Lower Rates Ease Path for Homeownership in 2026

Mortgage borrowing costs in the United States have fallen to their lowest levels in three years, providing a welcome boost to prospective homeowners amid steady economic growth.

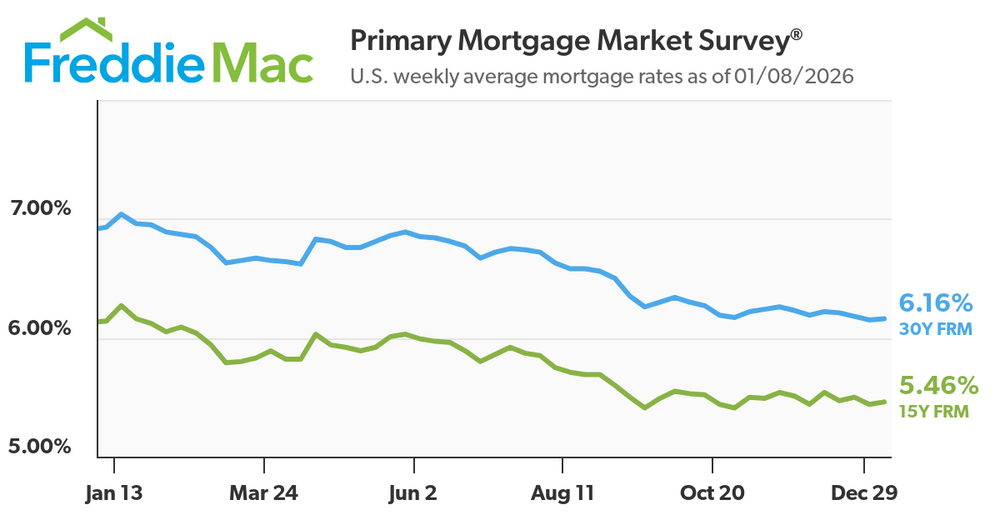

Freddie Mac’s Primary Mortgage Market Survey showed the 30-year fixed-rate mortgage averaged 6.16% for the week ending January 8, up slightly from 6.15% the prior week but down sharply from 6.93% at the same point last year. The 15-year fixed-rate mortgage, popular among refinancers, averaged 5.46%, edging up from 5.44% but below last year’s 6.14%.

Sam Khater

“Mortgage rates are holding steady in a narrow range just above 6% as we enter 2026,” said Sam Khater, chief economist at Freddie Mac. “With the economy continuing to expand and financing costs trending lower, we’re seeing stronger housing demand–purchase loan applications are up more than 20% from a year ago.”

Fannie Mae and Freddie Mac, both under federal conservatorship since the 2008 financial crisis, do not originate loans. Instead, they buy mortgages from lenders, package them into mortgage-backed securities, and sell them to investors, recycling funds back into the lending market and helping keep rates competitive.

Federal Reserve interventions have historically amplified these effects. During the early stages of the Covid-19 pandemic, the Fed purchased $580 billion in agency MBS, expanding its holdings from $1.4 trillion in March 2020 to $2.3 trillion by mid-2021. That program helped drive 30-year rates to record lows near 2.75%.

Analysts expect further easing in mortgage costs, projecting declines of 25 to 50 basis points, with some estimates suggesting rates could fall even more.

Even modest drops can translate into meaningful savings. On a median-priced U.S. home of $425,000 with a 20% down payment, a rate decline to 5.9% could reduce the monthly principal and interest payment by roughly $118. For first-time buyers navigating affordability constraints, that reduction can make a significant difference, though accumulating a down payment remains the largest barrier.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Please visit:

Our Sponsor