Executive Summary (TL;DR)

- Cannabis retail is a low-margin, high-compliance business across the U.S. Winners design for regulatory fit first—zoning, buffers, local authorization/zoning compatibility letters, conditional approvals, and accessibility—then optimize labor, inventory, and vendor terms to protect gross margin and cash flow.

- Treat this retailer survival guide like an operating system: control fixed overhead (rent, TI, utilities), maintain a disciplined product mix that delivers repeatable margin after 280E, and harden internal controls to prevent shrink.

- Build durable people systems (hiring, training, scheduling, incentives) and vendor programs (assortment, terms, returns, promotions) to defend unit economics and GMROI.

- Investors and operators should assemble a regulatory diligence file, choose the right lease vs. buy path, and implement store-level KPIs before opening. Use compliant real estate and, where available, in-market dispensary acquisitions to compress timelines.

- Who should act: Operators building or optimizing storefronts; investors underwriting acquisitions, relocations, or roll-ups; brokers advising on compliant sites nationwide.

Table of Contents

- Why survival requires discipline in a post-hype market

- Cannabis retailer survival guide: the four pillars

- Site selection & zoning: buffers, local authorization/CUP, and land constraints

- Lease vs. purchase: control, speed, and capital efficiency

- Tenant improvements (TI), building systems, and specialty classifications

- Licensing, accessibility, and seed-to-sale operations

- Financial model: overhead, margins, 280E, and cash conversion

- Workforce systems: staffing, training, scheduling, and incentives

- Vendor strategy: terms, assortment, promos, and returns

- Inventory integrity: shrink controls, audits, and data

- Performance dashboard: KPIs that matter

- Risk, banking, and insurance considerations

- Due-diligence checklist

- Decision matrix: expand, relocate, or exit

- Next steps and where to find vetted retail real estate and operating dispensaries

Why survival requires discipline in a post-hype market

U.S. cannabis retail has shifted from land-grab to operational excellence. Winning stores design for compliance from the parcel level up, minimize cash burn during build-out, and rely on data—not hunches—to drive assortment, labor, and promotions. The objective is a repeatable playbook that withstands jurisdiction-by-jurisdiction variability, stabilizes margins after tax, and scales across multiple locations with consistent controls.

Fast path to action: If the next move is site control, start with retail storefronts already located in permissible zones that meet separation requirements; this can trim months from entitlement timelines.

Cannabis retailer survival guide: the four pillars

Your operating system rests on four pillars. Each decision compounds over time—either for you or against you.

- Overhead — Rent or debt service, CAM/NNN, utilities/HVAC, security, and ongoing compliance spend.

- Margins — Product mix and pricing (COGS, gross margin, GMROI), promotions, and 280E-aware expense discipline.

- Employees — Recruiting, training, scheduling, incentives, and controls that reduce cash/stock losses.

- Vendors — Terms, fill rates, marketing co-op, return allowances, and data-sharing to improve assortment.

Acronyms used (national framing): Zoning compatibility/local authorization letter (city/county verification that use is permitted), CUP (Conditional Use Permit), TI (Tenant Improvements), C1D1 (Class I, Division 1 hazardous location), DSCR (Debt Service Coverage Ratio), ADA (Americans with Disabilities Act). Environmental diligence includes wetlands delineation, riparian setbacks, and stormwater requirements for ground-up or heavy renovations.

Site selection & zoning: buffers, local authorization/CUP, and land constraints

Start with zoning and buffers

Cannabis retail is local-first. Even with a state license, the Authority Having Jurisdiction (AHJ)—usually the city or county—controls zoning districts, separation buffers, caps, and operating conditions.

- Zoning districts: Storefront retail is typically allowed/conditionally allowed in commercial/mixed-use districts; industrial or agricultural zones rarely allow retail without exceptions.

- Buffers/separations: Many jurisdictions require minimum distances from K–12 schools, daycares, youth centers, parks, libraries, and sometimes other cannabis retailers. Baselines commonly range 600–1,000 ft (or more) depending on the jurisdiction. Verify the measurement method (entrance-to-entrance, parcel line, or property line) with the AHJ.

- Caps/undue concentration: Some cities limit retailers per capita or per district. A parcel can be compliant yet still blocked if caps are met.

Action: Have your broker or land-use consultant run a buffer analysis using the AHJ’s official method before spending on architectural drawings.

Local authorization and CUPs

- Local authorization/zoning compatibility letter: Most states require written confirmation that your proposed use is permitted at the parcel; terminology varies by state.

- CUP (Conditional Use Permit): Where retail is not permitted by right, a CUP may be required, adding public notice/hearings and conditions (hours, security, signage).

Action: Sequence permits so local authorization/CUP review precedes expensive TI drawings. Document all conditions early; they flow directly into security, lighting, and façade work.

Environmental overlays: wetlands, riparian setbacks, stormwater

Ground-up builds or substantial site work may trigger federal and local requirements:

- Wetlands delineation: Potential jurisdictional wetlands may require delineation and, if impacted, a Clean Water Act §404 permit (U.S. Army Corps of Engineers).

- Riparian setbacks: Codes often require setbacks from streams or riparian corridors; widths vary.

- Stormwater: Construction (and some operations) may require NPDES stormwater coverage and a SWPPP.

Action: Order desktop environmental screens early and budget for delineation and stormwater design if you’re developing or heavily reconfiguring a site.

Lease vs. purchase: control, speed, and capital efficiency

| Dimension | Lease a storefront | Purchase a building |

|---|---|---|

| Speed to market | Typically faster; landlord may provide vanilla shell/TI allowance; fewer approvals if previously retail | Slower if change of use or heavy build-out; full diligence on title, environmental, and code |

| Upfront cash | Lower (deposit + design + TI beyond allowance) | Higher (down payment, closing costs, full TI, soft costs) |

| Compliance control | Less control on building systems/façade; negotiate rights for security, signage, hours | High control; design to spec; easier to meet security, egress, vaulting |

| Balance sheet | Operating expense; escalations and NNN variability | Asset with depreciation (subject to 280E limits) and debt amortization |

| Flexibility | Easier to relocate at term end; sublease options with consent | Harder to exit quickly; potential value creation if market appreciates |

| Financing lens | Landlord underwriting; cannabis use riders | DSCR and collateral drive terms; cannabis-friendly lenders have narrower boxes |

Rule of thumb: Lease to test a new submarket or when brand equity is portable; purchase when you need long-horizon control, expect meaningful TI, or foresee redevelopment value.

Tenant improvements (TI), building systems, and specialty classifications

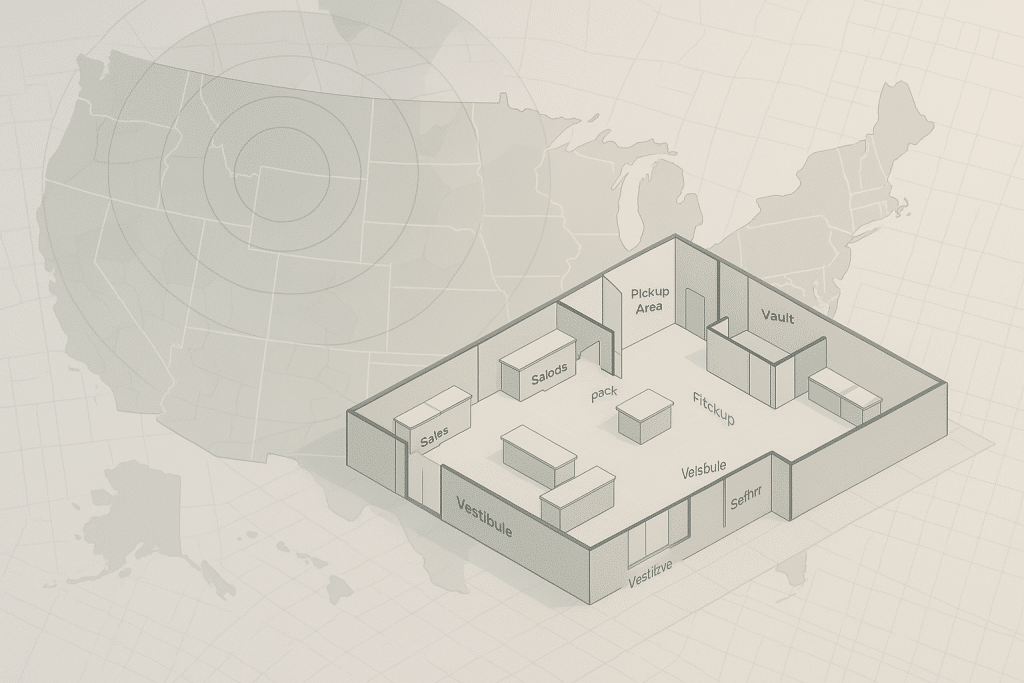

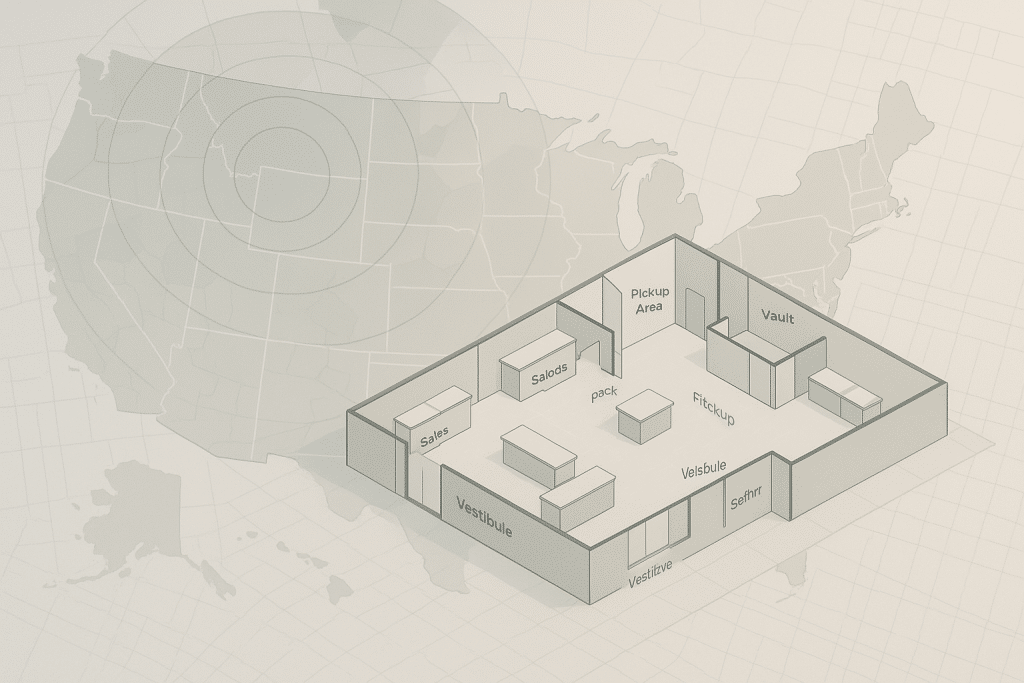

- Space program: Secure vestibule/check-in, sales floor, pick-up counter, back-of-house receiving, vault/secure storage, break room, and manager’s office.

- Security: Meet state/local surveillance retention, camera coverage (entrances, POS, vault), access control, intrusion alarms. Plan conduit and power up front.

- HVAC and lighting: Dispensaries carry higher internal loads. Specify HVAC capacity, filtration, and fresh air for comfort and odor control.

- ADA Title III: Ensure accessible entrance, counters, restrooms, and aisle widths.

- C1D1 considerations: Standard retail does not require C1D1. If any back-of-house process with flammable solvents is contemplated (e.g., extraction, certain lab activities), engage electrical/fire protection engineers for C1D1/C1D2 compliance.

- Life safety and egress: Confirm occupancy classification, occupant load, and egress components with the AHJ; coordinate early with the fire marshal.

Action: Hold a pre-submittal meeting with planning, building, fire, and police/security reviewers to align on requirements before construction documents.

Licensing, accessibility, and seed-to-sale operations

- Local before state: Most states require documented local approval prior to final state licensure.

- Seed-to-sale tracking: Integrate POS with the state-mandated system (e.g., Metrc or equivalent) plus accounting and inventory.

- Accessibility: ADA Title III requires equal access and ongoing maintenance of accessible features.

- Hemp/non-licensed SKUs: If you carry hemp-derived products, follow your state’s registration, labeling, and testing rules. Create a separate intake SOP so these SKUs never compromise marijuana inventory controls.

Action: Draft the security plan, diversion-prevention SOPs, and inventory reconciliation procedures in parallel with floor plans—regulators review both.

Financial model: overhead, margins, 280E, and cash conversion

- COGS & gross margin set the envelope for labor and overhead.

- GMROI (Gross Margin Return on Investment) ensures inventory earns its keep.

- Cash conversion is tight—many vendors require prepay or short terms—so increase turns and monitor payables.

- 280E: Federal law disallows most deductions except properly calculated COGS; price, promote, and staff accordingly.

Run the P&L like an industrial athlete:

Occupancy discipline, submetered utilities, security tech refresh budgets, variable frontline labor, and promotions that grow attachment rather than erode price.

Action: Maintain a rolling 13-week cash forecast to stress-test rent, payroll, tax deposits, and vendor payables under 5–10% revenue swings.

Workforce systems: staffing, training, scheduling, and incentives

- Start lean; cross-train for check-in, POS, pick-up, and receiving.

- Train on compliance (ID checks, purchase limits), POS/seed-to-sale, cash handling, and service.

- Schedule to traffic and conversion; assign defined roles per hour block.

- Incentivize store-level KPIs (conversion, dollars per labor hour, audit pass rate, and shrink).

- Two-person vault access, manager counts, and daily reconciliation.

Action: Implement a 90-day graduation path from trainee to senior associate tied to competencies and spotless audit behavior.

Vendor strategy: terms, assortment, promos, and returns

- Assortment discipline: Avoid SKU bloat; assign category roles (traffic driver, margin driver, basket builder).

- Terms: Seek net terms where legal or structured prepay with sell-through allowances/co-marketing.

- Promotions: Align to paydays/holidays; use ladders to build AOV without eroding everyday price.

- Returns: Pre-agree on damaged/defective returns and short-ship credits.

- Scorecards: Fill rate, on-time, returns %, promo compliance, GMROI contribution.

Action: Quarterly line reviews with top vendors + monthly promo planning meetings.

Inventory integrity: shrink controls, audits, and data

- Receiving: Blind receiving with two-person checks; photo documentation.

- Vault controls: Dual access, strict credentialing, randomized counts.

- Cycle counts: High-risk SKUs weekly; full cycle in ≤4 weeks.

- POS ↔ seed-to-sale parity: Daily reconciliation; clear exceptions by close.

- Analytics: Monitor negative inventory, no-sale opens, voids, return anomalies, and post-close edits.

- Returns policy: Uniform, with quarantine and lawful destruction where required.

Action: Publish a monthly shrink report to drive accountability.

Performance dashboard: KPIs that matter

| KPI | What it tells you | Targeting notes |

|---|---|---|

| Traffic | Demand at the door | Use for labor planning; seasonalize |

| Conversion rate | Sales ÷ traffic | Pair with service standards |

| AOV | Basket productivity | Grow via attachment & ladders |

| Gross margin % | Product profitability | Watch mix vs. promo impact |

| GMROI | Margin per $ of inventory | Prune low-velocity SKUs |

| Inventory turns | Velocity | Higher turns → lower cash tied up |

| $ per labor hour | Labor productivity | Align to schedule templates |

| Shrink % | Control health | Investigate spikes immediately |

| Audit pass rate | Compliance fidelity | Maintain >90% |

| Days cash on hand | Resiliency | Build cushion before expansions |

Action: Publish weekly; run a 30-minute “manage the business” review with managers.

Risk, banking, and insurance considerations

- Banking/AML: Many institutions serve cannabis with enhanced due diligence and reporting; expect fees commensurate with risk.

- Insurance: Premises liability, product liability, EPLI, cyber/POS, and property. Align limits with lease/lender requirements.

- Regulatory monitoring: Track state rulemaking, local ordinances (buffers, caps, delivery), and federal tax/banking developments.

Action: Maintain a compliance calendar (license renewals, camera retention checks, training refreshers) and hold quarterly reviews with bank, insurer, and counsel.

Due-diligence checklist (parcel → store launch)

Parcel & entitlement

- Verify zoning district and whether retail is permitted or conditional.

- Complete separation analysis (schools/daycare/youth centers, parks, libraries); document measurement method.

- Determine if local authorization/zoning letter and/or CUP is required; map process and hearing dates.

- Screen for wetlands, riparian setbacks, floodplain, and stormwater obligations.

- Verify utility capacity (electric, water, sewer) and ADA access at site/building entrances.

Building & TI

- Pre-submittal with planning/building/fire/security; align on security plan and vault design.

- Confirm life-safety classification, egress, occupant load, and restroom count.

- Specify HVAC, lighting, and camera infrastructure; lock TI schedule/phasing.

- Establish ADA compliance plan (routes, counters, signage).

Operations

- Select POS integrated with seed-to-sale and accounting.

- Draft SOPs for receiving, reconciliation, cash handling, returns, and destruction.

- Hire/train staff; set audit cadence; configure safe/vault access rules.

- Build initial assortment and promo calendar; negotiate vendor terms.

- Stand up compliance calendar and KPI dashboard.

Decision matrix: expand, relocate, or exit

| Signal | Expand | Relocate | Exit / Sell |

|---|---|---|---|

| GMROI & cash flow | ≥ targets; DSCR comfortable | Good unit but constrained by site/caps | Below targets with no fix |

| Regulatory posture | Stable; room for additional licenses | Buffers/caps now restrict growth | Tightening rules likely to impair value |

| Real estate economics | Favorable renewals or purchase options | Lease risk (term cliff/escalations) | Negative occupancy leverage |

| Brand equity | High repeat & NPS; scalable SOPs | Brand strong, location weak | Brand weak; CAC too high |

| Capital access | Affordable growth capital | Only with site upgrade | Scarce; redeploy elsewhere |

Action: If relocate or exit pencils, run a structured search: either acquire an operating dispensary with staff and revenue in place or secure a new compliant site ahead of term cliffs.

Where to go from here

- Evaluate parcels that already clear buffers and zoning hurdles; confirm measurables with the AHJ.

- Model lease vs. buy with after-tax cash flows reflecting 280E realities.

- Stand up your playbook: seed-to-sale-aligned POS, SOPs, KPI dashboard, and vendor scorecards before opening.

- Harden controls: shrink targets, cycle counts, and daily reconciliation from day one.

Myth vs. Fact

- Myth: “If the state grants a license, the city must allow my store.”

Fact: Local zoning, buffers, and caps control siting. Many projects stall at local authorization/CUP. - Myth: “Dispensaries can cut ADA corners because they’re ‘specialty’ retail.”

Fact: ADA Title III applies to public accommodations regardless of product—build and maintain accessible features. - Myth: “I can deduct all start-up and operating expenses like any retailer.”

Fact: 280E disallows most deductions except properly calculated COGS. - Myth: “C1D1 rooms are mandatory for dispensaries.”

Fact: Not for standard retail; C1D1/C1D2 applies to solvent-based processing areas.

The bottom line

Survival = regulatory fit + operational discipline. Lock in compliant real estate, engineer TI for durability and accessibility, defend margin after 280E, and run vendor and labor programs by the numbers. That’s how independents withstand volatility and how investors underwrite units that scale.

Disclaimer

This article is for educational purposes only and does not constitute legal, engineering, financial, or tax advice. Always consult qualified professionals and your local Authority Having Jurisdiction before making decisions.

Please visit:

Our Sponsor