Investors are preparing to deploy fresh capital into U.S. commercial real estate in 2026, encouraged by stabilizing asset values, improving operating fundamentals and growing confidence that borrowing costs are nearing a peak, according to a new survey from CBRE Group Inc.

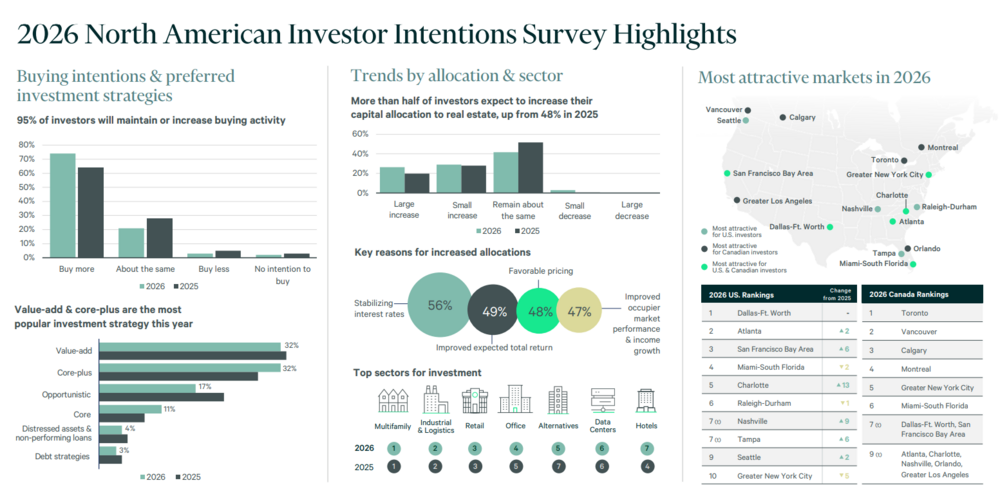

CBRE’s 2026 North America Investor Intentions Survey, which spans all major property types, found that 95% of respondents plan to acquire as much or more commercial real estate this year compared with 2025. More than half of investors–55%–expect to increase their capital allocations to the sector, up from 48% a year earlier, signaling a broad-based return of conviction after a prolonged market reset.

“Investors are entering 2026 with a more constructive outlook on the commercial real estate recovery, even as political and macroeconomic uncertainties persist,” said Tommy Lee, president and co-head of capital markets for the U.S. and Canada at CBRE. “Stabilizing debt costs and compelling entry points are reinforcing confidence, particularly for buyers targeting high-quality assets positioned for long-term growth.”

Sun Belt Strength, Gateway Opportunities

Dallas ranked as the most attractive U.S. market for investment for the fifth consecutive year, followed by Atlanta and San Francisco. Charlotte, Nashville, Tampa and Seattle entered the top 10 for the first time, reflecting sustained interest in high-growth Sun Belt metros alongside selectively repriced opportunities in gateway cities.

Multifamily Leads Investor Demand

Multifamily assets remain the clear favorite, with 74% of U.S. investors targeting the sector. Industrial and logistics properties ranked second at 37%, followed by retail at 27% and office at 16%, underscoring continued caution toward the office market despite improving sentiment in other sectors.

Across all property types, investors emphasized a preference for high-quality assets, reflecting a more selective approach to deployment. Among alternative investments, self-storage, land, industrial outdoor storage, cold storage and healthcare attracted the most interest, though just 11% of respondents said they plan to pursue alternatives, favoring repriced opportunities in traditional sectors instead.

Moderate-Risk Strategies Dominate

Value-add and core-plus strategies were selected by roughly two-thirds of investors, highlighting a tilt toward moderate-risk profiles offering enhanced returns. Core strategies gained modest traction, while interest in opportunistic, distressed and debt-focused strategies declined, suggesting investors are recalibrating risk as the market cycle matures.

Debt Conditions Remain a Key Variable

More than 70% of respondents said they plan to maintain the same debt-to-equity ratios as last year, and nearly half indicated they are willing to accept one year of negative leverage. The primary challenges cited were uncertainty around the direction of interest rates and reduced refinancing proceeds tied to lower property valuations.

Despite those constraints, investors continue to prioritize direct equity investments to capitalize on pricing dislocations, while interest in mezzanine financing, mortgage lending and secured loans remains resilient.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Please visit:

Our Sponsor