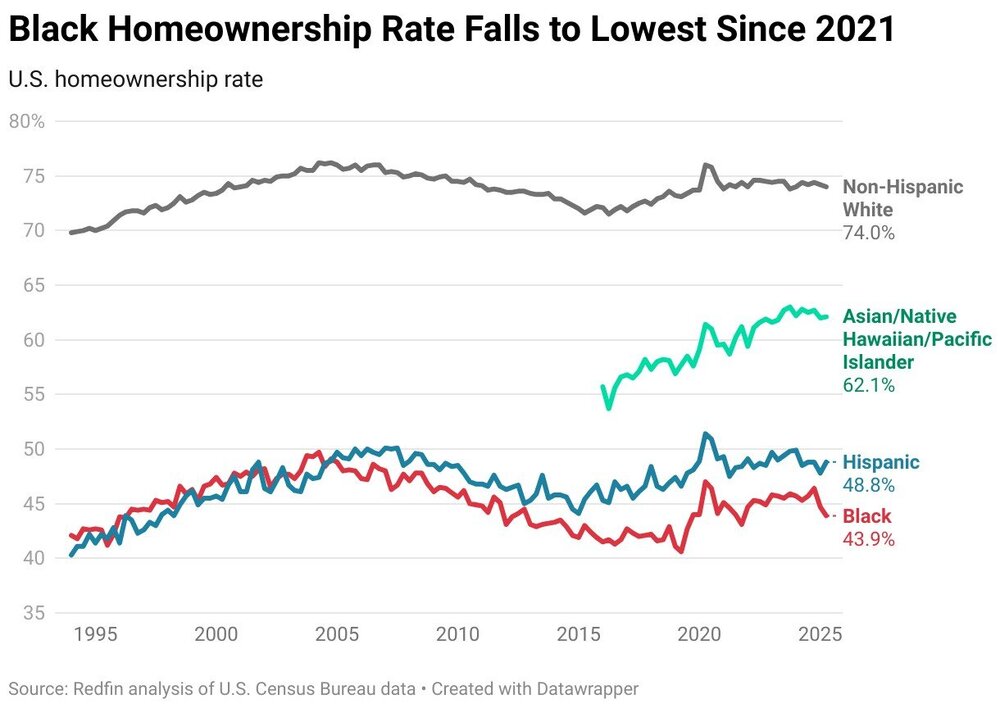

The U.S. homeownership rate for Black households dropped to 43.9% in the second quarter, its lowest level since late 2021, according to new data from Redfin. That’s down from 45.3% a year earlier, marking the steepest annual decline since the third quarter of 2021.

By contrast, Hispanic homeownership edged higher to 48.8% from 48.5%. Ownership among non-Hispanic white households slipped to 74% from 74.4%, while the Asian, Native Hawaiian and Pacific Islander rate eased to 62.1% from 62.8%.

Daryl Fairweather

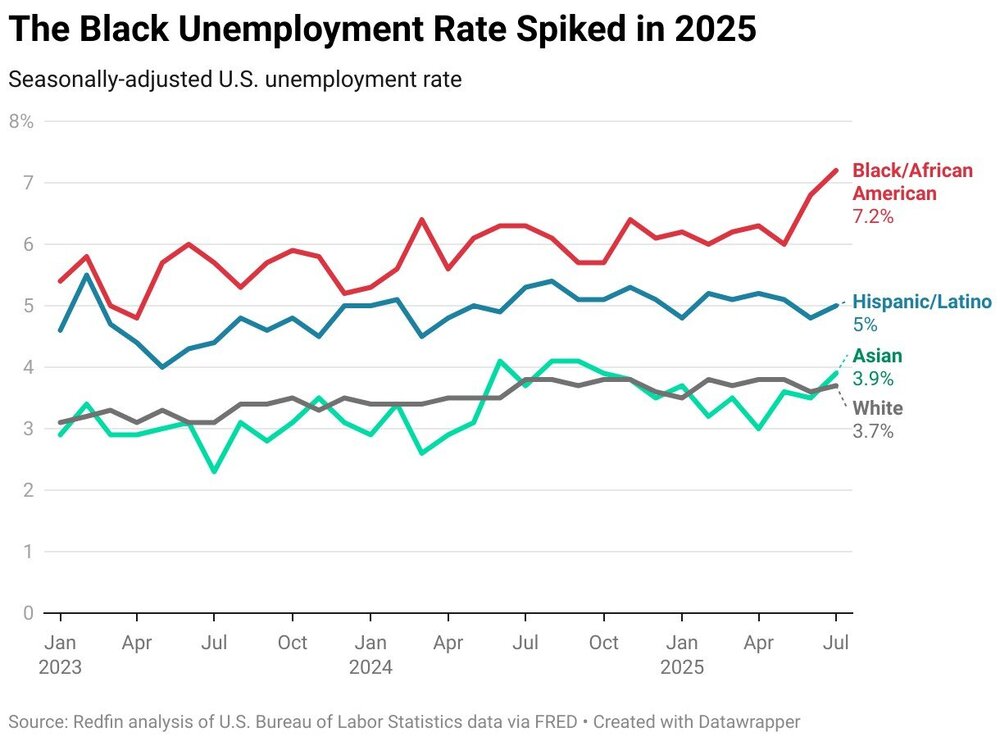

“Rising unemployment is one likely reason the homeownership rate for Black families has dropped recently,” said Daryl Fairweather, Redfin’s chief economist. “The recent wave of federal layoffs hit Black households badly because government jobs have historically been an avenue of upward mobility for Black workers. DEI programs have also been dismantled in workplaces across the private and public sectors, which may have resulted in fewer Black employees being hired or promoted.”

The unemployment rate for Black workers rose to 7.2% in July, the highest since October 2021, up from 6.3% a year earlier. Rates for other groups were largely stable: Hispanic unemployment dipped to 5% from 5.3%, white unemployment slipped to 3.7% from 3.8%, and Asian unemployment edged up to 3.9% from 3.7%.

Black women have seen a sharper jump in joblessness than men, with their unemployment rate climbing to 6.3% in July from 5.5% a year earlier. The rate for Black men rose more modestly, to 7% from 6.6%. A 2024 report from the National Association of Realtors showed that single women made up a third of Black homebuyers, compared with just 12% for single men.

Housing affordability has been under pressure nationwide, as elevated prices and mortgage rates sidelined would-be buyers. One headwind is starting to ease: the average 30-year fixed mortgage rate has slipped below 6.5%, down from above 7% early this year.

“Behind the decline in Black homeownership are families who aren’t building stability and wealth through housing,” Fairweather said. “For Black households who feel locked out of the American dream, the good news is that affordability is improving as mortgage rates come down, home prices are growing at less than half the pace they were a year ago, and buyers have been gaining negotiating power.”

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Please visit:

Our Sponsor