Executive Summary (TL;DR)

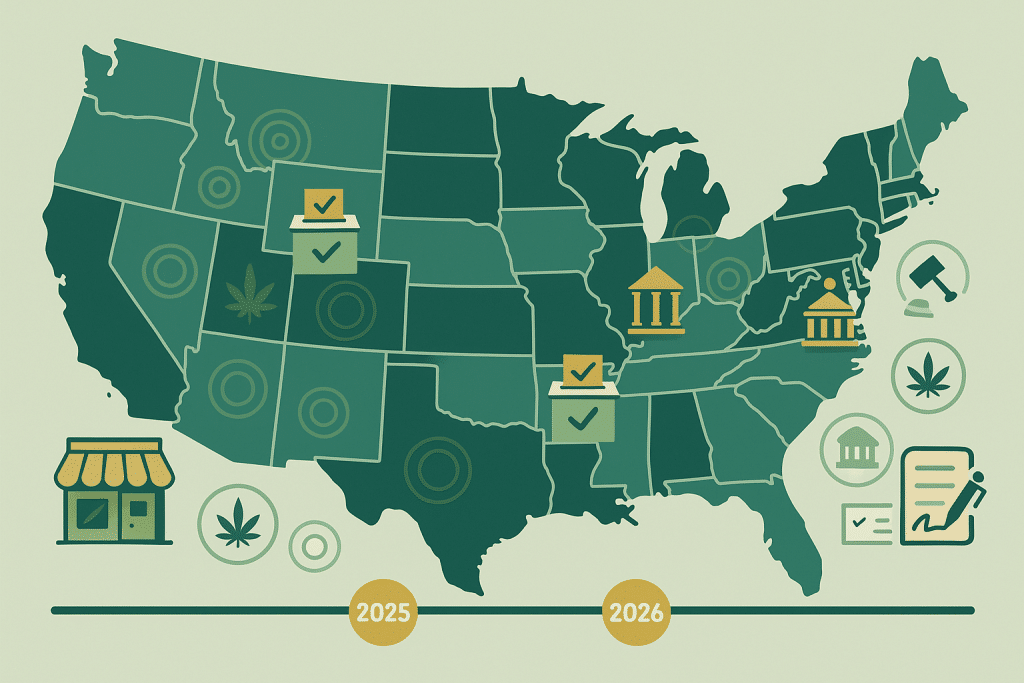

- Adult-use stands at 24 states + D.C. and medical at 40 states + D.C. as of mid-2025; expansion in 2025 has leaned legislative, not ballot-driven.

- 2024 recap: Florida, North Dakota, and South Dakota rejected adult-use; Nebraska approved medical via two initiatives.

- 2026 ballot watch: Florida’s renewed initiative is well into signature gathering amid new petition restrictions; Idaho and Nebraska (adult-use) have filings for 2026.

- Legislative watch (no ballot route): Pennsylvania advanced a House-passed adult-use bill; New Hampshire and Hawai‘i stalled; Texas remains legislative-only and is tightening local decrim.

- For operators/investors, treat legalization headlines as zoning-first opportunities: buffer distances, retail caps, separation rules, and Authority Having Jurisdiction (AHJ) calendars determine how quickly demand becomes leasable or salable revenue. To position early, monitor deal flow and evaluate businesses for sale.

Table of Contents

- The map: where legalization stands now

- 2024 election results (context for 2025-26)

- 2026 ballot watch: states to track

- Legislative pathways to watch (no citizen initiative)

- Zoning & real estate implications by pathway

- Readiness checklist for brokers, investors, and operators

- Myth vs. Fact

- Decision matrix for 2026 positioning

- Action plan & next steps

The Map: Where Legalization Stands Now

- Adult-use (non-medical): 24 states + D.C. (and several U.S. territories).

- Medical: 40 states + D.C. (and multiple territories).

- Federal status is unchanged pending rulemaking; assume federal illegality and state-by-state variability in track-and-trace (METRC/BioTrack), testing, packaging, taxation, and advertising.

Why operators/investors care: Even with statewide legalization, AHJ rules decide feasibility. Expect zoning overlays, sensitive-use buffers (schools/daycares/youth centers/libraries/parks), retail license caps, and separation distances between retailers. In practice, CUP/SUP timetables and inspection windows pace openings.

If your thesis includes roll-ups or a first-to-market push, keep a live short list of operating businesses and licenses on the market.

2024 Election Results (Context for 2025-26)

- Florida (Amendment 3, adult-use): Majority yes (~56%), below the 60% threshold; failed.

- North Dakota (adult-use): Failed.

- South Dakota (adult-use): Failed (after the 2020 measure was overturned and a 2022 retry failed).

- Nebraska (medical): Two medical initiatives passed, legalizing and creating a regulatory structure; rulemaking/regulatory work continued into 2025.

These outcomes reset expectations: in swing or conservative states, ballot thresholds, petition rules, and litigation risk are now as material as polling.

2026 Ballot Watch: States to Track

Focus questions for each state: Can voters actually place it on the ballot? If yes, what’s the most likely local-control framework (zoning, buffers, caps) if it passes?

Florida (Adult-Use Initiative — 2026)

- Status: New initiative drive underway; >600k verified signatures as of July 2025 with continued collection toward ~880k requirement; measure routed for judicial review and dealing with new petition restrictions enacted in 2025.

- Process friction: 2025 law adds strict circulator rules, tight delivery deadlines, felony exposure, and other hurdles—parts of which are under active legal challenge.

- Local control expectations: If adopted, anticipate municipality opt-in/opt-out debates, separation distances, and signage/marketing limits consistent with current medical frameworks.

Real-estate play: Pre-screen retail corridors in high-tourism counties for buffer “moats” and parking; verify assignment/relocation rights in leases to protect against siting pivots. Keep a watchlist of turnkey or near-turnkey assets.

Idaho (Adult-Use Initiative — 2026)

- Status: Ballotpedia lists a 2026 adult-use initiative cleared for signature gathering.

- Historical posture: Very limited prior reform; if qualified, expect conservative buffering and strict retail density rules.

- Real-estate play: Industrial/retail parcels near state borders with legalized neighbors would be competitive; model longer entitlement timelines.

Nebraska (Adult-Use Initiative — Filed for 2026)

- Status: Adult-use constitutional initiative filed August 2025 after medical passage in 2024; signature qualification still pending.

- Regulatory trajectory: 2025 saw medical program rulemaking press forward despite litigation noise—signaling administrative capacity.

- Real-estate play: Prioritize municipalities with favorable CUP/SUP histories, ample parking, and straightforward egress/ingress. Document C of O pathways and fire/life-safety expectations early.

North Dakota & South Dakota (Post-2024 Failures)

- Status: 2026 efforts not yet certified as of this writing; organizers assessing 2024 lessons.

- Real-estate play: If measures re-emerge, look for strict retail caps, wide separation distances, and limited hours; pre-identify sites with visibility and queue management options.

Legislative Pathways to Watch (No Citizen Initiative)

In these states, legalization hinges on bills, not ballots—so the timing is less predictable, and committee calendars can reset the thesis.

Pennsylvania (Adult-Use — Active Debate)

- Status: House passed an adult-use bill in May 2025 (state-run retail model); Senate opposition to the model is significant. A bipartisan Senate bill with privately run stores was introduced in July; Governor supports legalization.

- Local control: Expect municipal siting with buffers and CUP/SUP conditions; potential delivery and hours debates.

- Real-estate play: Border counties already show cross-border demand; pre-permit odour mitigation, security, and parking ratios to speed inspections.

New Hampshire (Adult-Use — Senate Tabled)

- Status: House-passed legalization bills were tabled by the Senate in spring 2025, ending the 2025 push; New Hampshire has no citizen initiative.

- Local control: Anticipate hyper-local siting and town-meeting dynamics if a future bill moves.

- Real-estate play: Build town-by-town zoning matrices; focus on arterials with sufficient stalls and signage allowances.

Hawai‘i (Adult-Use — Stalled in 2025)

- Status: Senate action advanced in committee but broader legalization stalled; decrim/medical adjustments saw movement.

- Local control: Counties likely to exert zoning overlays, buffer zones, and cap-like density controls.

- Real-estate play: Urban Honolulu constraints—parking minimums, ventilation, odor control, and neighborhood notice—will define feasibility.

Texas (Adult-Use — Legislative Only)

- Status: No citizen initiative; 2025 saw bills to legalize in special session discussions and state actions to restrict local decrim ballots; hemp-THC regulation fights continue.

- Real-estate play: Any adult-use path would likely phase-in by locality; underwrite security plan specs, signage limits, and buffering beyond alcohol benchmarks.

Zoning & Real Estate Implications by Pathway

Ballot wins create compressed timelines and site races. Prepare these elements now:

- Zoning/Use Table Fit — Confirm cannabis retail/production/distribution as a permitted or conditional use in the exact zone code; check overlays/moratoria.

- Sensitive-Use Buffers — Map door-to-door vs. parcel-line measurement. Many AHJs require buffers from schools/daycares/libraries/parks and separation between retailers.

- Capacity & Access — Validate parking minimums, ADA, curb cuts, queue management plans, and delivery staging where allowed.

- Security & Odor — Camera coverage, UL-rated vaults/safes, monitoring, negative pressure and filtration; build to inspection checklists.

- Lease Mechanics — Secure cannabis use clauses, right to assign/relocate, TI allowances, and rent commencement keyed to approvals.

- Timeline Discipline — Backward-plan from CUP/SUP dates, public notices, final inspections, C of O, and track-and-trace onboarding.

To benchmark markets and match thesis to assets, use businesses for sale to watch where supply is building or consolidating.

Readiness Checklist for Brokers, Investors, and Operators

- Ballot-state pack: petition progress, ballot language, anticipated AHJ adoption windows, and draft site lists with buffer maps.

- Legislative-state pack: bill numbers, committee posture, Governor signals, local opt-in/opt-out precedents.

- Parcel binder: zoning letters, buffer analyses, premises diagrams, security plan, odor plan, parking studies, and CUP/SUP conditions.

- Compliance spine: seed-to-sale integration plan, COA intake SOPs, ID-scan protocols, variance resolution logs.

- Financing: stage capital to CUP → build-out → inspection, recognize §280E exposure until further federal action.

- M&A screen: license transferability/CHOW, relocation rights, inspection history, rent + NNN as % of sales, and sales per rentable sf.

Myth vs. Fact

- Myth: “If voters approve adult-use, stores open immediately.”

Fact: AHJ rulemaking, CUP/SUP calendars, and inspections govern timing. Build-outs and final approvals usually span months. - Myth: “State legalization overrides local siting constraints.”

Fact: Local zoning overlays, buffers, and retail caps routinely narrow viable parcels. - Myth: “Ballot wins guarantee favorable business rules.”

Fact: Implementation bills can add license caps, equity set-asides, and distribution limits—re-underwrite after the enabling statute. - Myth: “Polling at 55–58% means certain passage.”

Fact: Supermajority thresholds (e.g., 60%) and petition-law changes can sink otherwise popular measures.

Decision Matrix for 2026 Positioning

| Scenario | Likely Timeline | Site & Capital Strategy | Why |

|---|---|---|---|

| Florida qualifies & passes | Rulemaking 6–12 months; phased openings | Lock buffer-moat sites now; leases with assignment/relocation; pre-permit security/odor | Tight local controls + tourist demand = premium corridors |

| PA passes legislatively | Staged by regs; urban priority | Build municipal zoning matrices; underwrite delivery and hours variability | No ballot; legislative tweaks can change store model |

| ID qualifies; outcome uncertain | If passes, conservative rollout | Focus on border-adjacent trade areas; longer entitlement | High novelty + conservative controls = slow scale |

| NH tables again | 2027+ | Hold cash; seek ancillary and delivery (if allowed) | Senate/Governor signals dominate |

| ND/SD try again | Signature-dependent | Keep a two-site shortlist per metro; capex with contingencies | History of defeats + organization capacity risk |

Action Plan & Next Steps

- Pick 2–3 theses (e.g., Florida tourist corridors; PA border capture; Idaho border trade) and stand up zoning/parcel grids today.

- Pre-clear sites with AHJs for use, buffers, stalls, security, and odor; draft premises diagrams and SOPs now.

- Stage capital to entitlement milestones; assume §280E persists in 2025–26; maintain flexibility for capex deferrals.

- Build a watchlist of potential targets and Browse current listings to track pricing and availability where rules already favor openings.

- Refresh quarterly: ballot qualification status, petition-law litigation outcomes, and any local opt-in/opt-out shifts.

Disclaimer

This article is for educational purposes only and does not constitute legal, engineering, financial, or tax advice. Always consult qualified professionals and your local Authority Having Jurisdiction before making decisions.

Please visit:

Our Sponsor