Pending home sales in the U.S. showed little movement in January 2026, highlighting the cautious stance of buyers despite improving affordability conditions. According to the National Association of Realtors (NAR) Pending Home Sales Report, contracts for existing homes declined 0.8% from December and were down 0.4% compared with a year earlier.

Regionally, trends diverged: month-over-month sales rose in the Midwest and West but fell in the Northeast and South, while year-over-year figures were higher in the South and West and lower in the Northeast and Midwest.

Lawrence Yun

“Improving affordability conditions have yet to induce more buying activity,” said NAR Chief Economist Lawrence Yun. “With mortgage rates nearing 6%, an additional 5.5 million households that could not qualify for a mortgage one year ago would qualify at today’s lower rates. Most newly qualifying households do not act immediately, but based on past experience, about 10% could enter the market–potentially adding roughly 550,000 new homebuyers this year compared with last year.”

Yun cautioned, however, that without an increase in housing supply, these new buyers could simply drive up home prices, exacerbating affordability challenges. He highlighted the recent passage of the Housing for the 21st Century Act in the House of Representatives, calling it a bipartisan effort to expand housing supply and lower barriers to homeownership.

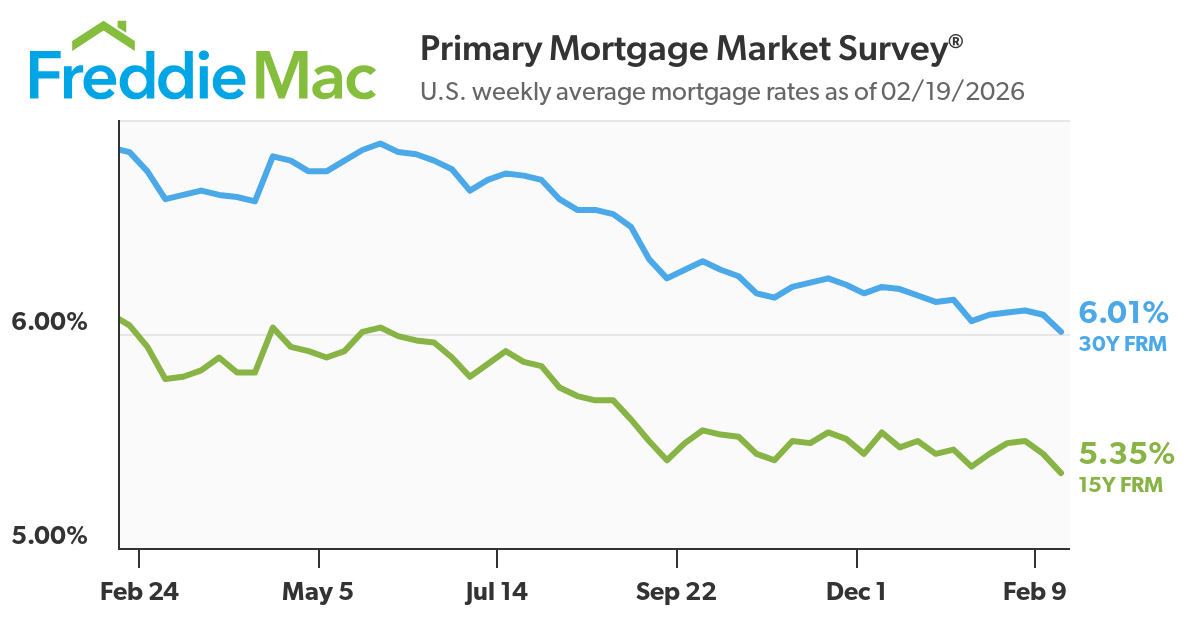

The improved affordability comes amid declining mortgage rates. Freddie Mac reported that the 30-year fixed-rate mortgage (FRM) averaged 6.01% as of February 19, 2026, down from 6.09% the prior week and 6.85% a year ago. The 15-year FRM averaged 5.35%, also down from 5.44% last week and 6.04% a year prior.

“Mortgage rates dropped again this week, now down to their lowest level since September 2022,” said Sam Khater, Freddie Mac’s Chief Economist. “This lower rate environment is not only improving affordability for prospective homebuyers, it’s also strengthening the financial position of homeowners. Over the past year, refinance application activity has more than doubled, enabling many recent buyers to reduce their annual mortgage payments by thousands of dollars.”

Even with borrowing costs at multiyear lows, potential buyers remain cautious, signaling that rate declines alone may be insufficient to ignite a broad rebound in housing demand. Analysts point to lingering affordability pressures, limited inventory, and economic uncertainty as factors keeping many would-be buyers on the sidelines.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Please visit:

Our Sponsor