U.S. Housing Market Enters 2026 in Uneven Transition as Affordability Pressures Mount

According to new data from property analytics firm Cotality, the U.S. housing market is opening 2026 in a state of recalibration rather than recovery, with cooling prices, widening regional disparities and mounting affordability strains reshaping buyer and seller behavior.

After two years defined by rapid appreciation and constrained supply, 2025 marked a turning point. National home-price growth slowed to near stall speed by year-end, demand softened under higher borrowing costs and insurance premiums, and local markets increasingly diverged. Strength in parts of the Northeast and Midwest contrasted sharply with pronounced weakness across several Sun Belt metros, particularly in Florida and Texas.

Affordability remains the dominant structural challenge. When taxes and insurance are included, only about half of U.S. metropolitan areas remain within reach of the median household, Cotality estimates. At the same time, residential reconstruction costs are rising at more than double the pace of overall inflation, intensifying financial pressure on existing homeowners as well as new buyers.

Investor participation is also emerging as a defining force in select markets, especially in areas recovering from natural disasters, even as national policy debates around institutional ownership continue to outpace its measured share of overall transactions.

Price Growth Slows as Regional Gaps Widen

National home-price appreciation decelerated sharply toward the end of 2025, increasing just 1% year over year in November, according to Cotality. The slowdown, however, masked pronounced regional divergence. Several Northeastern and Midwestern cities posted renewed momentum, while markets across Florida and Texas recorded some of the steepest pullbacks. Washington, D.C., ranked among the fastest-declining large metros.

Mortgage rates are expected to ease modestly in 2026, a factor that could draw sidelined buyers back into the market. Analysts caution, however, that limited inventory and elevated non-mortgage costs are likely to keep competition intense in desirable neighborhoods while leaving weaker markets sluggish.

Florida Listings Linger

Homes in major Florida metros are taking longer to secure buyers, underscoring cooling demand in a region that had been a pandemic-era growth engine. In Miami, the median home that went under contract in December spent 69 days on the market, well above the national median of 47 days and slightly longer than earlier in the fall. Tampa, Orlando and Jacksonville also registered rising days-on-market figures, while inventory in Tampa and Orlando climbed roughly 10% from a year earlier.

New York and Austin See Sales Slumps

Two of the country’s most closely watched housing markets–New York City and Austin, Texas–posted some of the steepest transaction declines among large metros. Fourth-quarter sales volumes in both cities fell nearly 30% from a year earlier, far exceeding the modest national decline. Listings accumulated and marketing times lengthened sharply, with Austin’s median time to contract nearly tripling over the course of the fall and New York registering a significant jump as well.

Disaster Recovery Draws Investors

In California communities affected by Santa Ana-driven wildfires a year earlier, recovery patterns are increasingly shaped by investor activity rather than returning owner-occupants. Roughly 6.6% of destroyed properties changed hands over the past year, a resale rate well above that of minimally damaged homes. Nearly half of those transactions involved investors, and when purchases through limited-liability companies and other corporate structures are included, investor or corporate participation rises to roughly three-quarters of sales, Cotality found.

Institutional Buyer Debate Outpaces Market Share

Despite heightened political scrutiny, large institutional investors account for only about 3% of single-family home purchases nationwide, according to the firm’s analysis. A nationwide ban on such buyers would therefore have limited impact on overall supply, analysts say, particularly because most proposals do not compel existing owners to divest. Curtailing institutional purchases could also tighten rental supply in markets where would-be buyers are delaying ownership.

Single-Family Rents Cool to Multi-Year Lows

Annual rent growth for single-family homes slowed to 1.1% in November, marking the weakest pace in roughly 15 years. The deceleration is broad-based: 43 of the 50 largest U.S. metros posted slower growth, and 16 recorded outright declines. Florida led in annual rent drops, while several Midwest markets, including the Chicago area, continued to see modest gains. Even previously fast-rising luxury segments have largely leveled off.

Cash Buyers Gain Pricing Power

All-cash purchasers are negotiating increasingly steep discounts as higher interest rates and rising contract cancellations elevate the value of speed and certainty for sellers. The average discount on cash transactions reached about 9% in 2025, more than double the level seen four years earlier. The trend risks widening the affordability gap, as financed buyers face both higher monthly payments and intensified competition from liquidity-rich bidders.

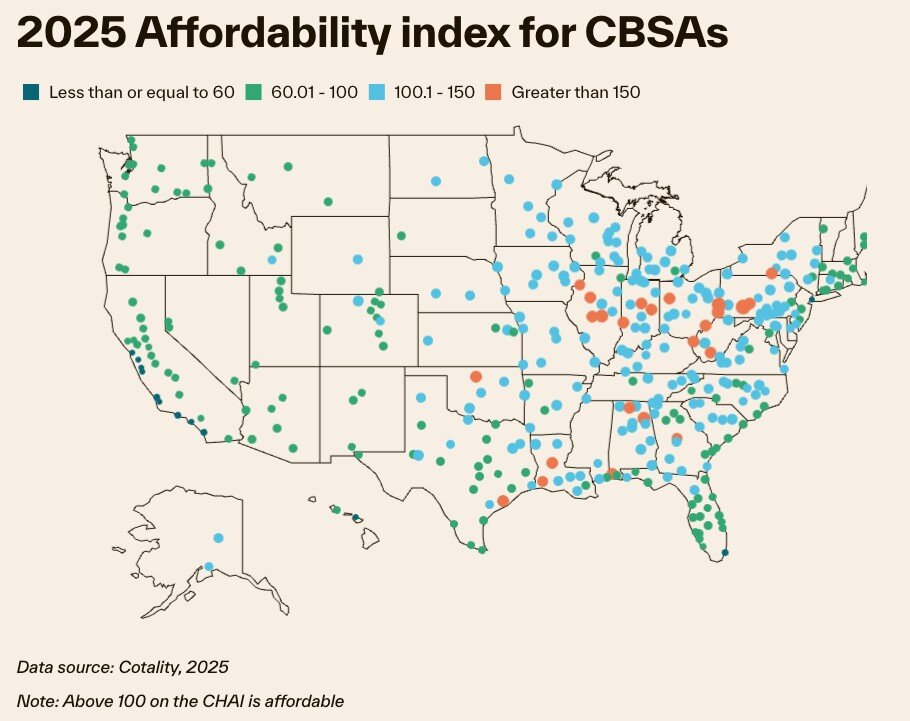

Affordability Diverges Across Metros

Only 56% of metropolitan areas remain affordable to the median household once property taxes and insurance premiums are factored into monthly payments, according to Cotality’s affordability index. In many regions, escrow expenses alone account for more than 40% of total housing costs, exposing households to payment shocks when insurance or tax bills rise.

“Escrow Squeeze” Shrinks Affordable Markets

The number of U.S. markets classified as affordable has fallen sharply over the past decade. Areas meeting Cotality’s affordability thresholds dropped by roughly 40% from 2014 to 2025, while regions considered highly affordable have nearly vanished. Analysts attribute the contraction largely to rising insurance premiums, property taxes and maintenance expenses rather than mortgage rates alone.

Reconstruction Costs Outpace Inflation

Residential rebuilding expenses continue to climb faster than consumer prices, with reconstruction costs rising 6.6% year over year as of January 2025–more than twice the overall inflation rate. Higher material and labor costs are increasing the risk of insurance coverage gaps for homeowners and raising the long-term cost of ownership in disaster-prone regions.

Outlook for 2026

Cotality expects modest relief from slightly lower mortgage rates to stimulate selective buying activity in 2026, but structural constraints–limited inventory, elevated insurance premiums and rising non-mortgage expenses–are likely to keep outcomes highly localized. Rather than a broad-based rebound or downturn, the year ahead is shaping up as a market defined by divergence, with affordability and cash liquidity emerging as the primary determinants of who can buy, where, and at what price.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Please visit:

Our Sponsor