The U.S. housing market ended 2025 on a weaker footing than expected, raising fresh concerns about momentum heading into 2026 as buyers pulled back sharply from signing new contracts.

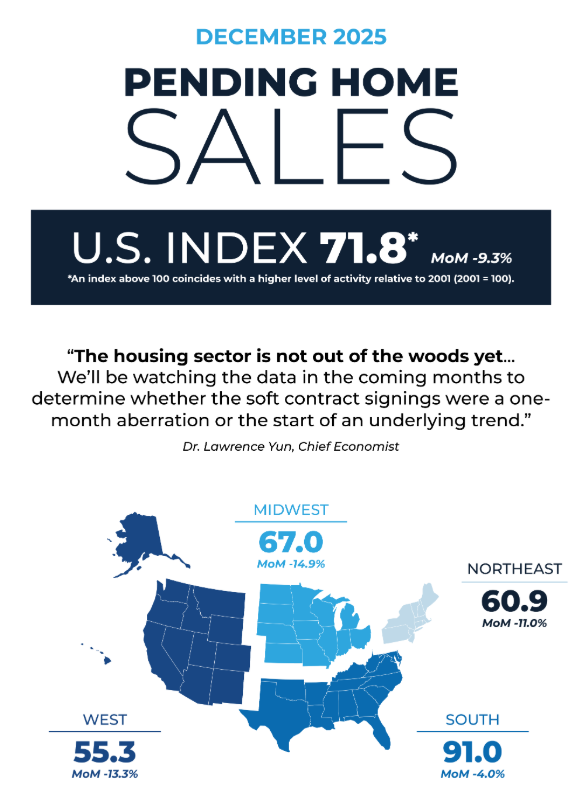

Pending home sales — a forward-looking gauge of closed transactions — fell 9.3% in December 2025 from the prior month and were down 3% from a year earlier, according to data released last Thursday by the National Association of Realtors. The decline erased gains from recent months and marked one of the steepest monthly drops of the year.

The pullback was broad-based, with contract activity falling across all four U.S. regions on a month-over-month basis. On an annual basis, only the South posted growth, underscoring widening regional divergence in housing demand.

Lawrence Yun

“The housing sector is not out of the woods yet,” said Lawrence Yun, NAR’s chief economist. “After several months of encouraging signs in pending contracts and closed sales, the December figures have dampened the short-term outlook.”

Seasonal distortions may have amplified the slowdown. December contract activity is often difficult to interpret due to holiday disruptions, weather-related challenges, and reduced in-person home searches. Still, Yun said the size of the decline warrants close scrutiny in the months ahead to determine whether it reflects a temporary pause or a more persistent softening in demand.

Compounding the slowdown is a renewed squeeze on housing supply. While closing activity increased in December, new listings failed to keep pace, pushing inventory lower. The number of homes on the market fell to 1.18 million — matching the lowest level recorded in 2025 — limiting options for prospective buyers.

“Consumers prefer to see abundant inventory before making the major decision of purchasing a home,” Yun said. “When choices are scarce, enthusiasm fades.”

Regionally, the Midwest and West posted the sharpest monthly declines in pending sales, down 14.9% and 13.3%, respectively. The Northeast saw an 11% drop, while the South was comparatively resilient, slipping 4% from November and posting a 2% year-over-year increase.

Despite the national slowdown, select metro areas continued to show strength. Among the 50 largest U.S. markets, cities such as Louisville, San Antonio, Virginia Beach, and Charlotte posted double-digit annual gains in pending sales, according to Realtor.com® Economics. Boston, Phoenix, Miami, and Pittsburgh also registered notable year-over-year increases, highlighting pockets of localized demand amid broader softness.

Additional insight from the latest REALTORS® Confidence Index survey suggests market conditions remain mixed. Homes spent a median of 39 days on the market in December, up from both the prior month and a year earlier. First-time buyers accounted for 29% of purchases, continuing a gradual decline, while cash transactions edged higher to 28%.

Investor and second-home activity remained steady at 18% of transactions, while distressed sales continued to represent a negligible share of the market. Notably, sentiment among real estate professionals has improved: nearly one-third of NAR members now expect buyer traffic to increase over the next three months, while expectations for higher seller traffic also rose.

Still, the December contract data casts a shadow over the early-2026 housing outlook, as elevated mortgage rates, tight inventory, and affordability pressures continue to restrain demand — even as underlying interest from buyers shows signs of stabilizing.

Whether the December 2025 decline proves to be a seasonal stumble or the start of a more sustained slowdown will become clearer as early-spring data emerges.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Please visit:

Our Sponsor