Persistent affordability pressures in the U.S. housing market are continuing to reshape who buys homes — and who does not. New research from real-estate analytics firm Cotality shows that elevated mortgage rates and record-high prices are sidelining many owner-occupant buyers, while sustaining unusually strong demand in the rental market and keeping property investors firmly in play.

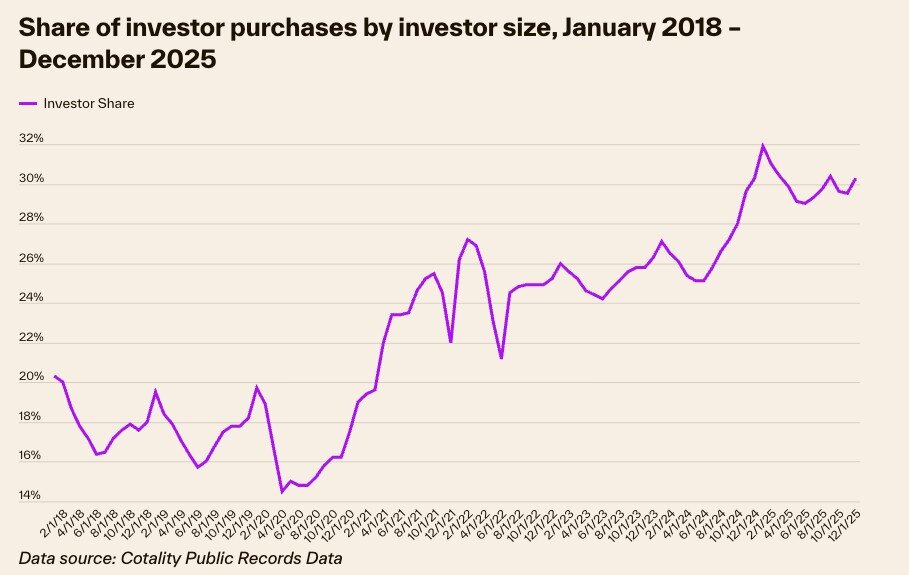

By the end of 2025, investors accounted for roughly 30% of all single-family home purchases nationwide, inching up from 29% a year earlier. The change is modest, but the durability of investor participation stands out against a broader slowdown in overall home sales and a pullback among first-time buyers.

“Fewer first-time homebuyers mean more people are staying in the rental market, and investors are responding to that demand,” said Thom Malone, Principal Economist at Cotality. “The current landscape differs significantly from the pandemic-era surge, which was fueled by rapid price appreciation. Now, while real estate is no longer the ‘hottest’ asset, strong rental demand and the ability to secure acquisitions below list price are keeping investors engaged even as traditional buyers retreat.”

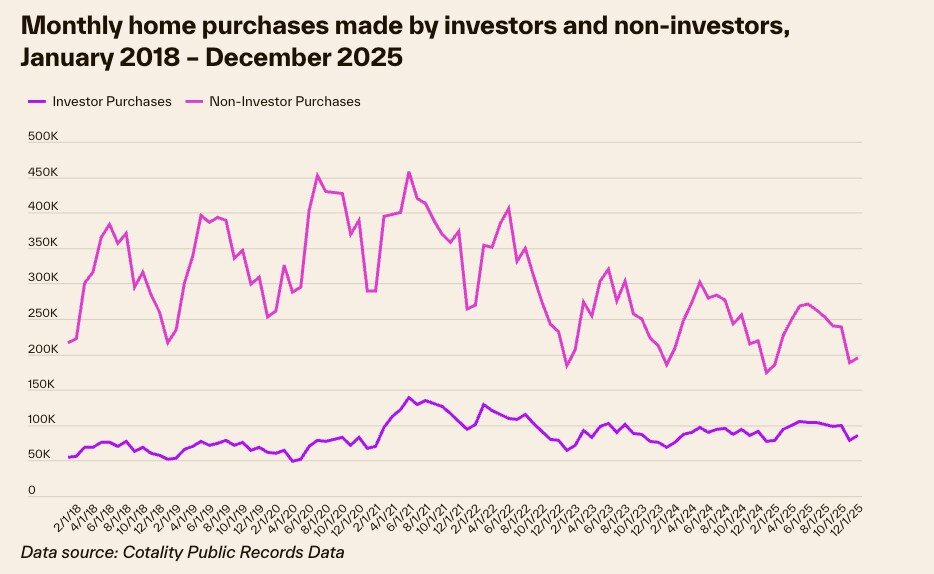

Monthly investor acquisitions hovered between 80,000 and 100,000 through late 2025, a pace largely unchanged from the prior year. Total housing transactions remain well below the frenzied levels seen in 2021, yet investors have proven markedly more resilient than traditional buyers. Over the past four years, the gap between owner-occupant purchases and investor purchases has narrowed dramatically, shrinking from roughly 270,000 homes to about 110,000.

Cash continues to be a decisive advantage. Investors, far more likely to transact without financing, are insulated from higher borrowing costs and better positioned to secure price concessions from sellers facing thinner buyer pools.

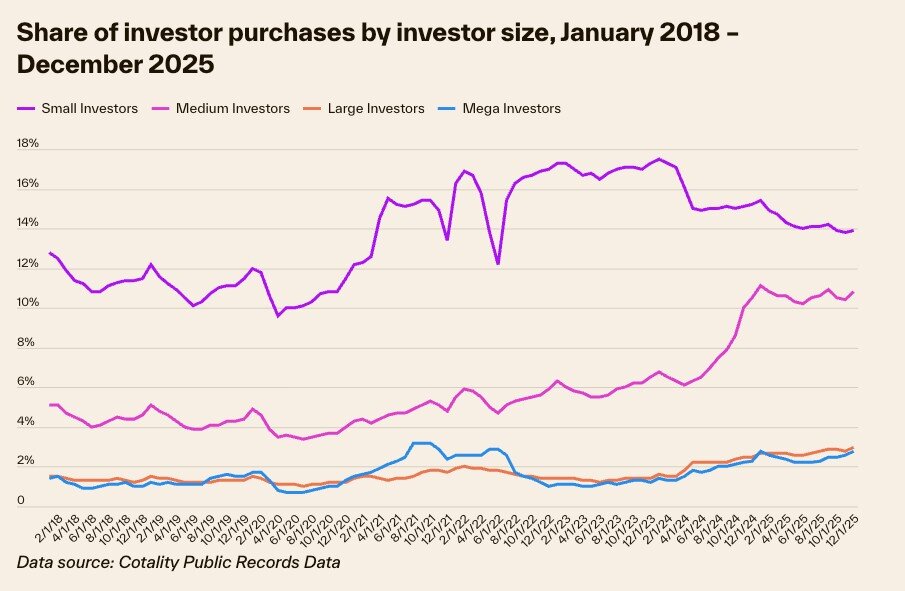

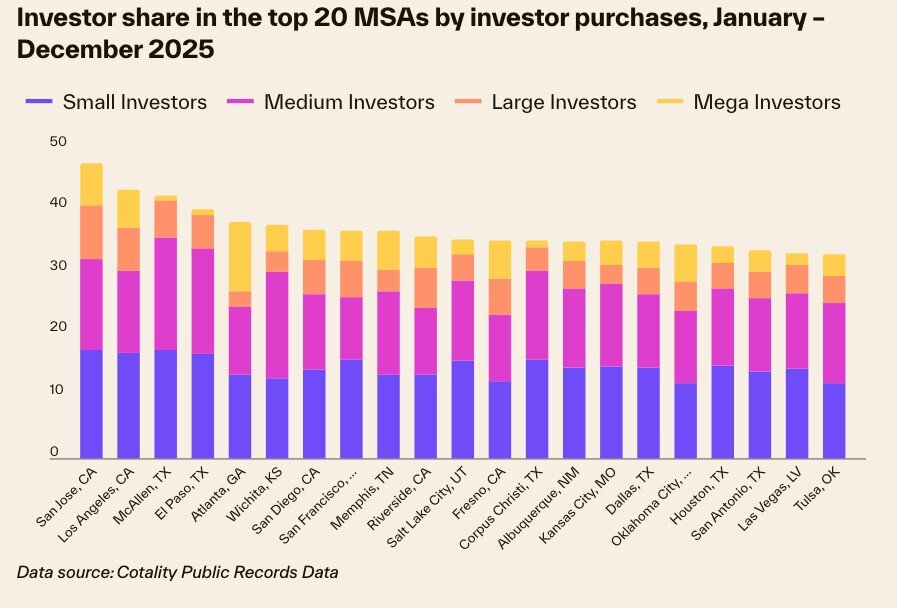

Small and mid-sized landlords — those controlling fewer than 100 properties — remain the backbone of investor activity. Together they account for nearly one in four U.S. home purchases, underscoring how fragmented the rental ownership landscape remains. Large institutional buyers, often associated with single-family rental portfolios numbering in the hundreds or thousands of units, represent only about 5% of transactions, though their influence extends beyond raw volume through professional management practices and access to capital.

Geography Reveals Diverging Dynamics

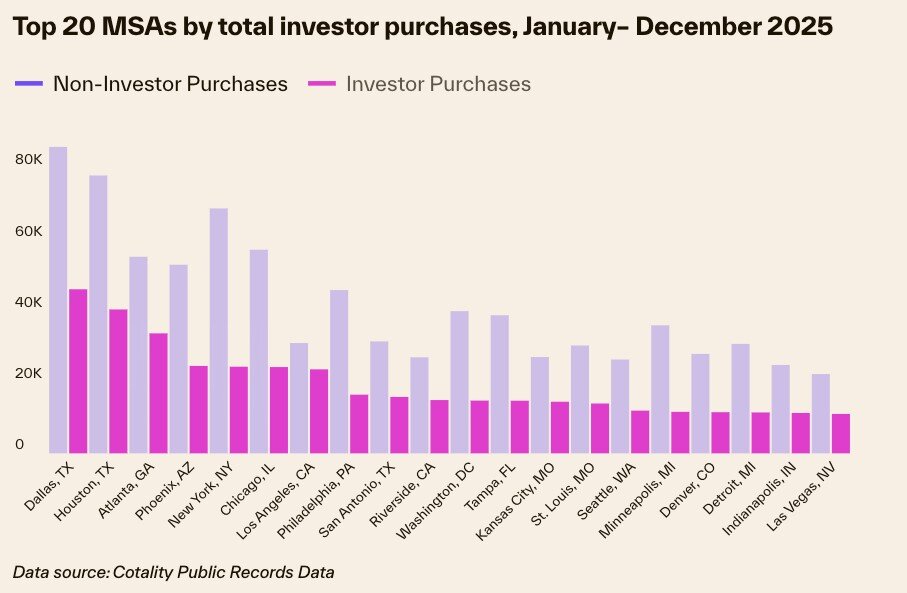

Investor activity is not evenly distributed. Dallas and Houston rank among the busiest metros for acquisition volume, buoyed by population growth and steady rental demand. Atlanta and Phoenix also feature prominently, reflecting their status as long-standing magnets for domestic migration and new household formation. New York and Chicago, by contrast, draw investors for a different reason: expectations of long-term appreciation in supply-constrained urban markets.

Volume, however, does not equate to dominance. While Texas metros lead in the number of purchases, they fall into the middle of the pack when measured by investor market share. In higher-cost regions — particularly parts of California such as San Jose and Los Angeles — investors command a larger percentage of transactions, largely because affordability constraints have pushed many traditional buyers to the sidelines rather than because of an outsized influx of new capital.

Ancillary trends are also shaping regional dynamics. The proliferation of accessory dwelling units, especially in California, is creating additional income streams that make investment properties more financially attractive even as entry prices climb.

Rates Remain the Deciding Variable

Looking ahead, analysts expect investor participation to remain broadly stable into early 2026, with a seasonal dip toward roughly a quarter of all purchases as owner-occupant activity typically rises during the spring and summer selling season. Beyond that, the trajectory hinges largely on interest rates.

If borrowing costs remain elevated, affordability constraints are likely to persist, limiting a meaningful rebound in first-time or move-up buyers. A decline in rates could shift the balance, drawing more traditional households back into the market and modestly reducing investor share. Economists caution, however, that lower rates would more likely narrow the gap between what buyers can afford and what sellers are willing to accept, rather than ignite another rapid escalation in home prices.

For now, the market’s defining feature remains a stalemate: high prices, cautious consumers and investors willing — and often able — to transact where others cannot.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Please visit:

Our Sponsor