Yet 1 in 5 Single Family Homes in the U.S. are Purchased by Investors

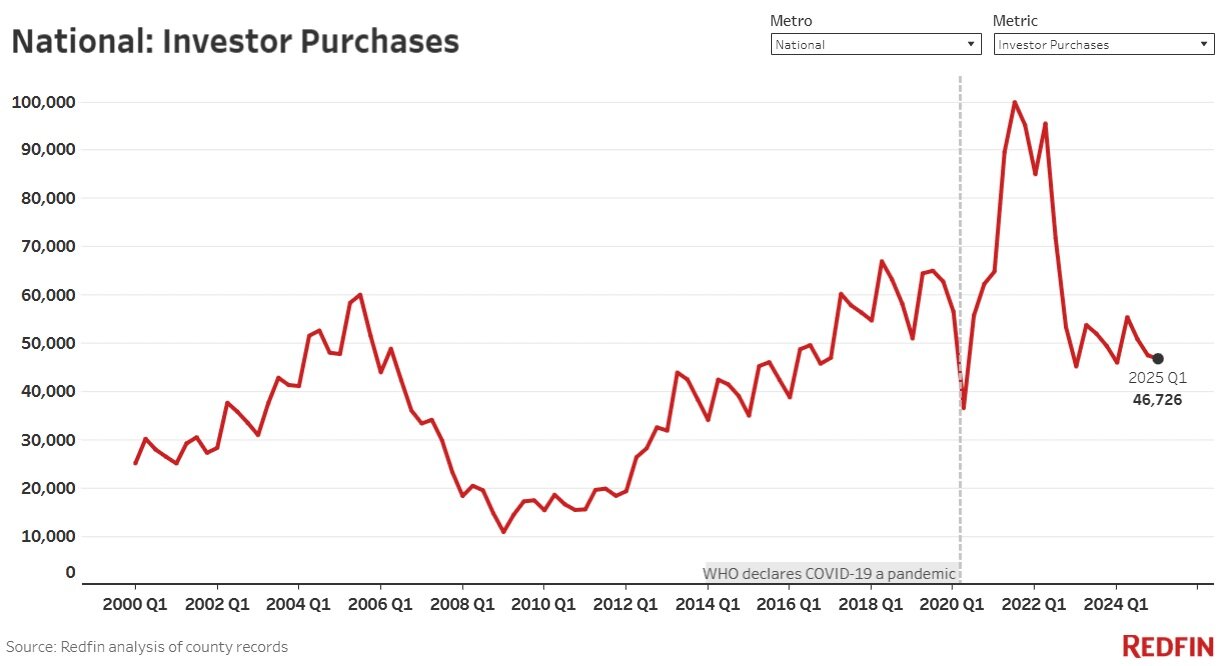

After years of volatile swings in real estate activity during and after the pandemic, U.S. property investors appear to be returning to more measured behavior. According to new data released by Redfin, investors purchased 46,726 homes in the first quarter of 2025–a modest 2% increase from a year ago–signaling a stabilization of investor activity in the residential market.

Investor buying has remained within a narrow 4% range for the past year, a stark contrast to pandemic-era extremes when activity surged as much as 145% in 2021 and plunged 47% in early 2023. In raw numbers, investor purchases have now returned to pre-pandemic levels, with current activity reflecting a more cautious, ROI-driven approach amid today’s higher interest rate environment.

“Investor home purchases have leveled off because rapid sale-price and rent growth is no longer the norm,” said Sheharyar Bokhari, Senior Economist at Redfin. “While some are still profiting from flips or rentals, especially where rents are climbing, many who entered the market during the pandemic boom have since retreated.”

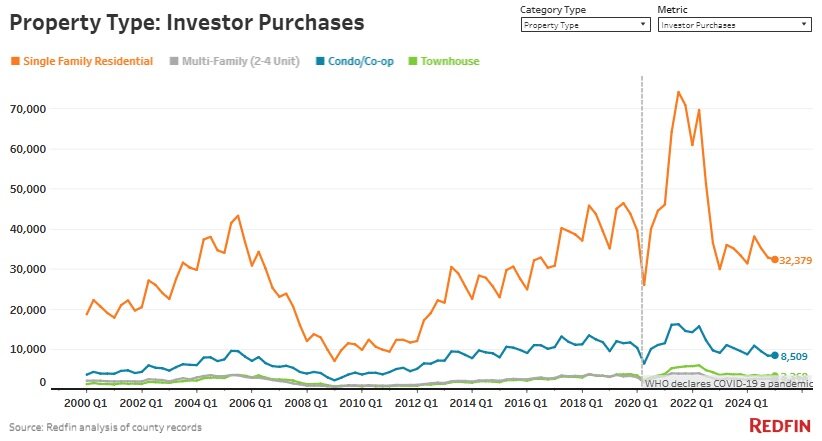

Condo Purchases Hit 10-Year Low

While total investor activity is steady, demand for condos has notably declined. In Q1 2025, investors bought 8,509 condos–a 3% year-over-year drop and the lowest quarterly figure in a decade, excluding Q2 2020 when the pandemic halted transactions.

Redfin attributes this pullback to a rapidly cooling condo market. Nearly 70% of U.S. condos sold below list price in early 2025, the weakest showing in five years. In Florida, surging HOA and insurance costs–fueled by rising climate-related risks–have made oceanfront condo ownership less attractive to investors.

“Condo landlords are trying to offload units that no longer generate returns,” said Stuart Naranch, a Redfin Premier agent in Washington, D.C. “High mortgage rates, tighter HOA rental rules, and rental caps are squeezing profits, leaving only cash buyers with enough cushion to take the risk.”

Florida Sees Steepest Investor Pullback

Florida continues to lead the nation in investor exits. Miami saw the largest drop in investor purchases, down 19% year over year. Orlando (-13%) and Fort Lauderdale (-12%) also ranked among the top five metro areas with declining investor activity, alongside Warren, MI, and Columbus, OH.

Despite the pullback, Miami still saw investors purchase 30% of all homes sold in Q1–though down from a 2022 peak of 35%. Redfin notes that Florida’s rising costs, declining home prices, and surplus inventory have dulled investor appetite across the state.

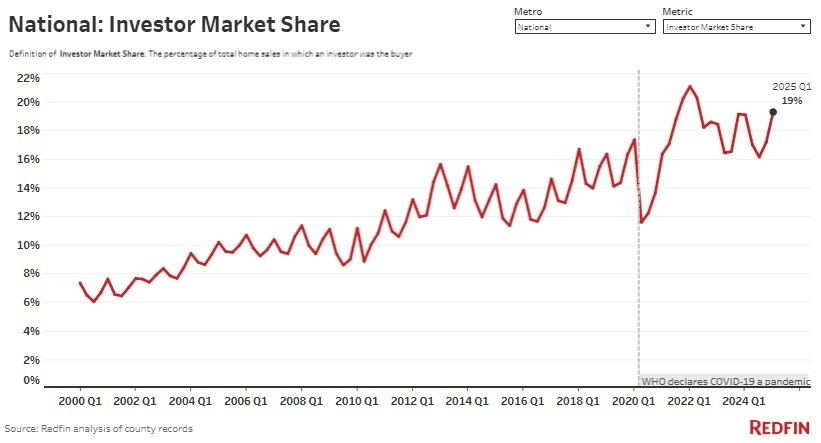

Investors Still Active in One-Fifth of U.S. Housing Market

Nationwide, investors accounted for 19% of all homes sold in Q1, holding steady from a year earlier and slightly up from 18% two years ago. Investor activity has closely mirrored consumer demand trends, constrained by high interest rates that limit profitability for both flippers and landlords.

Still, investor appetite for single-family homes is increasing. Purchases of single-family homes rose 3% year over year, while townhouses and multi-family units each rose 1%. Condos remain the lone declining segment.

Shift Toward Higher-Priced Homes

Investors are also shifting their attention toward more expensive properties. Purchases of high-end homes jumped 12% in Q1–the largest gain in three years–while mid-priced home purchases rose 2%. In contrast, investor purchases of low-priced homes fell 4%.

Even so, low-priced homes still made up 46% of all investor purchases, while high- and mid-priced homes comprised 30% and 24%, respectively. Investors maintain the strongest market share in the low-end segment, buying 26% of all low-priced homes sold in Q1.

Profit Margins Remain Positive

Investors continued to see gains from property sales, with a median capital gain of $182,980 per home sold in March–up 2.8% year over year. Only 6% of investor-sold homes incurred losses, nearly flat from 5% the previous year.

Meanwhile, investor-owned listings made up 8.4% of total U.S. home listings in March, down from 8.9% a year ago–the lowest share in nearly two years. The decline reflects slower investor selling activity following a major drop in acquisitions during 2023.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Please visit:

Our Sponsor