Office Conversions Will Outpace New Construction in 2025

In a landmark shift for the U.S. office real estate market, more office space is set to be removed from inventory than added for the first time since at least 2018, according to a new report from global real estate services firm CBRE. The trend marks a critical turning point in the sector’s path toward stabilization and early signs of recovery.

CBRE’s analysis, which covers 58 of the largest office markets across the country, projects that 23.3 million square feet of office space will be demolished or converted to other uses by year’s end. In comparison, only 12.7 million square feet of new office construction is expected to be completed–less than half of what is being removed.

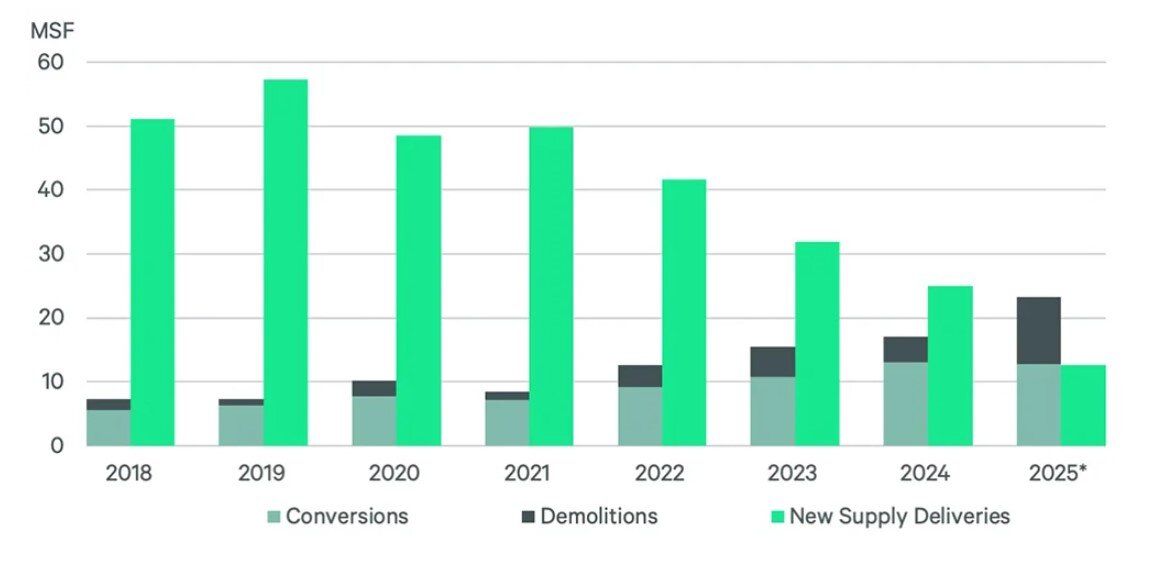

This reversal has been building for several years. Office construction completions have fallen steadily from 51.2 million square feet in 2018 to just 25 million in 2024, and now to a projected 12.7 million in 2025. Meanwhile, office conversions alone–excluding demolitions–have grown from 5.5 million square feet in 2018 to an expected 12.8 million this year.

“This net reduction–albeit slight–of office space across major markets likely will contribute to lowering the vacancy rate in the quarters ahead, which would benefit building owners,” said Mike Watts, CBRE’s Americas President of Investor Leasing. However, Watts warned that conversion momentum could face obstacles as the pool of viable buildings shrinks and construction costs remain elevated.

Tariffs, high labor and material costs, and uncertain financing conditions have further complicated large-scale conversion efforts.

Despite these challenges, several key market metrics are showing positive movement. Net absorption has remained positive for four straight quarters following six quarters of declines. Office leasing activity also surged 18% year-over-year in Q1 2025. Still, national office vacancy remains stubbornly high at around 19%, near record levels.

Conversions Lead with Housing Focus

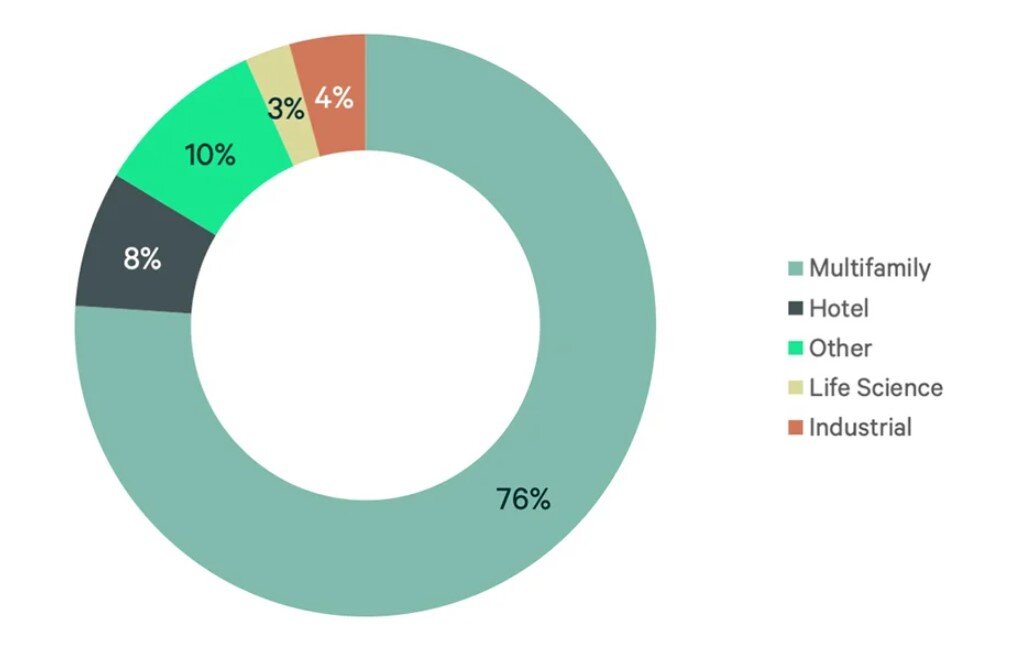

Conversions are increasingly being driven by the multifamily sector. As of May, 76% of active office conversion projects nationwide were slated to become apartment or condominium developments. Hotels represented the next largest category at 8%, followed by industrial and logistics (4%), life sciences labs (3%), and other uses (10%).

Since 2016, CBRE estimates that office-to-residential conversions have produced 33,000 housing units. Another 43,500 units are in the pipeline, based on an average of 170 units per project.

“The amount of residential units added to the national inventory from conversions won’t come close to solving the national housing shortage, but it will help–especially on a local level,” said Jessica Morin, CBRE’s Americas Head of Office Research. “Meanwhile, the office market will benefit as obsolete space is removed from the market in favor of the highest and best use. Additionally, conversions will boost the vibrancy of neighborhoods within various markets.”

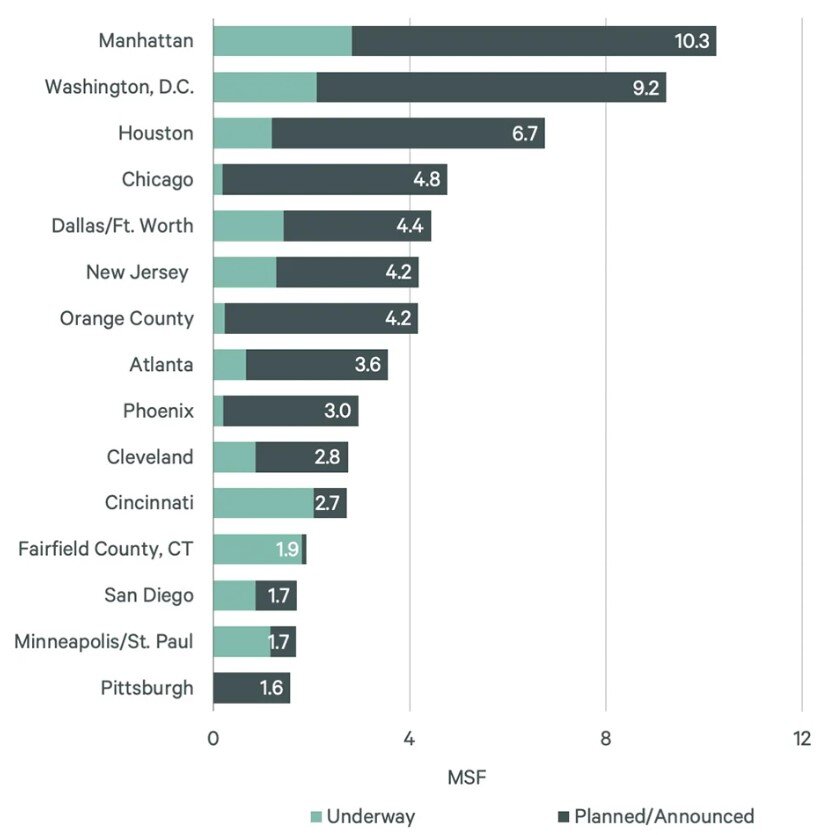

Conversion activity varies significantly by location. Major metro areas such as Manhattan, Washington, D.C., and Houston lead in total square footage slated for conversion, while cities like Cleveland and Cincinnati rank highest by percentage of their total office stock being converted.

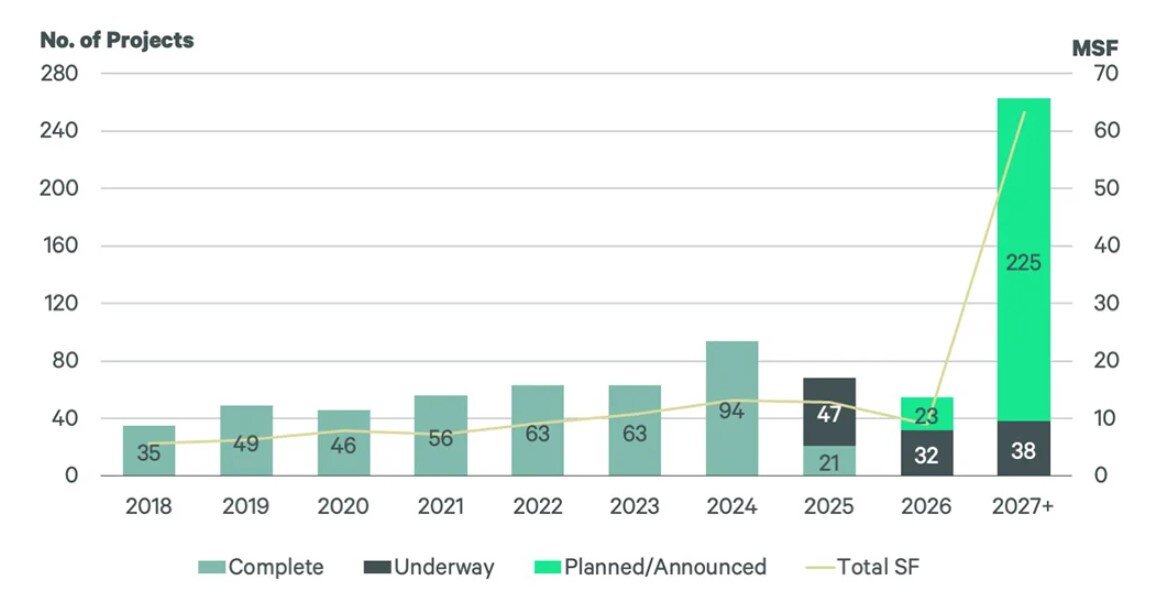

With 81 million additional square feet of office space already in the conversion pipeline for future years, the shift toward a leaner, more diversified office market appears poised to continue–reshaping urban real estate landscapes across the U.S.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Please visit:

Our Sponsor