Amid Mixed Trends Across Commercial Property Types

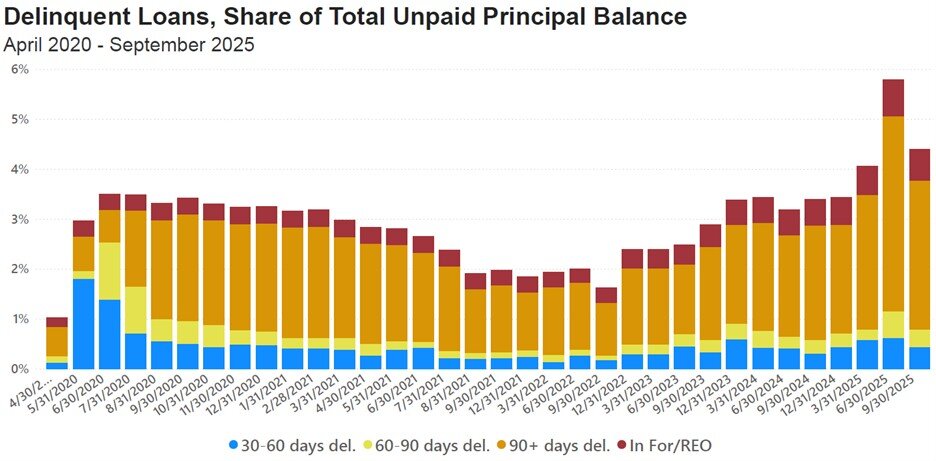

Delinquency rates on commercial real estate loans fell in the third quarter of 2025, marking a modest rebound after a surge in the prior quarter, according to the Mortgage Bankers Association’s latest Commercial Real Estate Finance (CREF) Loan Performance Survey.

“After significant increases in the second quarter, delinquency rates declined in the third quarter,” said Judie Ricks, MBA’s Associate Vice President of Commercial Real Estate Research. “Year-to-date, delinquencies remain elevated compared with the first quarter, driven largely by later-stage delinquencies and Foreclosure/REO properties. Investors should continue monitoring this segment closely amid broader economic uncertainty.”

The proportion of commercial loans that were non-current fell in Q3, though performance varied by property type. Delinquency rates rose for multifamily and healthcare loans, while office, retail, industrial, and lodging loans saw declines.

Among different funding sources, commercial mortgage-backed securities (CMBS) registered the highest delinquency levels: 5.66% of CMBS loan balances were 30 days or more past due, up from 5.14% in the prior quarter.

Other capital sources maintained relatively stable delinquency rates:

- Life company loans: 1.45% delinquent, down from 1.40%

- GSE loans: 0.64% delinquent, essentially unchanged from 0.61%

- FHA multifamily and healthcare loans: 0.79% delinquent, down from 1.04%

Overall, while third-quarter results suggest some easing, the persistence of delinquencies in certain sectors underscores continuing pressures in parts of the commercial mortgage market.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Please visit:

Our Sponsor