Executive Summary (TL;DR)

- Debt maturities, higher-for-longer rates, and uneven state rollouts are compressing cash for many operators. Treat 2025 as a triage-and-reset year: fix unit economics, right-size real estate, and restructure liabilities before they choose you.

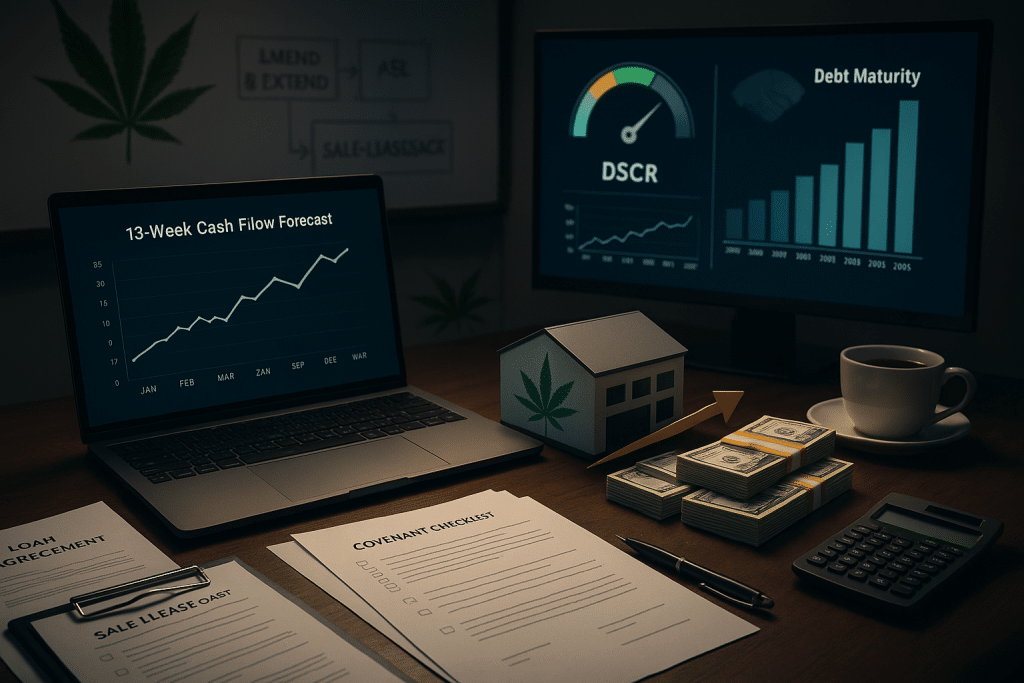

- Start with a 13-week cash forecast and a lender-ready data room. Run a debt options matrix (amend/extend, PIK toggles, ABL upsizes, sale-leasebacks, vendor paper, minority equity, asset sales) against the same KPI pack lenders use.

- Use real estate as a release valve: relocate or consolidate into compliant shells, sublease surplus, or execute sale-leasebacks where covenant-friendly. If speed matters, acquire revenue with disciplined underwriting. → Search vetted opportunities

- Build covenant headroom (DSCR/LTV) and prepare a “Plan B” (Article 9 sale or structured 363-style process if you’re truly over-levered).

- The operators who win this cycle move first, communicate in lender-speak, and convert fixed cost into variable cost without damaging the customer experience.

Table of Contents

- What’s driving the debt avalanche

- Your 30-day triage: cash, covenants, and communication

- Model-by-model fixes: retail, cultivation/processing, delivery

- Real estate levers that buy time (and value)

- Financing & restructuring toolkit (with decision matrix)

- KPI pack lenders expect (and how to read it)

- Execution calendar: 13 weeks to stability

- Myth vs. Fact

- Next steps

What’s driving the debt avalanche

Primary keyword: cannabis industry debt

Three pressures stack in 2025:

- Rate shock and maturities. Floating-rate debt repriced quickly while revenues lagged. Refinancings require stronger covenants and true cash flow.

- Tax drag. Federal IRC §280E still disallows most deductions for plant-touching entities, distorting after-tax profits and DSCR.

- Fragmented markets. Local control, caps, buffer rules, and uneven adult-use launches keep some stores and farms below break-even density.

Implication: Treat debt as a portfolio of projects to be repriced, extended, or repaid by freeing trapped working capital and optimizing fixed costs—especially real estate.

Your 30-day triage: cash, covenants, and communication

1) Cash first (48-hour view → 13 weeks)

- Build a 13-week cash forecast by legal entity and bank account. Lock a daily cutover time; reconcile forecast vs. actual every morning.

- Color-code non-discretionary (payroll, taxes, rent, utilities, insurance, critical vendors) vs. discretionary (marketing, R&D pilots).

2) Covenant check

- Pull loan agreements; extract DSCR, fixed charge coverage, LTV, inventory/AR borrowing bases, cash dominion, and reporting timelines.

- Build a “last-twelve-months” pack plugging GAAP P&L into lender metrics (remember 280E effects on EBITDA and tax expense).

3) Communicate early

- Send a lender update deck (KPI page + forecast + variance analysis + action list). If a breach is likely, you want to ask for terms before a default.

- Establish a weekly cadence with your senior lender and top 10 vendors; pre-negotiate short-term forbearance windows if needed.

Pro tip: Open a lender-friendly data room now—debt schedule, leases, insurance, licenses, corporate chart, KPIs, and the 13-week model (PDF + .xlsx). It signals competence and speeds amendments.

Model-by-model fixes: retail, cultivation/processing, delivery

Retail (storefront or non-storefront)

- Improve contribution dollars—not just GM%: build attachment ladders, simplify promo mix, and cull low-ROI discounts.

- Tighten inventory integrity (blind receiving, daily POS ↔ seed-to-sale reconciliation, weekly cycle counts) to cut shrink.

- Labor to traffic: staff to conversion and dollars per labor hour; enforce a manager-on-duty playbook.

Cultivation & processing

- Water/chemistry stability (finished-water alkalinity, inflow vs. drain EC/pH) reduces rework and lifts grade distribution.

- For extraction/manufacturing, run a line-rate map (nameplate vs. effective throughput) and attack downtime with spares + PM cadences.

- Consider consolidating rooms or subleasing surplus in non-core facilities.

Delivery

- Batching wins: set geofenced time blocks, boost stops per run, target ≥95% on-time.

- Enforce two-step ID (app + door) and maintain a clean delivery ledger for track-and-trace.

- If you lack density, partner your last-mile with a strong retailer to pool demand.

Real estate levers that buy time (and value)

- Sale-leaseback (free cash; keep operations). Useful when covenants allow and cap rates pencil against your DSCR plan.

- Relocate/consolidate into compliant shells with better access, utilities, and parking; retire expensive or non-compliant space.

- Sublease or license portions of underutilized space (storage, non-hazardous light industrial). Confirm lease and AHJ permissions.

- Acquire revenue instead of adding fixed cost—if you can buy a cash-flowing dispensary or delivery book cheaper than greenfield. → Find assets and licenses

- Timeline trampoline: While you entitle a new address, use an interim lease or buy a business with approvals, then migrate.

Every real-estate move must pass the buffer/measurement test (property-line vs. entrance-to-entrance vs. parcel centroid) and keep your permits/authority intact with the jurisdiction.

Tools to consider

- Amend & extend: push maturities; add temporary PIK toggles (pay-in-kind interest) to preserve cash.

- ABL upsizes: increase borrowing base on eligible AR/inventory after tightening policies.

- Unitranche or second-lien add-ons: more expensive but often faster; mind intercreditor provisions.

- Vendor financing: 30/60/90-day terms with top suppliers.

- Sale-leaseback proceeds: de-lever and fund working capital.

- Minority equity: cleanest if valuation is sensible and board terms allow execution speed.

- Structured sale of non-core assets or licenses.

- When distressed: forbearance, Article 9 sale, or stalking-horse/363-style process if you’re past the point of bilateral fixes.

Decision matrix (simplified)

| Situation | Most likely path | Why |

|---|---|---|

| Near-term maturity; decent DSCR with promo cuts | Amend & extend + PIK for 4–6 quarters | Buys time to repair contribution dollars |

| Negative FCFE but valuable real estate | Sale-leaseback + working-capital reserve | Converts fixed asset to cash; keeps ops intact |

| Borrowing base constrained; strong AR turns | ABL upsize + inventory policy | Cheaper than mezz; aligns to working capital |

| Multi-site with non-performers | Asset sales + consolidation | Simplifies operations; reduces fixed cost |

| Covenant breach; lenders forming a group | Forbearance + structured process | Time to shop assets while operations continue |

KPI pack lenders expect (and how to read it)

Core

- Revenue bridge (traffic × conversion × AOV), promo mix, category GM%.

- Contribution dollars by location; dollars per labor hour; shrink %.

- DSCR (TTM and forward), fixed charge coverage, cash conversion (Days Inventory + Days Sales − Days Payables).

- Same-store comps and cohort repeat behavior.

For cultivation/processing

- Yield per ft² per day; grade distribution; cannabinoid/terpene averages.

- Line-rate vs. effective throughput; OEE-style view (availability, performance, quality).

For delivery

- On-time arrival, stops per run, re-attempts, ID pass rate.

- Ledger variance (outbound vs. return).

What lenders read between the lines: trend direction, variance control, and whether you can execute a plan—not just model one.

Execution calendar: 13 weeks to stability

Week 1–2: Triage

- Finalize 13-week cash plan; daily variance calls.

- Data room live; lender update out.

- Freeze non-critical capex; reset promo policy; immediate labor-to-traffic changes.

Week 3–4: Real-estate actions

- Launch sale-leaseback or sublease marketing package where appropriate; open talks with landlords on term and options.

- Short-list compliant shells for consolidation or relocation. → Start a property scan

Week 5–8: Financing moves

- Negotiate amend & extend; close ABL upsize; finalize vendor terms.

- Execute asset sale(s) of non-core SKUs/licenses if needed.

Week 9–13: Operational lock-in

- Migrate or consolidate; shut unnecessary rooms/locations; implement stable SOPs (inventory, cash, delivery, cultivation).

- Roll to monthly forecasting with a new budget and covenant headroom buffer.

Myth vs. Fact

- Myth: “We’ll grow out of it once pricing rebounds.”

Fact: Price cycles help, but cash discipline and unit economics pay sooner—and lenders need proof now. - Myth: “Sale-leasebacks are financial engineering.”

Fact: They’re a tool; when used with realistic rent coverage, they right-size capital structure without disrupting operations. - Myth: “Lenders don’t want to negotiate.”

Fact: Lenders want visibility and credible plans. Early communication widens your option set. - Myth: “Debt problems are finance problems.”

Fact: They’re operational math; fix contribution dollars, shrink, and schedule—your balance sheet follows.

Next steps

- Stand up your 13-week cash model and lender pack this week.

- Make a real-estate move that converts fixed cost into runway.

- Pick two financing levers and one operational lever to close in 60 days.

- Need a head start? Tight, vetted assets and operators trade daily on 420 Property. → Browse opportunities now

Disclaimer

This article is for educational purposes only and does not constitute legal, engineering, financial, or tax advice. Always consult qualified professionals and your local Authority Having Jurisdiction before making decisions.

Please visit:

Our Sponsor