Executive Summary (TL;DR)

- Treat cannabis as a compliance-first, capital-intensive industry. Your first job is regulatory fit: confirm zoning, buffers, local authorization (zoning compatibility letter), and—if required—CUP (Conditional Use Permit) before spending on design.

- Capital reality check: plan for hundreds of thousands in accessible capital to reach first revenue. In many markets and models, a working target of ≥$500k (equity + debt) is a pragmatic threshold for de-risking site control, build-out, inventory, and operating runway.

- Build an operating system early: SOPs, seed-to-sale integration, security, ADA accessibility, vendor programs, cash forecasting, and KPI dashboards.

- Decide build vs. buy: pursue a new license and site, or acquire an in-market operation to compress timelines.

- Next step: source compliant properties and active businesses from a trusted marketplace. → Start with vetted cannabis listings and businesses

Table of Contents

- Scope and audience

- The capital question: how much, why, and where it goes

- Roadmap: idea → site control → permits → build-out → first sale

- Siting: zoning, buffers, and local authorization

- Real estate path: lease vs. purchase

- Facility & TI: what a compliant dispensary needs

- Licensing, accessibility, seed-to-sale, and security

- People, vendors, and inventory integrity

- Financial model: 280E, cash conversion, and KPIs

- Due-diligence checklist

- Myth vs. fact

- Decision matrix: build new vs. acquire existing

- Next steps (with links)

Scope and audience

This cannabis startup guide is written for operators and investors evaluating U.S. markets. It outlines the minimum viable pathway from concept to first sale with a focus on real estate, licensing, capital planning, and execution. Regulations vary by state and municipality; always verify with the Authority Having Jurisdiction (AHJ).

The capital question: how much, why, and where it goes

The single biggest early mistake is under-capitalization. Plan your stack to cover site control + entitlements + build-out + inventory + 3–6 months of operating runway. Use $500k as a planning floor for many retail concepts; actual needs vary by jurisdiction, scale, and whether you lease or purchase the building.

Startup capital stack & typical uses (illustrative)

| Use of funds | Typical items included | Notes |

|---|---|---|

| Entitlements & licensing | Local authorization/zoning letter, CUP, professional fees, background checks | Timeline-critical; discretionary hearings add cost/time |

| Design & permits | Architecture/MEP, life-safety, security plan, ADA details | Sequence after zoning clearance |

| TI (Tenant Improvements) | Demising, vault, camera infrastructure, HVAC, lighting, electrical | Value-engineer for durability; prewire security |

| FF&E & tech | POS, seed-to-sale integration, safes, fixtures, access control | Select systems with proven CTS/Metrc integrations |

| Inventory (opening order) | Initial mix, compliance packaging, backstock | Tie to promo calendar and vendor terms |

| Working capital | Payroll, rent/NNN, utilities, testing, insurance, taxes | Build a 13-week cash forecast; expect 280E impact |

Action: Pressure-test your model at +10% TI costs and −10% revenue. If DSCR (Debt Service Coverage Ratio) or cash on hand collapses under these deltas, you are under-capitalized.

Roadmap: idea → site control → permits → build-out → first sale

- Idea & business model (medical, adult-use, vertical or retail-only).

- Capital plan (equity, debt, equipment finance; confirm burn).

- Market screen (licensing windows, caps, buffers, neighborhood compatibility).

- Site control (LOI/PSA with zoning/permit contingencies).

- Local authorization (zoning compatibility letter) and, if required, CUP.

- Design & building permits (architectural, mechanical/electrical/plumbing, life safety).

- Security & seed-to-sale integration planning (premises diagram, camera retention, access control).

- Build-out & inspections (certificate of occupancy).

- State license issuance (after local approval).

- Inventory, staffing, SOPs, soft open.

- Grand opening and first sale.

Shortcut path: Evaluate acquisitions to skip early entitlement risk. → Search active cannabis businesses and properties

Siting: zoning, buffers, and local authorization

Local rules control siting. Even with state programs, cities/counties define:

- Permitted districts (commercial/mixed-use for retail; industrial rarely allows storefronts).

- Separation buffers from schools, daycares, youth centers, parks, libraries, and sometimes other cannabis premises. Methods vary: property line, entrance-to-entrance, or parcel measurement.

- Caps/undue concentration limits by geography or population.

- Discretionary approvals such as CUP with public notice and hearings.

Action: Commission a buffer analysis using the AHJ’s measurement method before design spend. Keep a running “regulatory diligence file” (codes cited, measurement screenshots, staff emails).

Next step: When you’re ready to source compliant options, use a marketplace with robust filters for cannabis-zoned storefronts. → Browse vetted inventory on 420 Property

Real estate path: lease vs. purchase

| Dimension | Lease a storefront | Purchase a building |

|---|---|---|

| Speed | Faster if previously retail; TI allowance possible | Slower; full diligence and often heavier build-out |

| Upfront cash | Lower (deposit + design + TI beyond allowance) | Higher (down payment, full TI, soft costs) |

| Control | Less control; negotiate signage/security rights | Full control of systems and vaulting |

| Balance sheet | Operating expense with escalations and NNN | Asset with depreciation; debt amortization (note 280E) |

| Flexibility | Easier to pivot/relocate at term end | Harder to exit quickly; upside if market appreciates |

Rule of thumb: Lease to test a submarket and conserve cash; purchase for long-horizon control or redevelopment/value creation.

Facility & TI: what a compliant dispensary needs

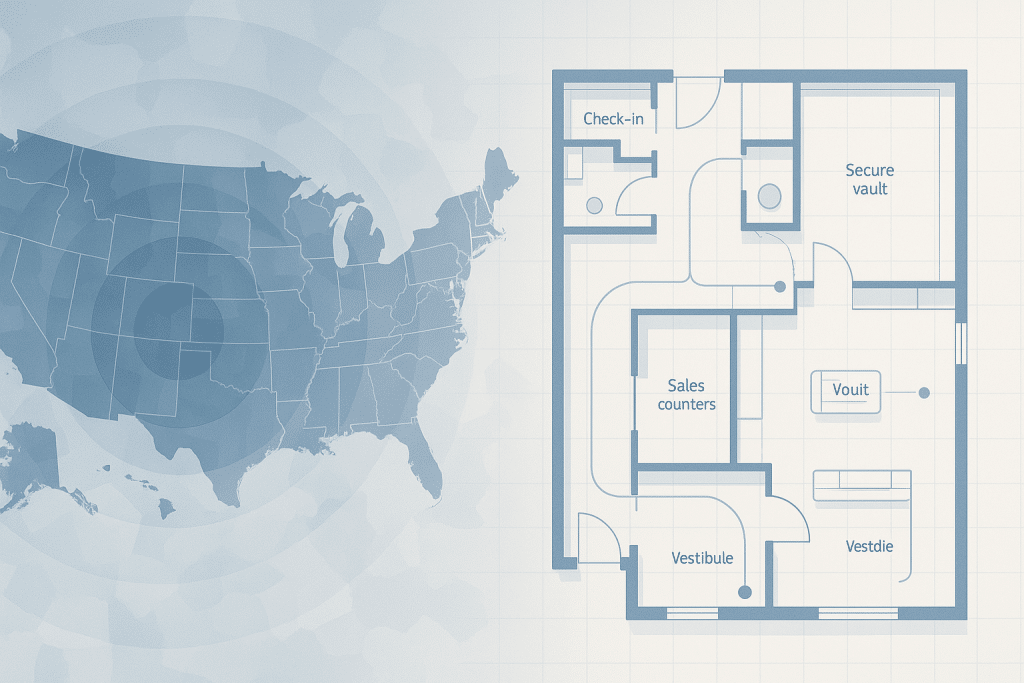

- Space program: Vestibule/check-in, sales floor, back-of-house receiving, vault/secure storage, pick-up counter, staff spaces.

- Security: Camera coverage (entrances, POS, vault), retention periods, intrusion alarms, access control.

- Life safety: Occupancy classification, egress, emergency lighting.

- HVAC & lighting: Higher internal loads than typical retail; design for comfort and odor control.

- ADA Title III: Accessible routes, counters, and restrooms; maintain accessible features post-opening.

- Specialty areas: Standard retail does not require C1D1 (hazardous location) unless solvent-based processing is present; coordinate with fire authority if any hazardous process is contemplated.

Action: Hold a pre-submittal with planning/building/fire/police to align on vault specs, camera retention, exterior lighting, and façade guidelines before final drawings.

Licensing, accessibility, seed-to-sale, and security

- Local before state: Most programs require documented local authorization prior to final state license.

- Seed-to-sale tracking: Integrate POS with the mandated system (e.g., CTS/Metrc equivalents) and accounting for daily reconciliation.

- Accessibility: ADA Title III obligations apply to public accommodations regardless of product.

- Security plan: Define camera fields of view, storage duration, access roles, cash handling, and visitor protocols.

Action: Draft SOPs (receiving, reconciliation, returns, destruction) while drafting floor plans; regulators review both.

People, vendors, and inventory integrity

People: Hire lean; train on ID checks, purchase limits, POS/seed-to-sale, cash handling, and service standards. Schedule to traffic. Incentives should reflect conversion, $ per labor hour, audit pass rate, and shrink.

Vendors: Avoid SKU bloat. Use category roles (traffic driver, margin driver, basket builder). Negotiate terms where legal; align promo calendars to demand peaks. Implement vendor scorecards (fill rate, on-time %, GMROI contribution, returns %).

Inventory integrity: Blind receiving, dual-control vault access, randomized cycle counts (weekly for high-risk SKUs), POS ↔ seed-to-sale parity daily, and exception clearing by close. Quarantine returns and follow destruction rules.

Financial model: 280E, cash conversion, and KPIs

- 280E (federal tax): Disallows most deductions/credits except COGS. Price, promote, and staff using after-tax margins.

- Cash conversion cycle: Vendors may require prepay/short terms; increase turns and protect GMROI.

- KPI dashboard: Traffic, conversion rate, AOV, gross margin %, GMROI, turns, $/labor hr, shrink %, audit pass rate, days cash on hand.

Action: Maintain a rolling 13-week cash forecast; re-forecast after material regulatory or promotional changes.

Due-diligence checklist (parcel → store launch)

Land Use & Siting

- Verify district permissibility (by-right vs. conditional).

- Map buffers to sensitive uses; confirm measurement method in writing.

- Identify caps/undue-concentration limits; monitor queue status.

- Determine if a CUP or similar discretionary review is required; calendar hearings.

- Run environmental screens (wetlands delineation triggers, riparian setbacks, floodplain).

- Confirm stormwater (NPDES) obligations for construction.

Utilities & Building

- Power capacity and upgrade timeline; roof load and sprinkler density.

- HVAC sizing and odor control strategy.

- Camera infrastructure, data retention capacity, access control.

- ADA compliance plan (routes, counters, restrooms, hardware).

Licensing & Ops

- Local authorization/zoning letter; premises diagram aligned to rules.

- POS + seed-to-sale integration; daily reconciliation SOP.

- Security plan and cash handling SOP; visitor and vendor protocols.

- Hiring plan; training matrix; audit cadence; KPI dashboard.

Myth vs. Fact

- Myth: “Once I win a state license, the city must allow my store.”

Fact: Local zoning, buffers, caps, and discretionary approvals control siting. - Myth: “Dispensaries can bypass ADA because of age-restricted entry.”

Fact: ADA Title III applies to public accommodations regardless of age limits. - Myth: “I can deduct start-up costs and rent like normal retail.”

Fact: 280E disallows most deductions except properly calculated COGS. - Myth: “Security is a one-time hardware purchase.”

Fact: Ongoing monitoring, storage retention, and tech refresh are recurring costs.

Decision matrix: build new vs. acquire existing

| Signal | Build new (license + site) | Acquire existing operation |

|---|---|---|

| Regulatory posture | Predictable licensing window; room in caps | Tight caps; long queues; local moratoria |

| Capital profile | Strong cash for TI + runway; patient timeline | Willing to pay for speed; financeable cash flows |

| Team readiness | In-house development & compliance expertise | Ops-heavy team ready to optimize day 1 |

| Brand thesis | Distinct concept demands custom build | Speed > brand customization at launch |

| Risk tolerance | Comfortable with entitlement risk | Prefer known revenue + diligenceable records |

Next steps

- Evaluate compliant properties and active businesses to match your capital plan and timeline. → Browse current cannabis listings and businesses

- Sequence approvals: secure local authorization (and CUP if required) before full construction drawings.

- Stand up SOPs and dashboards before opening day; run a controlled soft-open to validate staffing and reconciliation.

Disclaimer

This article is for educational purposes only and does not constitute legal, engineering, financial, or tax advice. Always consult qualified professionals and your local Authority Having Jurisdiction before making decisions.

Please visit:

Our Sponsor