California home sales in August 2025 edged higher, supported by stabilizing prices and a modest decline in mortgage rates, according to the California Association of Realtors.

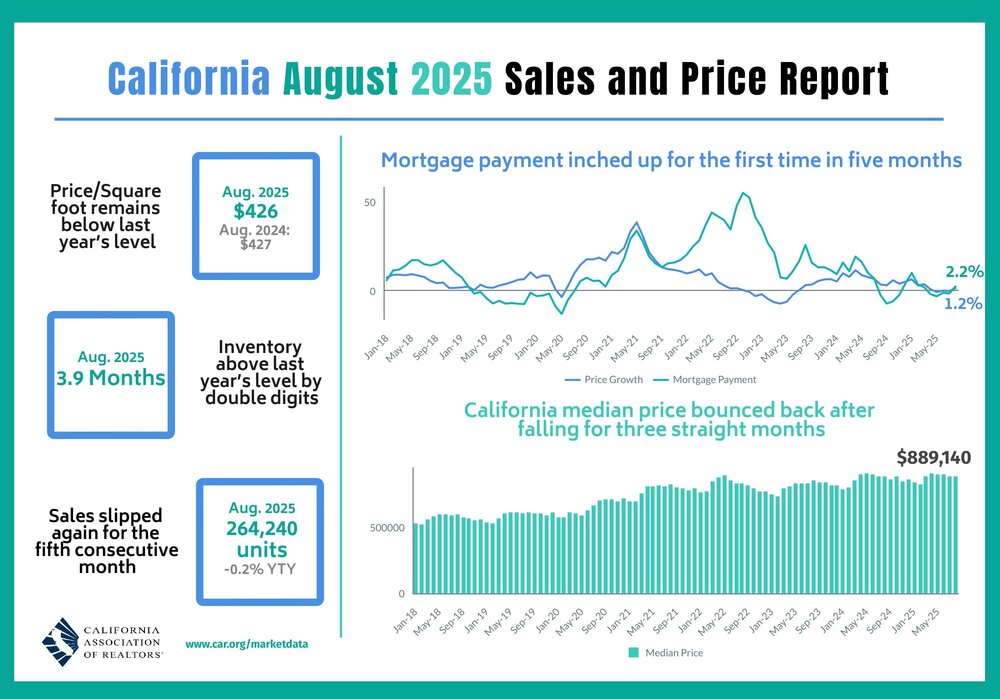

Closed escrow sales of existing single-family detached homes reached a seasonally adjusted annualized rate of 264,240, up 0.9% from July’s 261,820 but down 0.2% from August 2024. Despite the slight month-over-month increase, the figure remains below the 300,000 benchmark, marking the 35th consecutive month that sales have stayed under that level.

“Despite a softer-than-expected home buying season this year, the rebound in pending sales last month is encouraging,” said C.A.R. President Heather Ozur. “Many buyers have been waiting for lower mortgage rates, and recent declines could prompt them back into the market.”

Pending home sales, a forward-looking indicator, surged 8.3% from July and rose 0.2% from a year ago, the first annual gain in nine months. Mortgage rates, meanwhile, fell to a 10-month low, reflecting broader economic weakness and giving buyers renewed incentive to enter the market.

Prices stabilize

The statewide median home price rebounded to $899,140, a 1.7% increase from July and 1.2% above last year. The gain reversed three consecutive months of year-over-year declines and exceeded the long-term July-to-August average increase of 1.2%.

“After steady declines earlier this summer, the market appears to have found a short-term balance between supply and demand,” said Jordan Levine, C.A.R. Senior VP and Chief Economist. “If mortgage rates hold or fall further, year-over-year price growth may continue into the fall.”

Regional trends

Only the Far North (+2.9%) and Central Coast (+1.6%) recorded year-over-year sales gains, while the San Francisco Bay Area (-4.1%), Southern California (-3.7%), and Central Valley (-3.5%) posted declines. At the county level, 24 of 53 counties saw annual sales gains, led by Mariposa (+81.8%), Lassen (+46.7%), and Kings (+36.1%). Conversely, Yuba (-35.3%), Calaveras (-31.3%), and Tehama (-24%) experienced the steepest declines. Median home prices rose in three of five regions, with the Central Coast (+6.3%), San Francisco Bay Area (+2.8%), and Southern California (+1.2%) posting gains, while the Far North (-3.1%) and Central Valley (-1.0%) fell. At the county level, 29 counties recorded annual price gains, led by Santa Barbara (+32.6%), Monterey (+20.8%), and Trinity (+10.7%), while Del Norte (-21.7%), Mendocino (-17.3%), and Plumas (-12.3%) saw the steepest declines.

Market fundamentals

California’s housing market showed mixed signals in August, reflecting both soft demand and tentative stabilization. The Unsold Inventory Index rose slightly to 3.9 months from 3.7 in July, while total active listings increased 23.5% from a year earlier, marking the slowest pace of annual growth since March 2024. Homes continued to sell more slowly, with a median time on market of 31 days, up from 22 days in August 2024. The statewide sales-price-to-list-price ratio declined to 98.3% from 100% a year ago, while the median price per square foot for single-family homes edged down slightly to $426 from $427. Meanwhile, the 30-year fixed mortgage rate averaged 6.59%, modestly higher than 6.50% in August 2024, according to C.A.R.’s calculations based on Freddie Mac data.

Overall, the data suggest that California’s housing market may be finding a tentative balance, with buyers beginning to respond to lower borrowing costs and signs of price recovery after a prolonged period of softness.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Please visit:

Our Sponsor