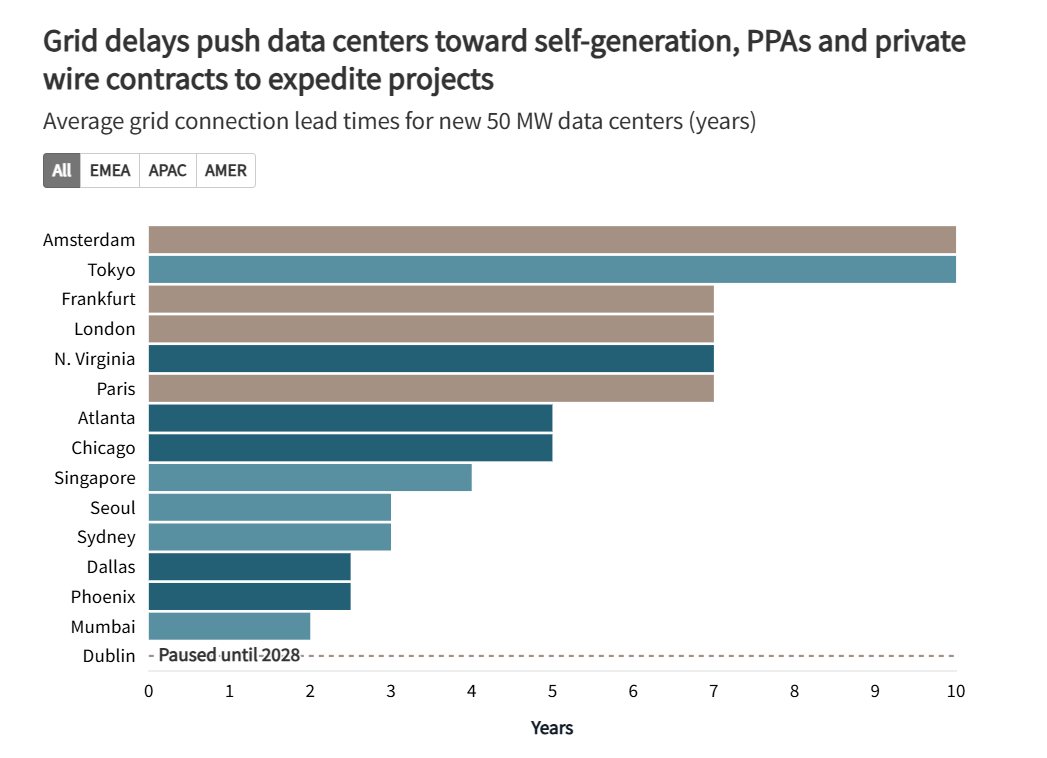

“We’re witnessing the most significant transformation in data center infrastructure since the original cloud migration,” said Matt Landek, global division president for data centers and critical environments at JLL. Hyperscale technology companies alone are expected to allocate around $1 trillion to data center spending between 2024 and 2026, he said, even as supply constraints and grid connection delays stretching as long as four years complicate development strategies and energy sourcing decisions.

AI reshapes the market

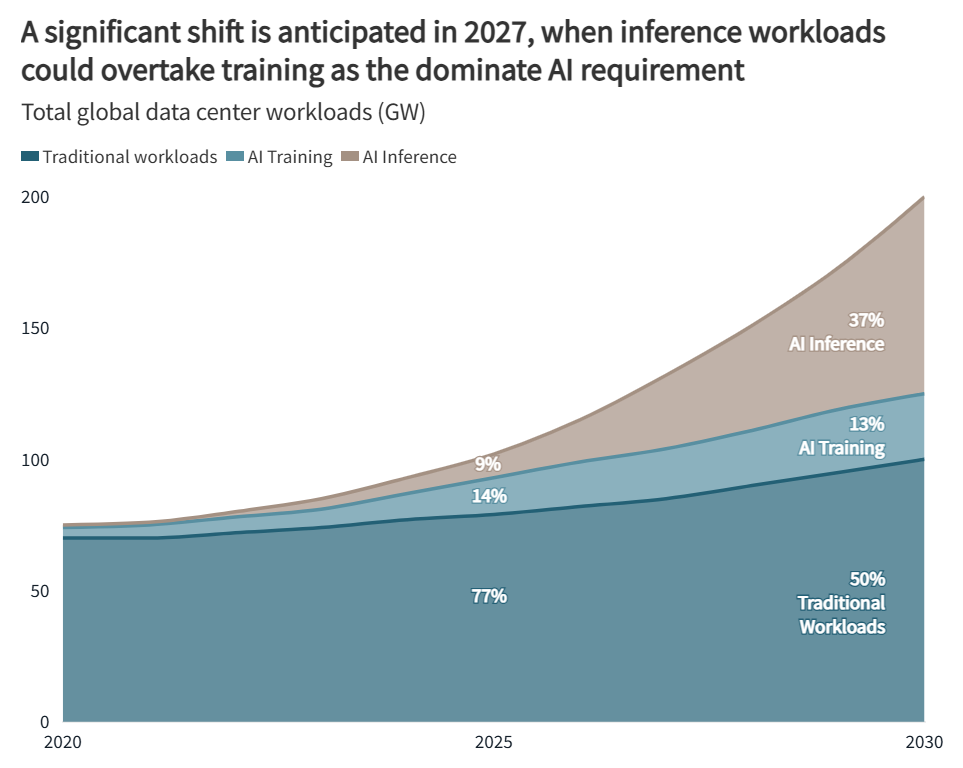

Artificial intelligence is rapidly redefining both the economics and the physical design of data centers. AI-related workloads are expected to rise from roughly 25% of total capacity in 2025 to about 50% by 2030. JLL projects a pivotal shift around 2027, when inference — the real-time deployment of trained AI models — overtakes training as the dominant computing requirement.

“The industry is moving toward an entirely new infrastructure paradigm,” said Andrew Batson, global head of data center research at JLL. Facilities designed for AI training can require as much as ten times the power density of traditional data centers and command lease-rate premiums of around 60%, he said. Governments are also stepping in, viewing AI infrastructure as a strategic asset and spurring sovereign investments that could amount to an estimated $8 billion in capital expenditures by 2030.

The ripple effects extend into the semiconductor industry. AI chips are projected to increase their share of global semiconductor revenues from about 20% today to roughly 50% by 2030, with custom silicon capturing an increasing portion as hyperscalers design their own processors. Over time, emerging technologies such as neuromorphic computing could ease infrastructure demands by delivering more energy-efficient inference, though those systems remain largely experimental.

Diverging regional trajectories

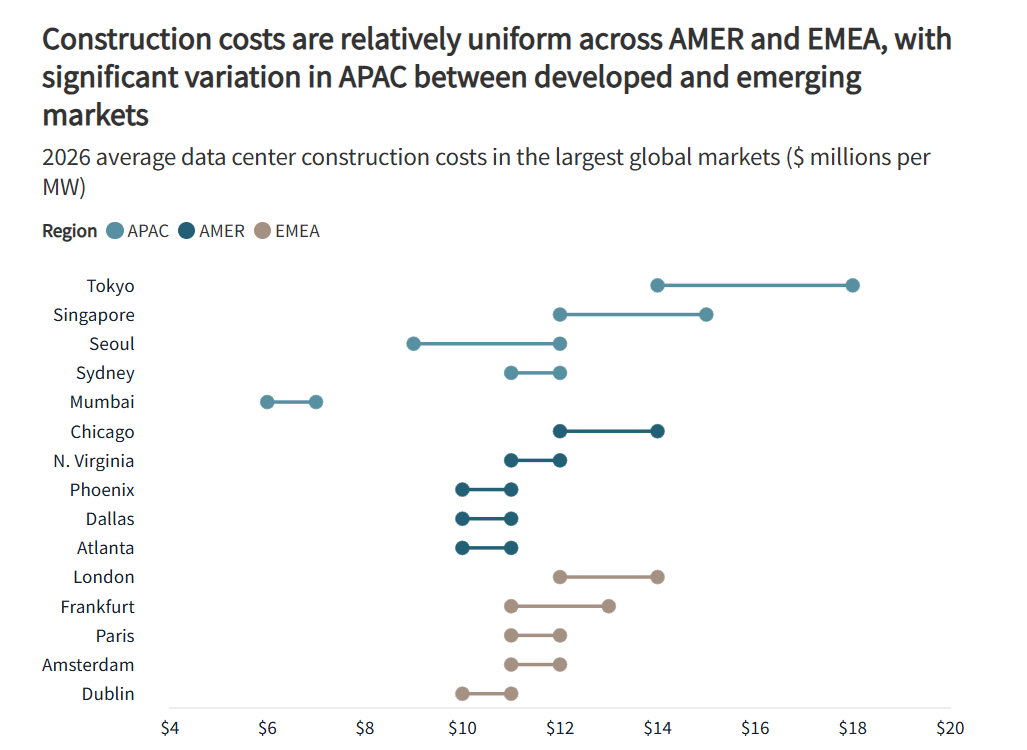

The Americas are expected to remain the world’s largest data center market, accounting for roughly half of global capacity and posting the fastest growth rate through 2030. Asia-Pacific capacity is projected to rise from about 32 gigawatts to 57 gigawatts, while Europe, the Middle East and Africa are expected to add roughly 13 gigawatts of new supply.

Regional dynamics vary sharply. In Asia-Pacific, growth is being led by colocation providers, while on-premise enterprise capacity is forecast to shrink by about 6% as companies continue migrating to the cloud. In EMEA, expansion is being driven primarily by hyperscalers, with demand concentrated in established European hubs such as London, Frankfurt and Paris, alongside fast-growing Middle Eastern markets pursuing digital transformation agendas. The U.S. dominates activity in the Americas, representing close to 90% of regional capacity.

In the U.S., developers are rethinking how they build. “We’re seeing a clear shift toward phased developments measured in hundreds of megawatts, or even gigawatts,” said Andy Cvengros, executive managing director and co-lead of JLL’s U.S. data center markets team. Single-tenant hyperscale leases are increasingly preferred over multi-tenant colocation, he said, as developers prioritize access to power above all else. For projects targeting delivery in 2027, speed to power has become the decisive factor in site selection, eclipsing traditional considerations such as land cost or proximity to urban centers.

Strong fundamentals, tight supply

Despite rapid expansion, market indicators point to continued balance rather than overheating. Global occupancy stands at about 97%, according to JLL, and roughly 77% of projects currently under construction are already pre-leased. Lease rates worldwide are projected to rise at a compound annual rate of about 5% through 2030, led by the Americas, where rates are expected to climb around 7% annually due to acute supply shortages.

Construction challenges remain a persistent constraint. More than half of projects in 2025 experienced delays of three months or longer, even as developers began preordering critical equipment as much as two years in advance. Average equipment lead times have stretched to about 33 weeks globally, roughly 50% longer than before 2020. To offset these bottlenecks, the industry is increasingly turning to modular construction and prefabricated solutions, with annual sales of modular systems and micro data centers projected to reach $48 billion by 2030.

Power becomes the bottleneck

Energy access has emerged as the sector’s most formidable obstacle. In many primary markets, grid interconnection timelines now exceed four years, prompting some operators to directly finance power generation. Jurisdictions including Dublin and parts of Texas have effectively adopted “bring your own power” requirements, forcing developers to secure dedicated energy supplies before moving forward.

Strategies vary by region. In the U.S., natural gas is expected to play a significant role in easing grid constraints, serving both as temporary bridge power and, increasingly, as permanent on-site generation. Major hyperscalers already match their U.S. data center electricity consumption with renewable energy purchases. In EMEA, projects combining renewables with private transmission lines can cut tenants’ power costs by as much as 40% compared with grid pricing.

Battery energy storage systems are gaining traction as well, helping operators manage short-duration outages while also functioning as grid-support assets that can accelerate interconnection approvals. By 2030, solar paired with storage is expected to become a cornerstone of global data center energy strategies, with renewable power costs projected to undercut fossil fuels across all major regions.

As scrutiny around sustainability intensifies, operators face mounting pressure to justify their energy choices. While solar and wind remain the backbone of clean-energy strategies, interest in nuclear power is growing due to its reliability and carbon-free profile. Significant new nuclear capacity, however, is unlikely to come online at scale before the 2030s.

Capital markets mature

The surge in demand is reshaping how the sector is financed. Core investment strategies now account for about 24% of fundraising activity, up from less than 10% in earlier years, reflecting growing institutional confidence in data centers as a long-term asset class. Since 2020, global mergers and acquisitions activity in the sector has exceeded $300 billion, though future capital deployment is expected to tilt toward recapitalizations and joint ventures as portfolios mature.

Global core fund capital formation could surpass $50 billion in 2026, with target returns of 10% or more. Asset-backed securities and commercial mortgage-backed securities are also gaining prominence as financing tools, with issuance volumes roughly doubling each year since 2020 and projected to reach about $50 billion in 2026.

“The rise of AI-driven and neocloud platforms has made 2025 a defining year for the data center sector,” said Carl Beardsley, U.S. data center leader for JLL Capital Markets. Structuring capital stacks for these deals is increasingly complex, he said, as lenders and equity partners seek safeguards commensurate with multibillion-dollar investments. The scale and specialization required by AI infrastructure are forcing financiers to develop new approaches that balance rapid growth with disciplined risk management.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Please visit:

Our Sponsor