The U.S. housing market is entering the second half of the year on uncertain footing, according to Cotality’s latest midyear market analysis. While price growth is slowing and inventory is rising–offering a glimmer of hope to buyers–high home prices, property taxes, and borrowing costs continue to challenge affordability. Mortgage performance remains largely stable, but signs of regional divergence and evolving buyer behavior hint at deeper structural shifts ahead.

Here are 10 key takeaways from Cotality’s report that paint a complex picture of America’s housing and mortgage landscape in mid-2025:

1. Pending Sales Up, But Closings Down

Pending home sales rose 10% year-over-year in May 2025, but closed sales dropped 14%. This widening gap highlights the financial headwinds buyers face–ranging from high interest rates and taxes to elevated home prices–which are causing more contracts to fall through. Sellers, too, are responding with caution: 6.2% of listings were pulled from the market in April, the highest rate of delistings since 2011.

2. Listing Prices Keep Rising, But Sales Prices Stall

The national median list price hit $495,000 in May 2025 — up 5% from a year ago — while the median sale price remained flat at $450,000. The $45,000 spread between asking and closing prices is now twice as wide as it was in May 2024, underscoring the growing disconnect between buyer expectations and seller ambitions.

3. Rent Increases Continue–Especially in the North

Single-family rents grew 2.9% year-over-year in April for the second straight month. The steepest increases occurred in the Northeast, Midwest, and Mid-Atlantic regions. This trend reflects a spillover effect: rising for-sale home prices are forcing would-be buyers to remain renters, pressuring the rental market in supply-constrained areas.

4. Investors Still Active, Shielded by All-Cash Deals

Investors accounted for 30% of single-family purchases in 2025 so far. Half of those buyers are small-scale landlords with fewer than 10 properties. Their dominance–largely due to their ability to pay all-cash–highlights how insulated they are from high borrowing costs, unlike many individual homebuyers.

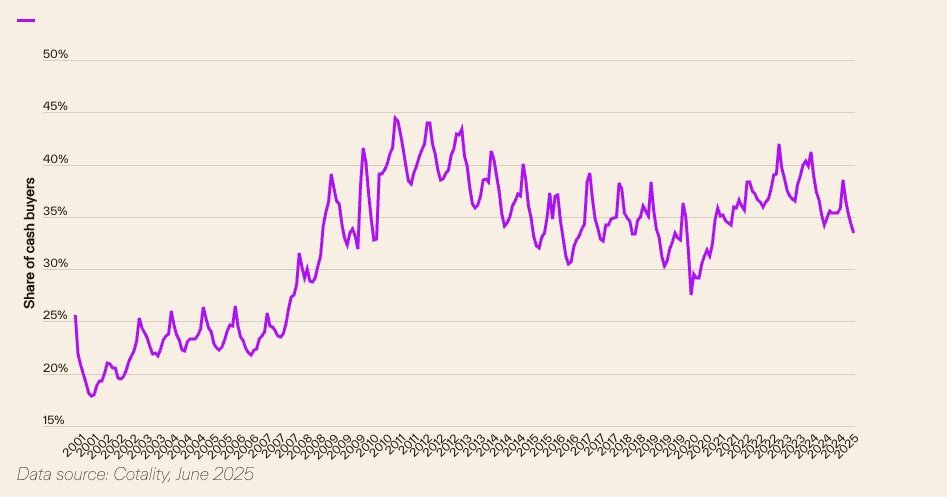

5. Cash Sales Slide, But Remain Elevated

Cash deals dropped to 36% of home sales in the first five months of 2025, down 2 percentage points from a year ago and marking the lowest rate since 2021. New home sales had a far lower cash share (14%) than resales (37%). Yet overall cash buying remains robust, buoyed by the investor segment.

6. Delinquency Rates Fall from 2024 Highs

Total mortgage delinquencies dropped to 2.8% in April 2025 from a recent peak of 3.2% in December 2024. Serious delinquencies (90+ days late) declined to 0.9%, while foreclosures held steady at 0.3%. The decline is attributed mainly to a reduction in early-stage delinquencies.

7. FHA and VA Loans Show Greater Distress

FHA loans are struggling more than other mortgage types: 3.6% are seriously delinquent, compared to 2.3% for VA loans and just 0.65% for conventional mortgages. These disparities suggest that lower-income or first-time buyers are disproportionately affected by current financial conditions.

8. Delinquencies Highest in the South and East

States with the highest serious delinquency rates include Louisiana (1.87%), Mississippi (1.57%), New York (1.5%), and Florida (1.43%). Broadly, the South and East are experiencing more mortgage stress, while Western states remain more stable.

9. $11 Trillion in Tappable Equity Remains Untouched

The average loan-to-value (LTV) ratio is 43%, meaning homeowners can access up to 37% of their home’s value while staying under the 80% LTV threshold. That translates to $11 trillion in potential tappable equity, or about $193,000 per homeowner–but with rates hovering between 6.5% and 7%, few are choosing cash-out refinances.

10. Equity Dips in Florida and Texas, But Remains Strong Nationwide

Average homeowner equity fell by $4,000 nationwide between Q1 2024 and Q1 2025. Florida and Texas saw steeper declines–$26,000 and $23,000 respectively–due to regional price corrections. Nonetheless, the average homeowner still has over $300,000 in home equity, up $120,000 from the start of the decade.

Bottom Line

The housing market in 2025 is a paradox. Inventory is up and mortgage delinquencies are down, yet affordability remains out of reach for many due to price and rate pressures. As the gap between buyers and sellers grows wider, and regional disparities deepen, the second half of 2025 could hinge on one variable: whether interest rates finally begin to ease.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Please visit:

Our Sponsor