Enjoying Record High Prices as Cash Buyers Dominate

Luxury home prices across the United States surged to record highs in September 2025, underscoring the widening divide between the high-end market and the rest of the housing sector. The median price of a U.S. luxury home reached $1.26 million, up 4.8% from a year earlier and marking the highest level ever for the month, according to a new report from Redfin. By contrast, non-luxury homes rose a modest 1.8% year over year to a median price of $371,583.

The analysis–covering transactions from July through September 2025–defines luxury homes as those in the top 5% of a metro area’s price range, while non-luxury homes fall between the 35th and 65th percentiles.

Cash and Confidence Drive the Top of the Market

Prices of luxury homes have outpaced the broader housing market for most of the past two years. Since September 2023, luxury prices have climbed roughly 11%, compared with about 6% growth among non-luxury properties.

“Luxury prices are outpacing the rest of the market because buyers at the top end are playing by different rules,” said Sheharyar Bokhari, senior economist at Redfin. “They’re not waiting for rates to drop or prices to fall–they have the cash, the stock gains, and the long-term confidence to act when they see a home they want.”

High-end buyers, less constrained by mortgage costs, have remained active despite persistently high borrowing rates and affordability pressures that continue to sideline many middle-income households. Some wealthy buyers, Bokhari added, are viewing real estate as a safe haven amid broader market uncertainty–a dynamic that has helped keep luxury demand resilient even as overall transaction volumes remain muted.

Sales Levels Stabilize Near Record Lows

Both luxury and non-luxury sales were largely unchanged from a year earlier–up 0.3% and down 0.3%, respectively–hovering near the lowest September levels since 2012. Pending sales, a forward-looking indicator of future closings, rose slightly, up 1.6% for luxury homes and 1% for non-luxury properties.

Those modest gains suggest the market has found a floor after one of the slowest years for housing activity in more than a decade.

Inventory Rebounds but Remains Tight

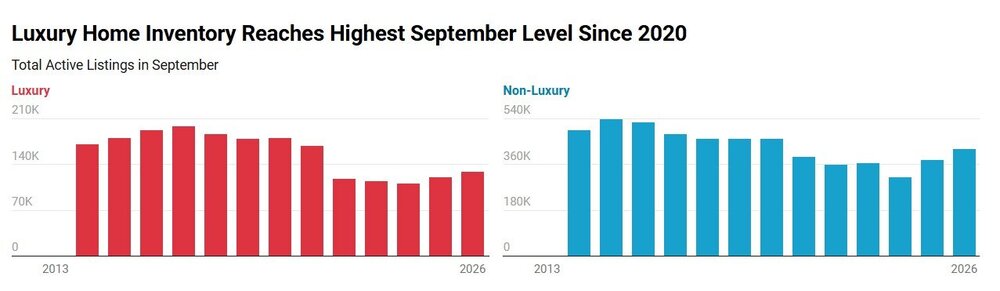

The number of luxury homes for sale rose 7.7% year over year to the highest September level since 2020. Non-luxury inventory climbed even faster–11.4%–to the largest September supply since 2019.

Still, inventory remains deeply constrained relative to pre-pandemic norms. Compared with 2015, the number of luxury listings is down nearly 50%, while non-luxury supply is about 25% lower.

“There’s definitely stronger demand for luxury homes, because those buyers are less worried about interest rates,” said Rebecca Love, a Redfin agent in Washington, D.C. “But there’s also really limited inventory in our area, and that’s keeping demand high and prices moving higher.”

New luxury listings were flat year over year, while non-luxury listings dipped 1.3%.

Homes Taking Longer to Sell

Even as prices rise, homes at all price points are taking longer to sell. The typical luxury property spent 52 days on the market in September, six days longer than a year earlier and the slowest pace for any September since 2020. Roughly 27% of luxury listings went under contract within two weeks, down from 28% last year.

Non-luxury homes fared slightly better, with a median 43 days on the market, up from 36 a year earlier. About one-third (33%) found buyers within two weeks, down from 36% in 2024.

Regional Trends: Florida Leads, But With Volatility

Among the 50 largest U.S. metros, price growth was strongest in West Palm Beach (+14.8% to $4.13 million), Newark (+12.3% to $2.05 million), and Virginia Beach (+11.2% to $1.07 million). The only markets to post declines were Tampa (-3.3% to $1.45 million) and Oakland (-2.2% to $2.9 million).

Luxury sales activity jumped most in San Francisco (+30.5%), Providence (+19.1%), and Fort Worth (+13.5%), but plunged in West Palm Beach (-22.4%), San Jose (-20.8%), and Philadelphia (-16.8%).

Inventory expanded sharply in Tampa (+31.1%), Fort Worth (+18.7%), and Nashville (+18.6%), while shrinking in Philadelphia (-21.6%), San Jose (-20%), and Chicago (-14.8%).

Luxury homes sold fastest in San Jose (14 days), St. Louis (16 days), and Detroit (16 days), while Miami (130 days), West Palm Beach (115 days), and Fort Lauderdale (114 days) saw the slowest turnover.

Bottom Line

The widening performance gap between luxury and non-luxury housing underscores how unevenly the U.S. real estate market has adapted to the new era of higher rates. With affluent buyers insulated from financing costs and still flush with cash from stock market and asset gains, luxury real estate continues to chart its own course–defying broader headwinds that have kept much of the market on pause.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Please visit:

Our Sponsor