Miami-Dade County’s housing market extended its gradual recovery at the start of 2026, buoyed by sustained single-family demand and a condominium sector that has largely stabilized despite financing headwinds, according to January 2026 data released by the Miami Association of Realtors.

Total residential transactions rose 1.2% from a year earlier to 1,869 closings, while single-family sales climbed 2.8% — the fifth consecutive month of annual gains. Condominium activity was effectively flat, down just 0.1%, underscoring a market that has held steady even as higher borrowing costs continue to weigh on affordability nationwide.

Luxury and Cash Buyers Drive Momentum

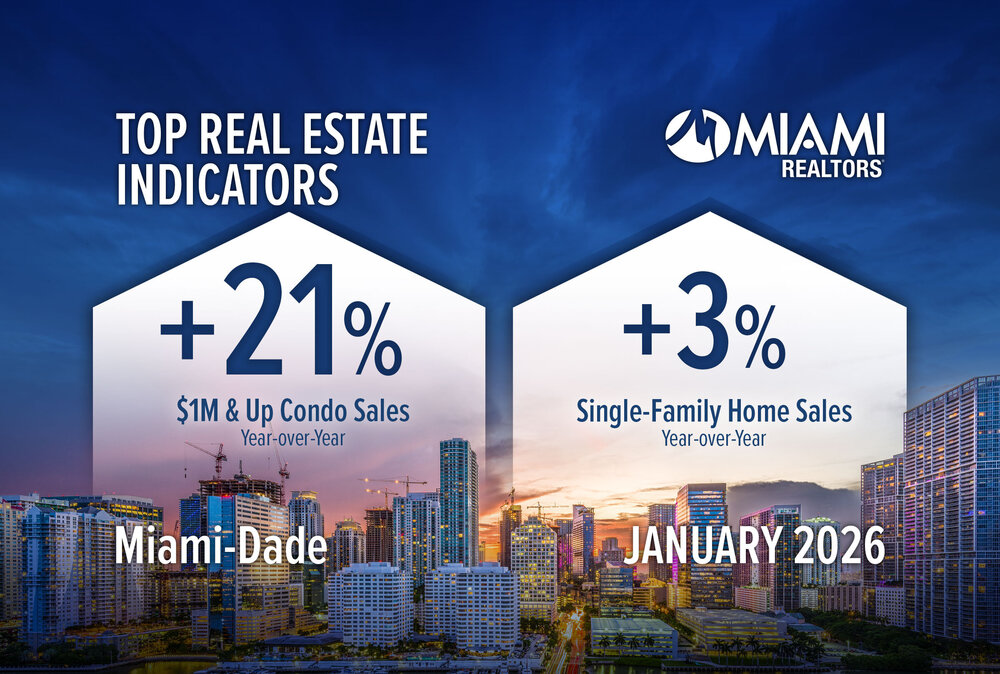

High-end demand remained a defining feature of South Florida’s property landscape. Combined sales of homes priced at $1 million and above surged more than 21% year over year, with both single-family and condominium segments posting nearly identical increases.

The region continues to distinguish itself as the country’s most cash-intensive major housing market. All-cash purchases accounted for 44% of January closings, far exceeding the U.S. average of roughly 27%. Industry analysts say the prevalence of liquidity-driven buyers — including foreign purchasers and domestic migrants relocating from higher-priced metropolitan areas — has insulated Miami from the full impact of elevated mortgage rates.

South Florida also retained its position as the nation’s leading ultra-luxury condominium hub in 2025, recording its highest-ever number of $20 million-plus condo transactions and near-record activity in the $10 million-plus tier across both condos and single-family homes.

Prices Extend Long-Term Climb

Home values continued their multi-year ascent. The median price for a Miami-Dade single-family home increased 3.7% from a year earlier to $699,990, marking price gains in 168 of the past 170 months. Since 2016, single-family median values have risen more than 159%.

Condominium prices showed similar resilience. The median condo sale price reached $420,000 in January, up from $415,000 a year ago and more than double the $205,000 level recorded a decade earlier. Condo prices have either held firm or advanced in 163 of the past 176 months, a streak spanning nearly 15 years.

Financing Constraints Temper Condo Upside

Despite stable sales, structural financing limitations continue to restrain condominium momentum. Fewer than 1% of condominium buildings across Miami-Dade, Broward, and Palm Beach counties are currently approved for Federal Housing Administration loans, according to federal housing data. Florida’s stricter reserve and down-payment requirements for non-approved buildings — often mandating 25% down versus 10% in most other states — further narrow the buyer pool.

Supply Still Below Pre-Pandemic Levels

Inventory conditions remain tighter than historical norms even as listings have inched higher. Active residential listings totaled 17,942 at the end of January, up 5.6% from a year earlier but still roughly 25% below pre-pandemic 2019 levels.

Single-family supply rose 9% year over year to 5,433 homes, translating to a 6.4-month inventory — broadly considered a balanced market. Condominium listings increased 4.2% to 12,509 units, representing a 13.7-month supply and tilting negotiating leverage toward buyers. Nationally, unsold housing inventory stands at a 3.7-month supply, according to the National Association of Realtors.

Dollar Volume and Construction Signal Underlying Strength

Total dollar volume of Miami-Dade residential transactions jumped 13% from a year earlier to $1.6 billion. Single-family volume rose 15.6% to $936 million, while condominium volume advanced 10.3% to $638 million.

Beyond resale activity, Southeast Florida leads the U.S. in multifamily construction, with more than 36,000 units underway as of late 2025. Developers and policymakers point to the state’s Live Local Act — which grants density incentives to projects allocating 40% of units to workforce housing — as a potential long-term catalyst for affordability.

Distress Near Historic Lows, Negotiations Lengthen

Signs of financial strain remain limited. Distressed properties, including bank-owned homes and short sales, represented just 2% of January closings, compared with roughly 70% at the height of the foreclosure crisis in 2009.

Homes are still selling close to asking prices, though marketing times have lengthened modestly. Sellers of single-family homes received a median 94% of original list price, while condo sellers captured 93%. The typical single-family property spent 53 days on the market before contract, versus 71 days for condos, both slightly longer than a year earlier.

Global Value Proposition Endures

Despite rapid appreciation, Miami continues to compare favorably with other global gateway cities on a price-per-square-meter basis. Wealth reports show that $1 million buys substantially more prime residential space in Miami than in markets such as Monaco, New York, or London — a differential that analysts say helps sustain international demand.

Taken together, January’s data depict a market characterized less by speculative surge than by steady, liquidity-supported growth: luxury demand remains robust, supply constraints persist, and price appreciation continues — albeit at a more measured pace than the post-pandemic boom years.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Please visit:

Our Sponsor